European Credit Update - March 2016

The European Central Bank announced a series of fiscal measures aimed at reviving the eurozone economy on March 10. The latest ECB policy package includes: deeper interest rate cuts; a new series of four targeted longer-term refinancing operations with a four-year maturity; and expanded monthly asset purchases, which will now extend to investment grade euro-denominated bonds issued by non-bank corporations.

The following week saw euro-based investment grade corporate bond sales reach a record €30.6 billion, according to data from Dealogic, overtaking the previous record of €21.05 billion set in the second week of May 2014.

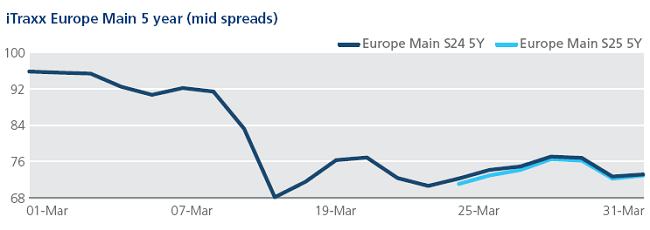

CDS on Tradeweb: European credit indices rolled into their 25th series on March 21: the iTraxx Europe and Crossover indices changed their compositions by four and 12 names respectively; however, their financial counterparts remained unchanged. Meanwhile, the 24th version of Europe’s investment grade benchmark closed at 68 bps on March 11, its tightest closing spread since September’s index roll.

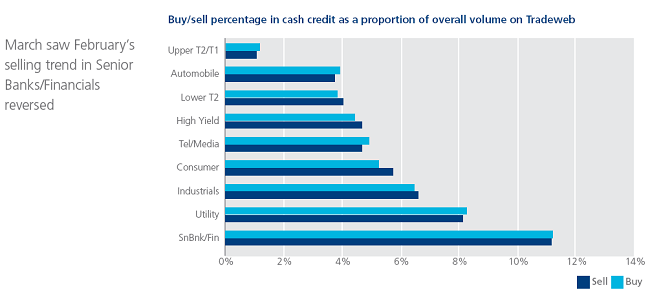

Cash on Tradeweb: In the latest blow to Britain’s steel industry, Tata Steel revealed on March 30 that it was planning to sell its UK factories, putting thousands of jobs at risk. The India-based firm blamed its decision on high manufacturing costs, competition from China and a global oversupply.

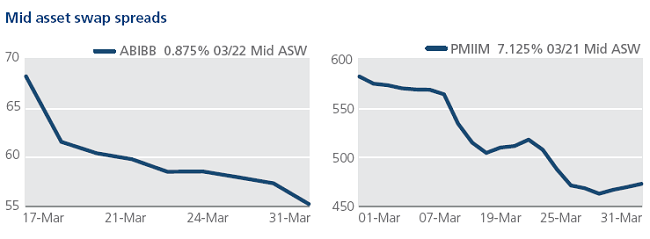

Belgium’s Anheuser-Busch InBev NV issued a €13.25bn multi-tranche bond on March 16, as part of its efforts to raise funds for the acquisition of SABMiller. This was the largest single sale of euro-denominated corporate bonds in history. Between March 17 and March 31, mid asset swap spreads for the company’s 0.875% 03/22 bond tightened by 13 bps to 55 bps.

On March 23, Banco Popolare and Banca Popolare di Milano (BPM) announced they had agreed to merge following approval by their respective boards. The deal, which will create Italy’s third-largest bank, is the first of its kind in the eurozone since the ECB took over the supervision of the area’s banking sector in 2014. In the secondary market, mid asset swap spreads for BPM’s 7.125% 03/21 bond tightened by 110 bps over the month to close at 473 bps.