European Credit Update - May 2014

The European Parliament elections dominated headlines in May, as their outcome was marked by the breakthrough of Eurosceptic and populist groups. Pro-European parties, however, still managed to secure the majority of the 766 parliamentary seats.

Portugal became the second Eurozone state after Ireland to exit its bailout program on May 17. The country opted to end its €78bn EU and IMF-assembled rescue package without applying for a precautionary credit line, and will now look to the bond markets to cover its financing needs.

On May 23, Standard & Poor’s raised Spain’s credit rating by one notch to BBB with a stable outlook, citing its “improving economic growth and competitiveness”. Greece’s sovereign debt was also upgraded to B from B- by Fitch after the country achieved the "key target" of a primary surplus in 2014.

The month ended amid speculation that the European Central Bank will take action against deflation as early as the first week of June. Most analysts are predicting a deeper cut in interest rates to boost lending to smaller businesses. In contrast, minutes from the Bank of England’s latest monetary policy meeting showed that its members are moving closer to raising borrowing costs.

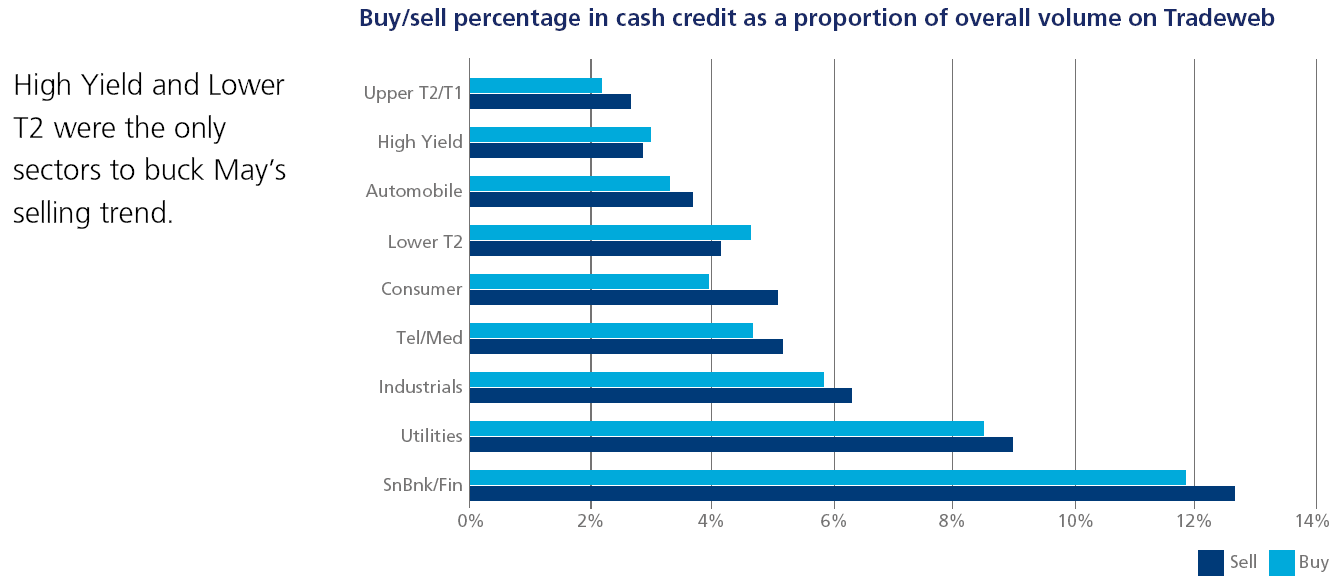

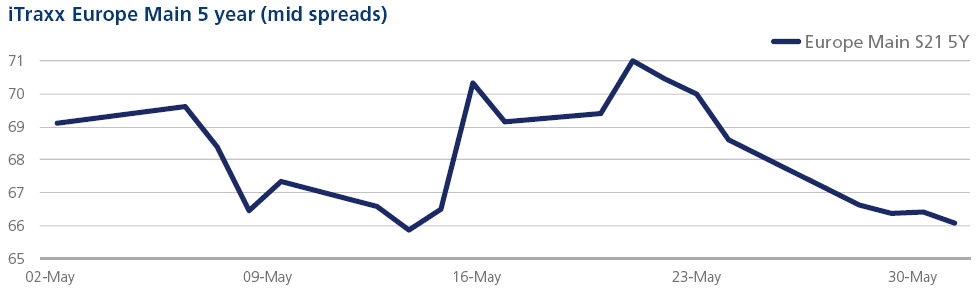

CDS on Tradeweb: Credit indices broke through key levels in May with lows of 65 bps, 255 bps and 72 bps for the Main, Crossover and Financial Senior respectively. Markets retraced mid-month to re-test May’s opening levels, but then continued performing through the latter part of the month closing at the tighter end of the range. The FinSen/FinSub ratio compressed by 1.5 bps during May and closed at 39 bps.

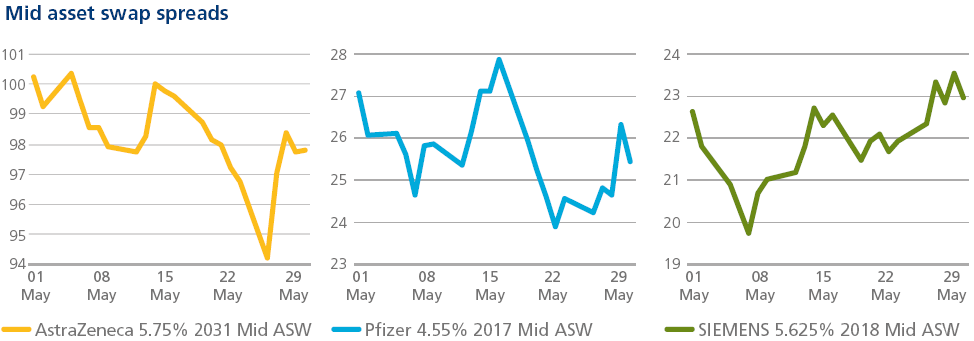

Cash on Tradeweb: U.S. pharmaceutical giant Pfizer decided to withdraw its bid for British drug maker AstraZeneca, following the latter’s rejection of a takeover proposal worth nearly $118bn. The New York-based firm had until 5pm GMT on May 26 to make an improved offer or walk away under UK takeover rules.

In industrials, Europe’s largest engineering company Siemens announced on May 30 that it would cut 11,600 jobs to reduce costs. Earlier in the month, the firm had unveiled a restructuring plan, dubbed “Vision 2020”, in an effort to compete with its more profitable peers. Mid asset swap spreads for Siemens’ 5.625% 06/18 bond tightened to just under 20 bps on May 7, before widening back into ASW 23 bps by month end.