Exchange-Traded Funds Update - March 2015

The following data is derived from trading activity on the Tradeweb European-listed ETF platform.

ETF total traded volume

In the first quarter of the year, total traded volume on the Tradeweb European-listed ETF platform reached a record-breaking €28.9 billion, up €8.2 billion from Q4 2014. The quarter-on-quarter percentage increase was 40%. Meanwhile, March was the second strongest month ever for the platform, with traded volume amounting to €10.5 billion, just €223 million below January’s record.

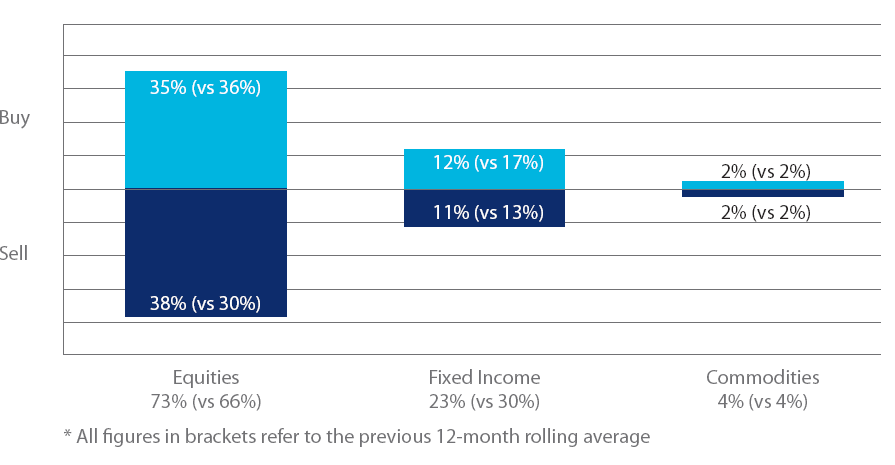

Volume by ETF asset class

February’s buying trend was reversed for equity-based ETFs in March. “Sells” in the asset class went up to 38% as a proportion of the overall traded volume, outstripping “buys” by three percentage points. “Buy” requests for fixed-income products, however, surpassed “sells” by one percentage point at 12%.

Top ten ETFs by traded volume

March’s ten most heavily traded ETFs track primarily European or U.S. equity indices. The SPDR S&P 500 UCITS ETF and the Amundi ETF MSCI EMU UCITS ETF held on to their top ten spots, while the only fixed income product in this month’s listing is the Lyxor UCITS ETF EuroMTS 15+Y Investment Grade (DR).