European Credit Update - June 2015

European Credit Update - June 2015Greece dominated the headlines for another month, particularly nearer the expiry of the country’s bailout program on June 30. Two days earlier, the Greek government had imposed capital controls to stem deposit outflows, while awaiting the results of a referendum on creditors’ terms scheduled for July 5. Standard and Poor’s downgraded Greece’s credit rating twice during the month: on June 11 from CCC+ to CCC and on June 29 from CCC to CCC-.

Meanwhile, month-end Eurostat figures showed that the region’s inflation rate had dropped to 0.2% in June from 0.3% in May. In contrast, UK inflation rose to 0.1% in May, according to a June 16 announcement from the Office of National Statistics.

In the U.S., the New York Fed President William Dudley said that a September interest rate rise was “very much in play” following the release of positive economic data throughout June. Nonfarm payroll employment increased by 280,000 jobs in May, while the latest University of Michigan's Index of Consumer Expectations came in at a five-month high of 96.1.

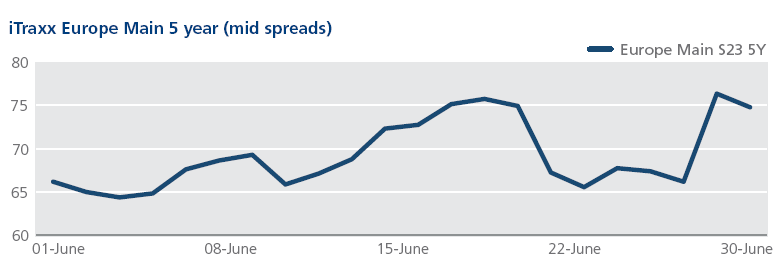

CDS on Tradeweb: European credit indices experienced another turbulent month, with the Crossover widening from 293 bps on June 1 to 333 bps on June 18. The remainder of the month saw further spread volatility and a trading range of 286 bps on June 23 to 328 bps on June 30. Mid spreads for the Europe index widened by 9 bps over the month to close at 75 bps.

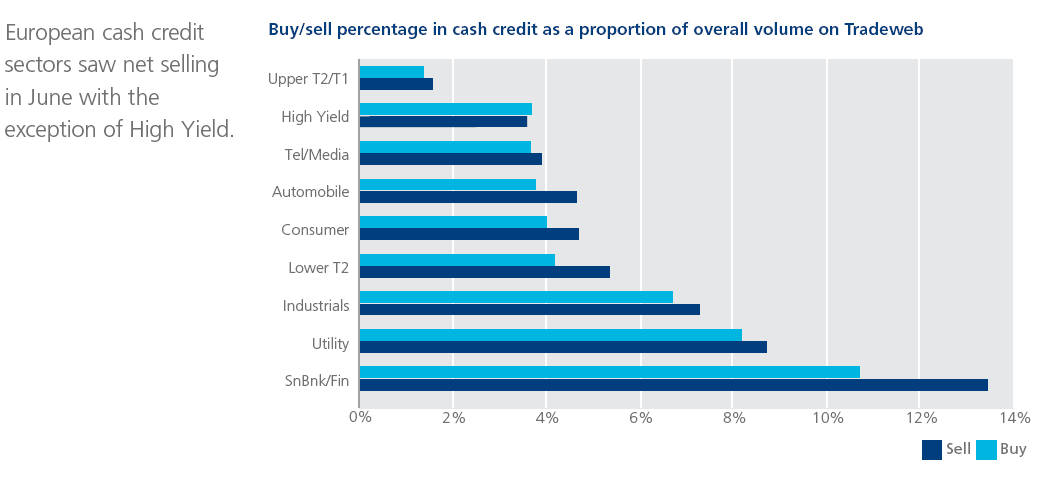

Cash on Tradeweb: Fitch Ratings downgraded Greece’s banks to 'Restricted Default' on June 29, a day after the country’s authorities had enforced extended bank holidays and capital controls. Standard & Poor’s followed suit on June 30, cutting the banks’ rating to “Selective Default”.

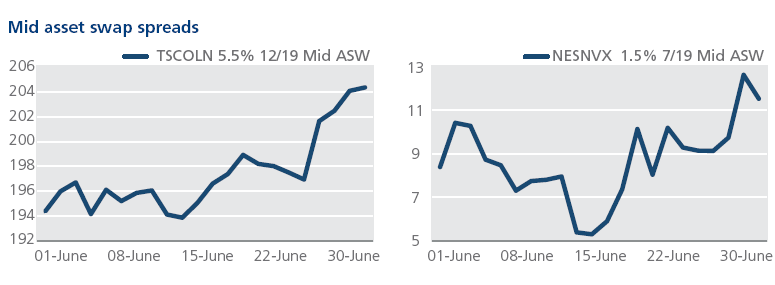

In Consumer, Tesco reported a 1.3% decline in its UK sales during the first quarter of the year, beating analyst expectations of a 1.6%-3% fall. Mid asset swap spreads for the company’s 5.5% 12/19 bond widened by 10 bps to 204 bps over the month. In the same sector, Nestle announced it would destroy more than $50m worth of its Maggi noodles in India following a ban by the local food safety regulator. The food and drinks giant also said it would reduce its Africa workforce by 15%. Mid asset swap spreads for the Nestle 1.5% 7/19 bond tightened by 3 bps to 5 bps between June 1 and June 15; however, they ended the month wider at 11.5 bps.