European Credit Update - July 2014

The Bank of England (BoE) kept interest rates and its quantitative easing program unchanged in July. The International Monetary Fund backed the BoE’s decision to maintain its monetary policy, but said that the central bank should be ready to adopt any necessary measures to keep the housing market in check.

In Eastern Europe, the escalation of geopolitical tensions resulted in new EU/U.S. sanctions imposed on Russia. The sanctions targeted key sectors of the Russian economy, including the energy, finance, defence and technology industries.

Meanwhile, the U.S. Federal Reserve announced on July 30 it would cut its bond purchases to $25bn a month from $35bn following better-than-expected second-quarter GDP data. The 4 per cent growth figure reversed the 2.9 per cent contraction in the first-quarter.

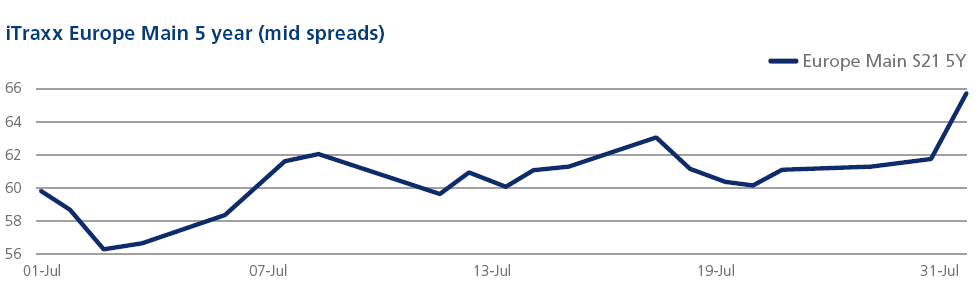

CDS on Tradeweb: The rally in credit indices continued in the first week of July with the Europe Main and Crossover closing as low as 56 and 224 basis points respectively. The rest of the month, however, was marked by a gradual widening of spreads amid heightened geopolitical concerns, with both indices closing at 66 and 266 bps respectively on July 31. Financial indices performed similarly, with the FinSen 12 bps wider on the month and 1.5 bp of Sen/Sub compression.

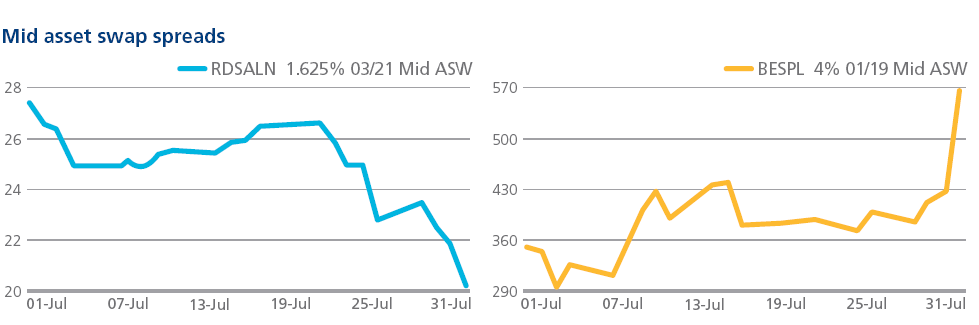

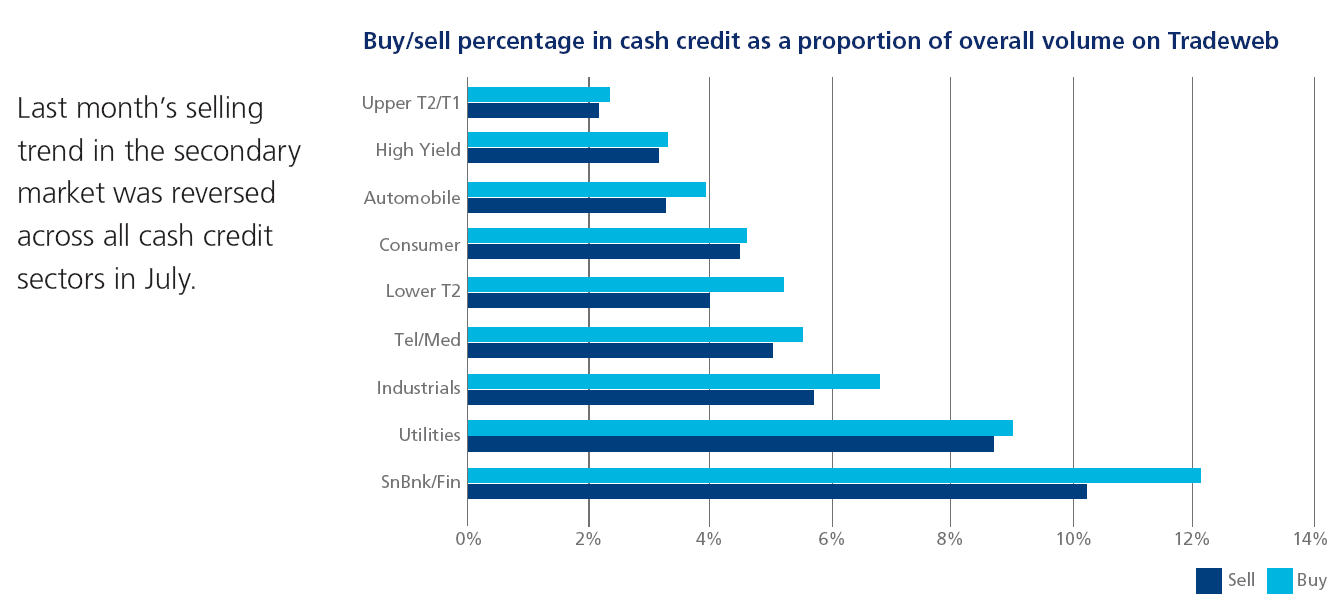

Cash on Tradeweb: July was earnings season for Europe’s largest two oil and gas producers. Second-quarter results announced on July 29 showed a 34 per cent profit increase for UK’s BP. The firm warned, however, that any further sanctions on Russia could harm its business in the country. Royal Dutch Shell also reported a rise in profit (33 per cent) despite impairments of $2 billion. Mid asset swap spreads for the Anglo-Dutch group’s 1.625% 03/21 bond ended the month 7 bps tighter from July 1.

In the Senior Banks/Financials sector, concerns about the financial health of Portugal’s Banco Espirito Santo intensified after the lender posted a first-half net loss of €3.58bn on July 30. The result revealed the extent of the bank’s exposure to its struggling major shareholder, Espírito Santo Group, and increased the chances of a government rescue. Mid asset swap spreads for its 4% 01/19 bond widened from 349 to 568 bps over the month.