European Exchange-Traded Funds Update - December 2016

The following data is derived from trading activity on the Tradeweb European-listed ETF platform.

ETF total traded volume

The Tradeweb European-listed ETF marketplace enjoyed a record-breaking fourth quarter, as activity significantly increased following Donald Trump’s election victory in the US. Total traded volume reached €38 billion, beating previous record-holder Q2 2016 by nearly €5 billion.

December was also the second strongest month ever for the platform, with notional volume exceeding €14.2 billion, only 6% shy of November’s top performance. Adriano Pace, managing director for equity derivatives at Tradeweb, said, “All platform metrics remained strong throughout the month, with new records achieved both in terms of the number of active clients and the number of completed trades. December also saw the arrival of our 27th liquidity provider on the platform, while there are now 15 dealers posting axes.”

Volume by ETF asset class

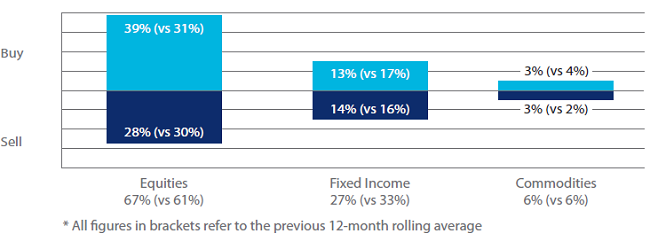

In December, activity in equity-based ETFs surged to 67% of the entire platform flow, compared with a 12-month rolling average of 61%. ‘Buys’ in the asset class rose to 39% as a proportion of the overall traded volume, surpassing ‘sells’ by 11 percentage points. Emerging Markets was the only equities category to see net selling during the month.

Monthly ‘sells’ in fixed income ETFs narrowly beat ‘buys’ at 14% and 13% respectively. More than €2.3 billion in notional was executed in government bond and corporate bond funds, amounting for 60% of the overall fixed income ETF volume. Meanwhile, activity in commodity-based ETFs dropped to 6%, mirroring the previous 12-month rolling average.

Top ten ETFs by traded volume

December’s most heavily-traded instrument was the db x-trackers MSCI World Index UCITS ETF, a fund offering exposure to global equities. In second place, the iShares Core S&P 500 UCITS ETF was also the most heavily-traded product in Q4 2016.