Following protocol, leading protocol

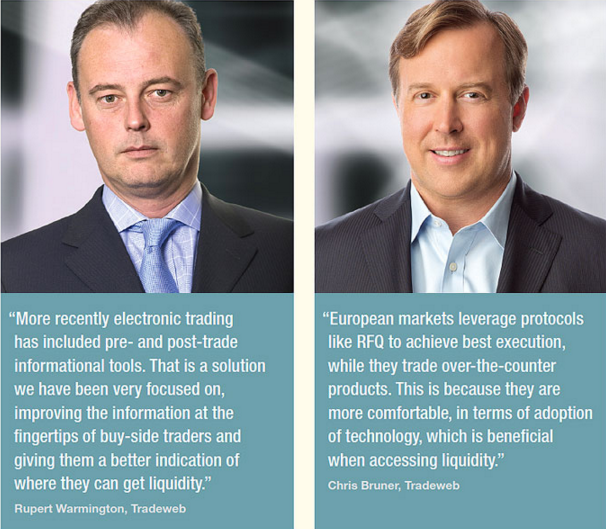

Fixed income traders say they’re not looking for a revolutionary new way to trade; they want the models that work to be revitalised. Tradeweb’s Rupert Warmington, managing director, head of European Credit Markets and Chris Bruner, managing director, head of US Credit Product discuss how electronic trading can be used to increase efficiency of existing market protocols, based on a close understanding of each instrument’s characteristics and changing market dynamics.

We’re seeing electronic trading grow, but slowly. Why?

Chris Bruner: In US credit, buy-side traders want to execute business in a way they haven’t done before on electronic platforms. Real money asset managers want to get better pricing and all the benefits of e-trading from a trade workflow perspective. As it stands, in the odd-lot space electronic trading developed as an efficiency mechanism for quote distribution. To get larger trade sizes and less liquid instruments traded electronically, workflows will have to help prevent information leakage yet still maximise the value of their relationships.

Rupert Warmington: Over the last five years, the market penetration of e-trading in Europe has risen to around 35-40%. A number of different factors have contributed to its growth, including an increase in the number of trades to be executed and the significant rise of fixed income exchange traded funds (ETFs). That has driven a lot of smaller-sized trades during the creation-and-redemption process and in portfolio rebalancing.

Chris Bruner: I think we’ve seen the impact of ETF rebalancing borne out over the last few years. It has contributed to some growth in the sub-US$2 million or odd-lot space, which was closer to 15-20% five years ago.

Where are traders most focused on electronic trading?

Chris Bruner: Let’s break the investment grade marketplace down in three buckets: under US$2 million, the protocols are well established with RFQ taking about 25-30% of trading activity. The middle, where trade sizes are US$2-US$5 million, is another 25-30% of the market. We believe there could be significant adoption in this space, but we don’t think one-size-fits-all ‘blast protocols’ are going to work.

Finally, we have the US$5+ million space, which is dominated by voice trading, and that’s 40-45% of the market. Currently that 40-45% plus the middle 25-30% is really all voice market. We expect the most change to occur in that middle bucket, with more investors shifting to e-trading, moving up the scale in the US$2-US$5 million space.

Rupert Warmington: For us the big rise has been in the use of the RFQ protocol. Time and operational efficiency, as well as compliance factors have been instrumental in helping build this market. E-trading in cash credit really took off in 2009, when credit spreads were at their highest levels and there was a rush into the asset class. Before the economic crisis, portfolio managers would do more of the execution themselves. This activity was later driven to buy-side execution desks.

In the last couple of years, however, requirements have changed with more emphasis being placed on better information to help identify the best path to liquidity.

Is execution the point in the trade lifecycle where automation can best assist with limited liquidity?

Rupert Warmington: More recently electronic trading has included pre- and post-trade informational tools. That is a solution we have been very focused on, improving the information at the fingertips of buy-side traders and giving them a better indication of where they can get liquidity. This is now a bigger requirement as a result of the relative reduction of dealer balance sheets, which has provoked the development of other trading constructs such as dark pools. Clients see the benefits of efficiency with e-trading, while the traditional trading process has become more time consuming.

Chris Bruner: Typically credit salespeople call sub-sets of clients that might be interested in an inquiry that they have on behalf of another client. We are working to replicate those workflows on our platform electronically, while providing them with access to a large number of dealers to make the trading process more efficient.

What can the US and European markets learn from one another?

Chris Bruner: The US has been focused on improving efficiency in the odd-lot space and people don’t have as much appetite to expand into areas traditionally dominated by voice trading. In Europe there is a longer heritage of credit e-trading partly because it is more diverse geographically, and counterparties are based in different countries.

Consequently, dealers differentiate their prices more in Europe. The ‘blast to everyone’ model has not been quite as successful in Europe, and most of the volume is still targeting a sub-set of people in the marketplace. If dealers trade electronically with only three or four other sell-side firms they know that they are not adversely selected, which they would be if they were put in competition with 50+ firms.

Rupert Warmington: In Europe trading protocols have typically been more discrete in their sell-side audience due to concerns over potential information leakage. This has allowed larger trades to be executed electronically and has consequently led to far greater penetration of e-trading relative to the US.

Chris Bruner: We have also seen a behavioural evolution in the adoption of e-trading. European markets leverage protocols like RFQ to achieve best execution, while they trade over-the-counter products. This is because they are more comfortable, in terms of adoption of technology, which is beneficial when accessing liquidity. To meet their needs, platforms like Tradeweb have added solutions to ease liquidity challenges that investors face, providing them access to more liquidity providers which increases their chances of getting a trade done.

Where can innovation improve the trading process?

Chris Bruner: Innovation is a key area of focus for us; we recently introduced a solution to optimise the credit trading process. In the US, investment grade bonds are traded on a spread-to-Treasury basis using a process called Treasury spotting. This functionality streamlines the steps necessary for a credit trader to secure a spot level. On Tradeweb, once a client completes a trade, the platform allows them to trade directly with the winning liquidity provider’s Treasury desk. We’ve been operating a multi-dealer Treasury platform since 1998, pioneering the RFQ trading protocol for the dealer-to-customer marketplace.

We’ve automated a traditionally manual process to make it as efficient as possible, by routing all of those hedges electronically to each of the Treasury desks. Our Treasury platform has a network of more than 2,000 clients accessing liquidity from over 50 dealers. The available composite Treasury pricing data provides clients with a precise benchmark for their hedging needs.

As a result, the buy side gets a very transparent price. The sell side knows this happens automatically and so typically in a few seconds after the trade, they are done. There is no need for manual intervention, and clients don’t need to wait 10 minutes because the market is busy. These workflow elements are very important, especially if you are trying to process hundreds of tickets each day.

Rupert Warmington: Tradeweb introduced axes in late 2014, which has provided considerable price improvement for clients on our European platform. For a trade over a million, no-one wants to blast their position to the whole street. You have to find out who on the sell side will be able to facilitate that trade and this helps clients to do just that. Actionable axes have had a very significant effect on buy-side hit rates as well; they have increased 29% by trade or 18% by volume.

In addition, when axed dealers are used we’ve seen a 5% price improvement on bid-ask spreads by volume.

This Q&A was originally published in the spring 2016 issue of The Desk magazine.