European Credit Update - January 2014

The New Year started off with a flurry of upbeat economic data. The World Bank said it foresees more robust growth for 2014, led by a recovery in advanced economies and stronger performance by developing countries. Meanwhile, the International Monetary Fund raised its global growth outlook to 3.7%, and upgraded forecasts for the US, UK and Eurozone.

Weaker than expected US jobs data published on January 10 temporarily threw into doubt the Federal Reserve’s decision to start tapering its QE programme by $10 billion a month. It was followed, though, by encouraging retail sales and inventory figures, and was quickly blamed on bad weather conditions.

Emerging markets, however, felt the impact of the Fed’s gradual withdrawal of stimulus combined with internal political and financial crises. Central banks, including those of India and Turkey, increased interest rates in an attempt to combat sharp currency falls and alleviate outflows pressure.

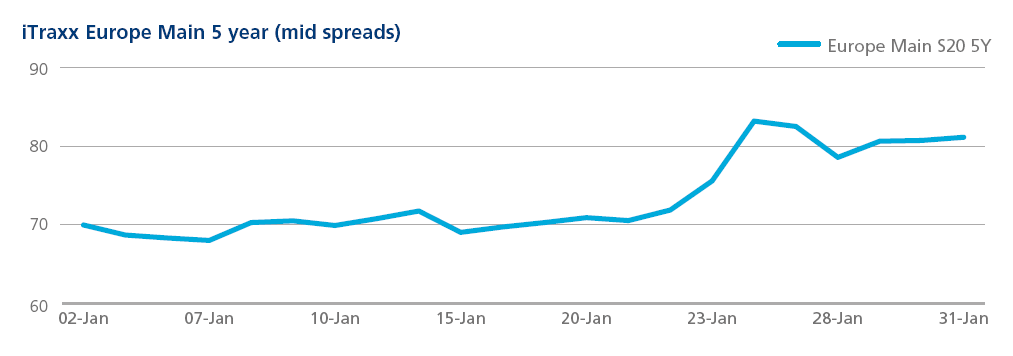

CDS: The first two weeks of 2014 saw the continuation of a strong credit market with tight spreads and low volatility. The iTraxx Main spread varied between 69 and 72 basis points over the time period. Emerging market concerns surfacing mid January coincided with a sell-off, sending the Main index 12 basis points wider to 84. The Crossover index hit a low of 275 basis points on January 7, but ended the month almost 40 basis points wider.

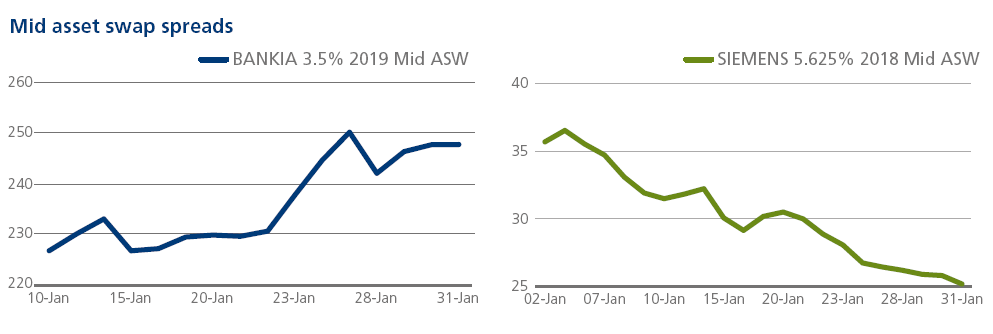

Cash: In the banking sector, Spain’s Bankia issued its first senior unsecured paper since it was bailed out in 2012. The sale of five-year debt on January 9 raised €1bn for the state-owned bank, which returned to profit last year and has already started taking steps towards an early privatisation. The bond’s mid asset swap spread widened by more than 21 basis points from launch to January 31.

Moving to industrials, Siemens AG posted its latest quarterly earnings on January 28. Despite a decrease in total revenue, the German manufacturer attributed strong net profits to its stringent cost-cutting strategy. Mid asset swap spreads for the company’s bond maturing in June 2018 ended the month 10.5 basis points tighter.