European Credit Update - March 2014

The Ukraine crisis entered a new phase on March 18, when Crimea joined the Russian Federation following a referendum conducted in the region. Three days later, Ukraine signed an association agreement with the European Union forging closer economic ties, while sanctions against Russia started to escalate.

New Federal Reserve chair, Janet Yellen, said on March 19 that the central bank would probably conclude its quantitative easing program this autumn, and could start raising interest rates as early as April 2015. In a later speech, Ms. Yellen underscored the Fed’s commitment to bolster the U.S. economy, given the slow pace of the recovery and the state of the labour market.

The month ended with the news that eurozone inflation had hit its lowest level since November 2009. Eurostat figures showed a drop to 0.5 per cent in March, down from February’s figure of 0.7 per cent and well below the ECB target of just under 2 per cent.

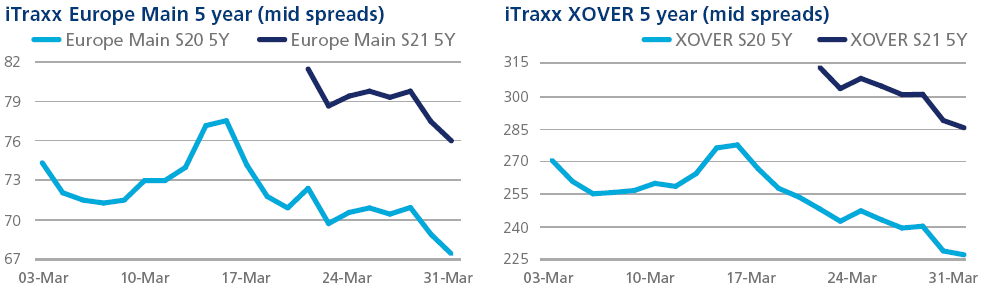

CDS: The tightening trend in European credit indices was briefly interrupted in the middle of March, when geopolitical fears about Ukraine intensified. Several days of weakness followed, as the iTraxx Europe Main and Crossover indices widened by 4 and 20 basis points respectively. They then retraced equally quickly into the March 20 roll*. The subsequent spread tightening saw key resistance levels of 70 basis points and 250 basis points broken, with the momentum continuing into month end. Financial indices performed in line with 5 basis points of SEN/SUB decompression throughout the month in Series 20.

*During the March 2014 index roll, the iTraxx Crossover Index was expanded by 10 names to 60. Markit said that this was in response to the continued growth in European high yield bond issuance.

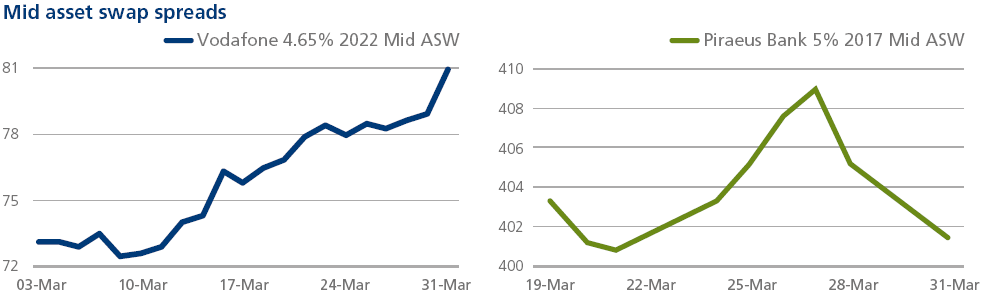

Cash: In the Telecommunications/Media sector, Vodafone confirmed the acquisition of Spanish cable company Ono for €7.2bn, which includes €3.3bn in debt. The deal marks the latest move in Vodafone’s strategy to add fixed-line networks to augment its mobile services. Mid asset swap spreads for the company’s 4.65% 01/22 bond widened by 8 basis points during March.

Moving to high yield, Piraeus Bank became the first Greek bank to access debt capital markets since the eurozone crisis erupted five years ago. Its March 18 launch of a three-year senior unsecured bond was six times over-subscribed. In the secondary market, the bond's mid asset swap spread widened as far as 409 basis points on March 27, before tightening back into ASW 401 by month end.