Front and Centre: How Tradeweb’s Clients are Trading Inflation Swaps

Matthew Scaddan

Cross Market Product Manager, Tradeweb

Inflation and the upward pressure on commodity prices (such as oil, gas and wheat) due to the Ukraine war show little sign of abating. Central banks such as the Federal Reserve and Bank of England continue to raise interest rates to help counter rising inflation.

However, such uncertainty means market participants have had to make longer-term decisions about how they hedge their exposure to inflation.

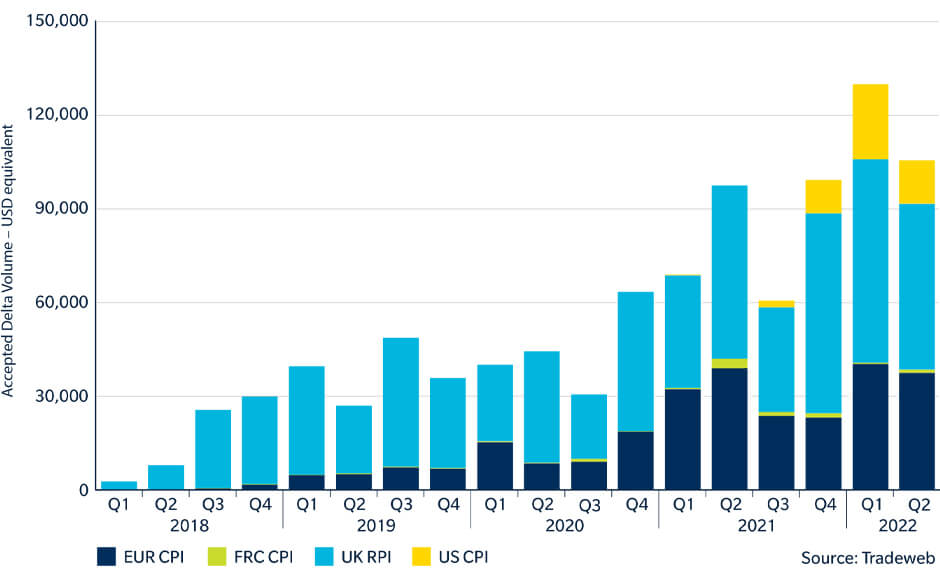

As a result, we’ve seen greater interest in the inflation swap market at Tradeweb and an increase in trading volumes in line with a longer-term pattern we have seen since launching into this space four years ago.

Inflation Swaps – A Growth Story

Embracing electronification

Since executing our first cleared inflation swap transaction in 2017 using the request-for-quote (RFQ) protocol, Tradeweb has carved out a position in the space by embracing the electronification of inflation swaps, which has seen the industry move away from execution by phone or chat. This type of execution was a time-consuming process, carrying the risk of the market moving between quotes and between different dealers before the trade was completed.

Tradeweb’s approach to the market has meant that inflation swap liquidity can be aggregated on a single screen, helping traders to request prices from multiple dealers simultaneously. This helps improve our client’s operational and capital efficiency. Features such as best execution, reporting and straight-through processing (STP) – where trades are registered directly by the clearing house – mean an entity’s risk can be quickly and automatically updated.

Putting clients first

As demand for inflation swap trading has increased in recent years, we have continued to develop our offering, putting our clients front and centre of the platform. We can now provide them with everything that central counterparties cover on the clearable side, which accounts for the vast majority of trades on our platform.

Our inflation swap trading proposition now includes four different cleared indexes – the Sterling RPI, Euro CPI, French CPI, and recently US CPI – with strong liquidity provision from 18 banks and liquidity providers. Indeed, our clients have benefited from streaming prices sent by banks to Tradeweb. This allows them to benchmark the prices they are seeing on the platform. We have also added inflation curves and forwards as a product.

New ways to trade

As inflation swap trading evolves, we are working closely with clients to give them the tools they need to get trades done.

For example, the standard lag to use unrevised inflation index is two months in the UK, and three months in Europe. However, our clients are increasingly looking to trade non-standard lag times – often looking further back – which they have been able to do that with our technology and support. In a further innovation for the market, we’re also supporting two-way pricing – or request-for-market (RFM) – for inflation swaps, allowing firms to ask for both the pay and receive price instead of just one price in RFQ.

Our clients are also beginning to make more extensive use of other Tradeweb products such as list trading and our multi-asset package (MAP) tool. MAP builds on our list trading capability to streamline the simultaneous execution of interest rate swaps, inflation swaps and government bonds on a single electronic venue and in a single trade.

And after success with interest rate swaps, we are also adding inflation to our Cross Market Swaps offering. Cross Market allows clients to link any two tickets and send them to independent dealers as a non-contingent package, and trade on the best spread while simultaneously executing both RFQs.

Continuing to innovate

Over the past four years, a broad mix of clients – including liability-driven investors (LDIs), asset managers, bank desks, pension funds, and hedge funds – have traded inflation swaps on the Tradeweb platform. As such, we have seen strong growth in volume over the past year – 35% year-on-year (as at Q2 2022).

From offering simple inflation swaps, we are now able to offer a full array of inflation options. And we’re going to continue innovating.

Click here to learn more about our inflation swaps platform.