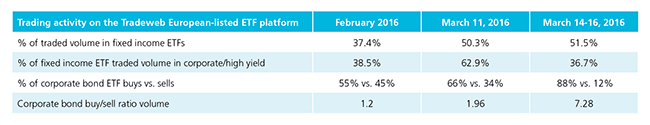

Fixed income ETF activity increases on the Tradeweb European-listed ETF platform since March 11

On March 10, the European Central Bank announced a new package of monetary stimulus measures intended to avert deflation and boost economic growth in the euro area. These measures included further interest cuts, a new round of cheap loans to commercial banks, and expanded asset purchases, which will now include non-financial corporate bonds.

The following day, fixed income ETF activity on the Tradeweb European-listed ETF platform increased to 50.3%, as a proportion of the overall traded volume, of which 62.9% was in corporate and high yield bond instruments. Corporate bond and high yield ETFs saw a strong “buying” bias on the day, as 66% of activity in the sector stemmed from “buy” trades.

Between March 14 and March 16, activity in fixed income ETFs climbed even higher to 51.5%; corporate and high yield bond products accounted for 36.7% of the volume traded in fixed income ETFs. In addition, corporate bond and high yield ETFs saw seven times more buyers than sellers over the same three days, with “buys” accounting for 88% of activity in the sector.

“Since the ECB announcement, we’ve noticed that clients are trading fixed income ETFs significantly more”, says Adriano Pace, managing director of equity derivatives at Tradeweb. “The products typically represent one third of the overall platform activity, so it will be interesting to see if this trend will persist in quieter market conditions”, he adds.