European Credit Update - October 2015

Following a meeting of its Governing Council on October 22, the European Central Bank announced that it would “re-examine the degree of monetary policy accommodation” at its next gathering in December. ECB president Mario Draghi said that the central bank was “open to a whole menu of monetary policy instruments” to combat deflationary pressures, including lowering interest rates and/or expanding its asset purchase programme.

Across the Atlantic, the U.S. Federal Reserve voted on October 28 to keep interest rates unchanged. However, it raised the likelihood of a rate hike as early as December, after removing language warning of global economic risks to U.S. growth and inflation.

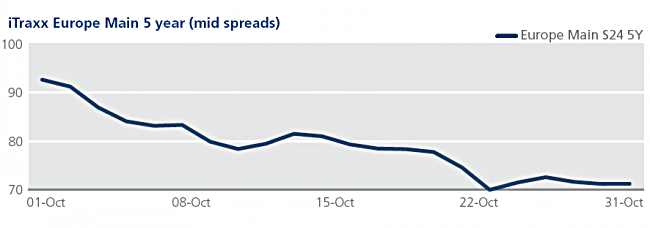

CDS on Tradeweb: In October, spreads for European credit indices hit their tightest levels since the index roll on September 21. The Europe (S24) and the Crossover (S24) ended the month 21 bps and 74 bps tighter, closing at 71 bps and 299 bps respectively. Financial indices had a similar trajectory, with spreads for the FinSen (S24) and the FinSub (S24) closing at 70 bps and 147 bps respectively on October 30.

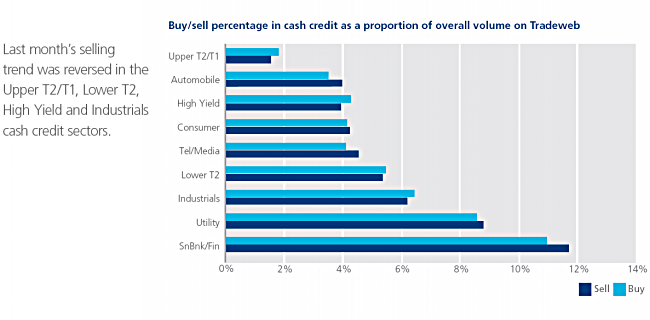

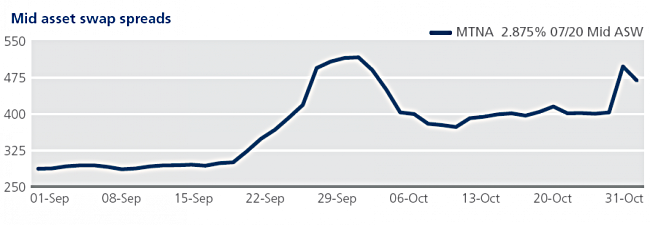

Cash on Tradeweb: The UK steel industry suffered two major blows in October. First, Thailand’s SSI said it was closing down its Redcar site in Teesside; later in the month, India’s Tata Steel confirmed that it would cut 1,200 jobs at plants in northern England and Scotland. Steel industry leaders and unions blamed these developments on a stronger pound, “a flood of cheap imports” amid plunging steel prices, and high electricity costs. Mid asset swap spreads for the 2.875% 07/20 bond issued by ArcelorMittal, the world’s biggest steelmaker, widened by 182 bps to 469 bps between September 1 and October 30.

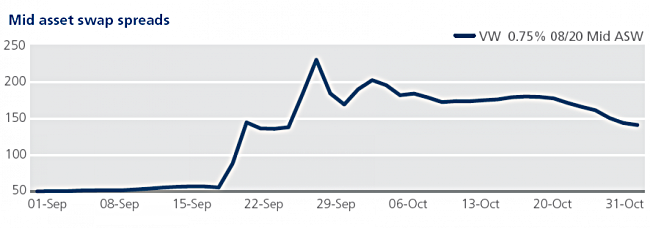

Meanwhile, Glencore and Volkswagen continued to make headlines in October. The former’s decision to slash its zinc production by a third was followed by its announcement that it was selling two of its copper mines in Australia and Chile. On October 28, VW reported its first quarterly loss in 15 years as it set aside €6.7 billion to address costs related to the diesel emissions scandal. In the secondary market, mid asset swap spreads for the firm’s 0.75% 08/20 bond ended the month at 142 bps, 92 bps wider than September 1.

In the Utilities sector, Royal Dutch Shell recorded a net loss of $7.4 billion in the third quarter of 2015, largely due to plunging oil prices and axed projects in Alaska and Canada. Underlying earnings fell by 70% to $1.8 billion. However, CEO Ben van Beurden stated that the Anglo-Dutch oil and gas company is still on track to complete its acquisition of BG Group in early 2016. Shell’s rival BP also reported losses in the third quarter, with underlying replacement cost profits falling 40% to $1.8 billion from $3 billion a year ago. The British oil giant announced that it would implement deeper spending cuts by 2017, as it braced itself for a prolonged period of lower oil and gas prices.