Government Bond Update - September 2017

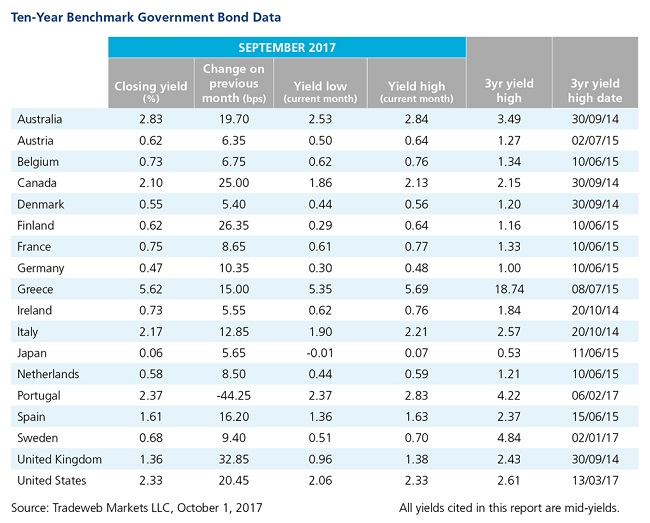

Global government bonds suffered a sell-off in September amid a bevy of central bank policy decisions, key economic data releases, and continued geopolitical uncertainty. According to Tradeweb data, only Portugal saw its 10-year benchmark bond yield decline during the month, closing at a 23-month low of 2.37%. On September 15, credit rating agency S&P Global upgraded the country’s debt from junk to investment-grade status.

In contrast, the 10-year UK Gilt mid-yield rose 33 basis points to finishthe month at 1.36%. On September 14, the Bank of England voted to keep interest rates unchanged and to hold its quantitative easing program to a maximum of £435 billion.

Over the course of September, a flurry of political events and economic news set the tone for markets throughout continental Europe. Highlights included the re-election of German Chancellor Angela Merkel, the build-up to the vote for independence in Spain’s Catalonia region, and the decision by the European Central bank to leave interest rates unchanged. The yield on Germany’s 10-year Bund increased by 10 basis points to end the month at 0.47%, while Spain’s 10-year government bond yield closed 16 basis points higher at 1.61%.

Elsewhere in Europe, Austria issued the first syndicated 100-year bond to be sold in the Eurozone. The mid-yield on the new century bond peaked at 2.08% on September 28, before dropping 4 basis points at month end. In Norway, where center-right Conservative Party candidate Erna Solberg was named Prime Minister on September 11, 10-year government bond yields rose 5 basis points during the month, closing at 1.58%. Greece also saw yields on its 10-year benchmark note climb 15 basis points to finish September at 5.62%.

Across the Atlantic, the Federal Reserve left its benchmark interest rate in the range of 1-1.25% and announced plans to start paring its $4.5 trillion balance sheet beginning in October. The mid-yield on the 10-year U.S. Treasury increased 20 basis points since August month end, closing at 2.33% on September 29.

In the Asia-Pacific region, mid-yields on Australian and Japanese 10-year debt moved up by 20 and 6 basis points to close the month at 2.83% and 0.06%, respectively. Both the Australian Central Bank and the Bank of Japan held interest rates steady. Japan’s gross domestic product was revised lower to 2.5%, from a preliminary reading of 4%, while Prime Minister Shinzo Abe called for a snap general election to take place in October.