European Exchange-Traded Funds Update - May 2018

The following data is derived from trading activity on the Tradeweb European-listed ETF platform.

ETF total traded volume

May proved to be the second strongest month on record for the Tradeweb European-listed ETF marketplace since its launch in October 2012. Total traded volume amounted to €22.38 billion, while the proportion of transactions processed via Tradeweb’s Automated Intelligent Execution tool (AiEX) remained high at 33.2%.

Adriano Pace, head of equities (Europe) at Tradeweb, said: “As the month drew to a close, platform activity accelerated amid heightened market volatility driven by political developments in Italy and Spain. More than €6 billion was executed in the last three days of May alone, which translates into 27% of the entire monthly flow.”

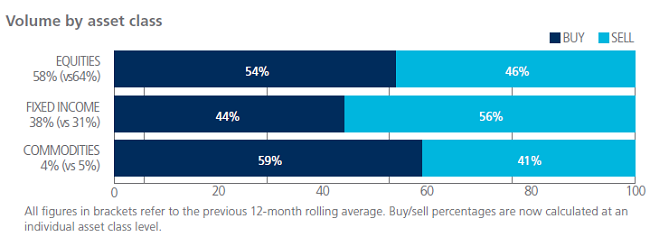

ETF volume breakdown

Fixed income ETFs saw net selling for the first time since December 2017. Activity in the asset class increased to 38% of the overall notional volume, beating the previous 12-month rolling average by seven percentage points. In contrast, ‘buys’ in commodity and equity-based ETFs outstripped ‘sells’. However, activity in both asset classes lagged the previous 12-month rolling average by one and six percentage points respectively.

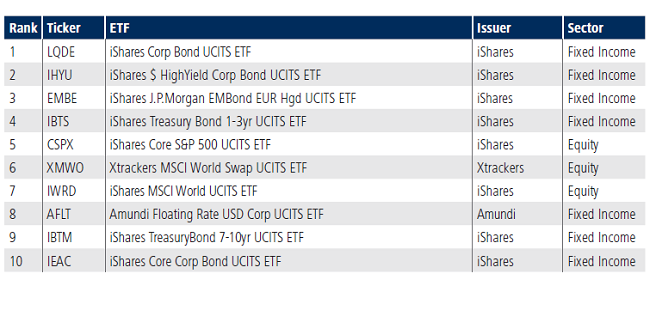

Top ten ETFs by traded volume

May’s list of the ten most heavily-traded ETFs was dominated by fixed income products, with the iShares Corporate Bond UCITS ranked first. The fund, which aims to track the performance of the Markit iBoxx USD Liquid Investment Grade Index, last appeared in the top ten in January 2018.