European Credit Update - September 2014

Geopolitical risks and soft economic data were a recurring theme in September. Tensions in the Middle East and Ukraine intensified, while in Europe, Scotland voted in a referendum to remain in the United Kingdom with a majority of 55% to 45%.

Eurozone business growth dipped to 52.3, its lowest level since December 2013, according to preliminary “flash” PMI data published on September 23. Earlier in the month, ECB president Mario Draghi had unveiled a new recovery plan for the eurozone. This included cuts to all key interest rates by 10 basis points, and the launch of asset-backed securities and covered bond purchase programs.

In the U.S., disappointing jobs growth announced on September 5 was followed by the Federal Reserve’s decision to maintain its low federal funds rate on September 17. The central bank also scaled back its quantitative easing program by another $10 billion with plans to conclude it in October.

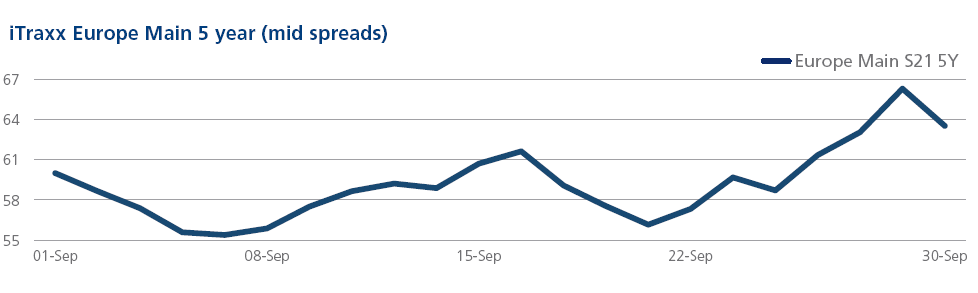

CDS on Tradeweb: European credit indices saw further volatility in September, with spreads closing just off the wide point of the month: at 64 bps vs 66 bps for the Main, 259 bps vs 271 bps for the Crossover, and 64 bps vs 67 bps for the FinSen. This was despite trading close on the tightest points for the year in the first week of September. Spreads for the Crossover tightened to 225 bps on September 4, before widening by 33 bps at month-end.

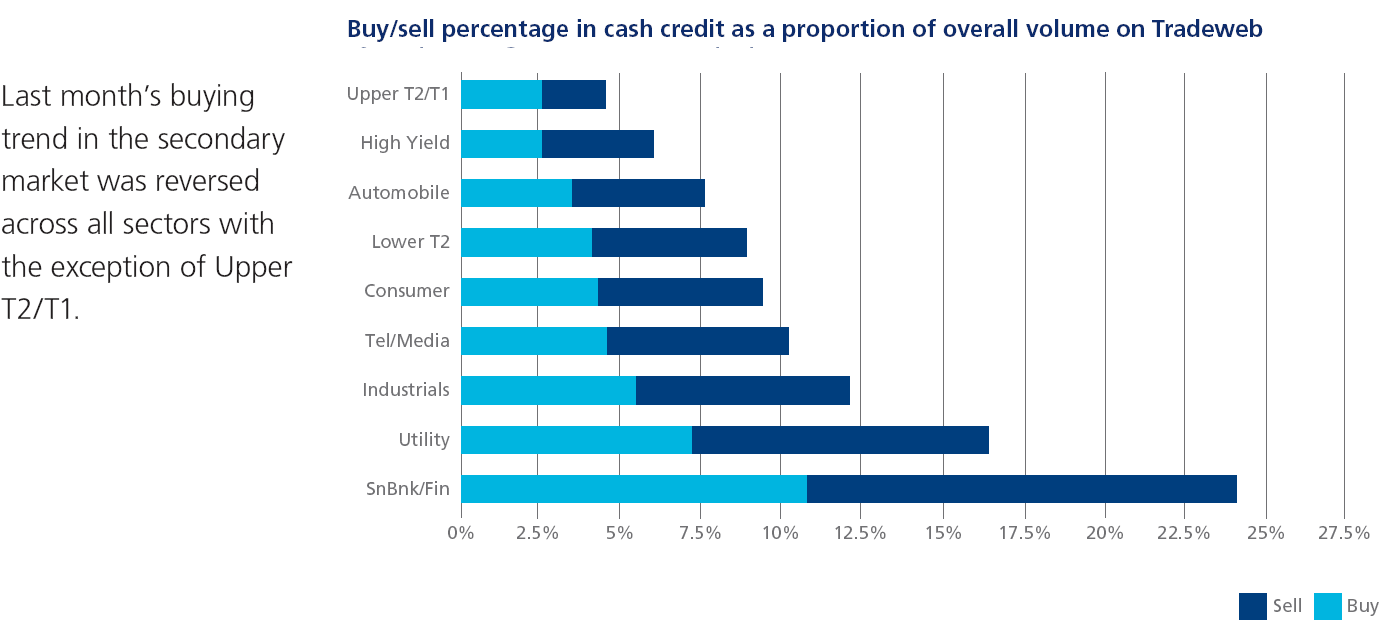

Cash on Tradeweb: Primary market activity returned aggressively at the beginning of the month. However, the number of issues coming to market for the second half of September tailed off significantly.

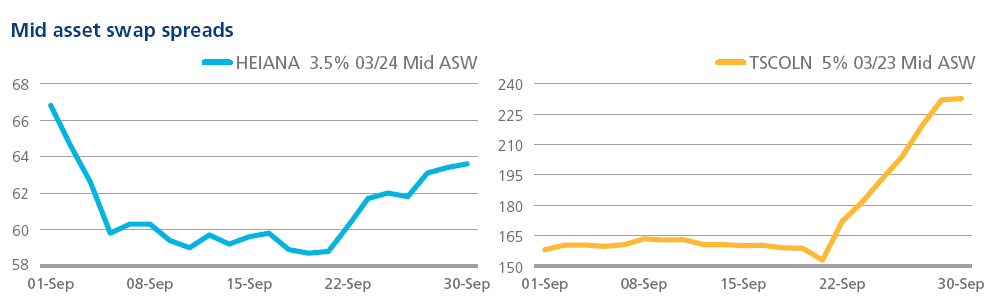

In the consumer sector, Dutch brewer Heineken rejected a takeover bid by London-based rival SABMiller. The family-owned firm said on September 14 that the proposal was “non-actionable” and confirmed its intention to stay independent. Mid asset swap spreads for Heineken’s 3.5% 03/24 bond tightened to 59 bps on September 18, before widening by 5 bps to close the month just below 64 bps.

On September 22, supermarket chain Tesco warned it had overstated its half-year profit by £250m. UK’s biggest retailer suspended four senior executives and brought forward the start date of its new CFO Alan Stewart by more than two months. Mid asset swap spreads for its 5% 03/23 bond widened by 75 bps to 233 bps over the month.