European Credit Update - September 2015

The Federal Open Market Committee voted to keep its record low benchmark interest rate unchanged on September 17, citing “recent global economic and financial developments”. Speaking at the University of Massachusetts a week later, Fed chair Janet Yellen said that a rate rise would likely be appropriate sometime this year.

The Bank of England also opted to keep interest rates on hold at 0.5%. According to data published by the Office for National Statistics on September 15, the UK inflation rate fell back to zero in August from 0.1% in July, a drop driven by declining oil prices. Meanwhile, inflation in the euro area was recorded at -0.1% in September.

In its latest Global Financial Stability Report released on September 29, the International Monetary Fund warned that “emerging markets must prepare for the adverse domestic stability implications of global financial tightening”. The fund had previously urged the world’s leading economies to maintain accommodative monetary policies in order to prevent real interest rates from rising prematurely.

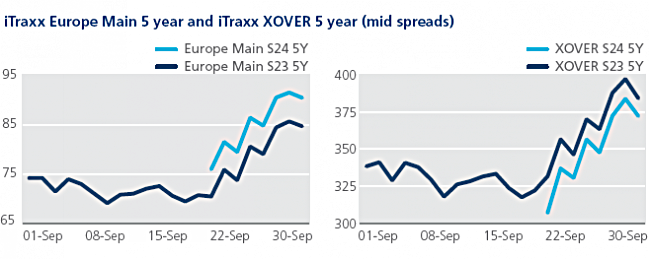

CDS on Tradeweb: European credit indices experienced further volatility in September amid soft Chinese economic data and mounting speculation over a rate lift-off in the U.S. In addition, September 21 saw the roll to the new iTraxx index series (S24).

Spreads for the Europe (S23) and Crossover (S23) moved tighter in the first half of the month, closing at 69 bps and 317 bps respectively on September 17. However, both ended the month in wider territory by 15 bps and 67 bps respectively.

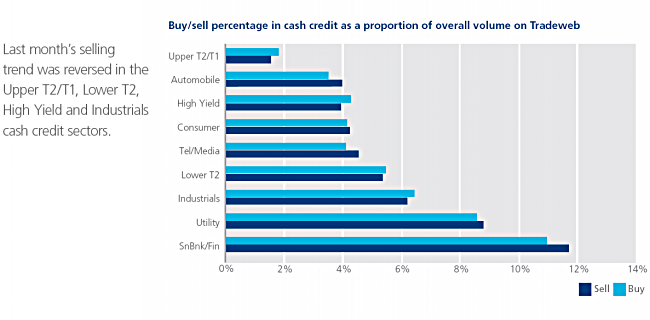

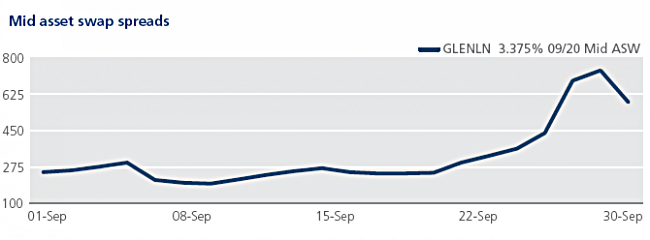

Cash on Tradeweb: Glencore continued to make headlines in September. The trading and mining group announced on September 7 a series of measures aimed at reducing its net debt of $30 billion to the low $20s billion by the end of 2016. Then on September 28, a note published by Investec analysts questioned Glencore’s equity value if commodity prices do not improve. Mid asset swap spreads for the company’s 3.375% 09/20 bond widened by 545 bps to 740 bps between September 9 and September 29, before closing the month 153 bps tighter.

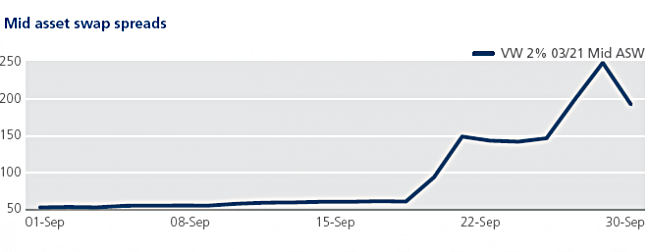

Another firm that dominated the news was Volkswagen. On September 18, U.S. authorities revealed that the German car manufacturer had fitted “defeat devices” to its diesel vehicles in order to skew emissions test results. Sales of new Volkswagen models were suspended in Switzerland on September 25, the same day Matthias Mueller succeeded departed CEO Martin Winterkorn. In the secondary market, mid asset swap spreads for the firm’s 2% 03/21 bond widened by 140 bps over the month to close at 193 bps.