European Credit Update - February 2014

Emerging market concerns – particularly the escalation of the Ukraine crisis - continued to make headlines in February. Data from the Bank for International Settlements shows that European banks had loaned $3.4 trillion to developing countries as at end of September 2013.

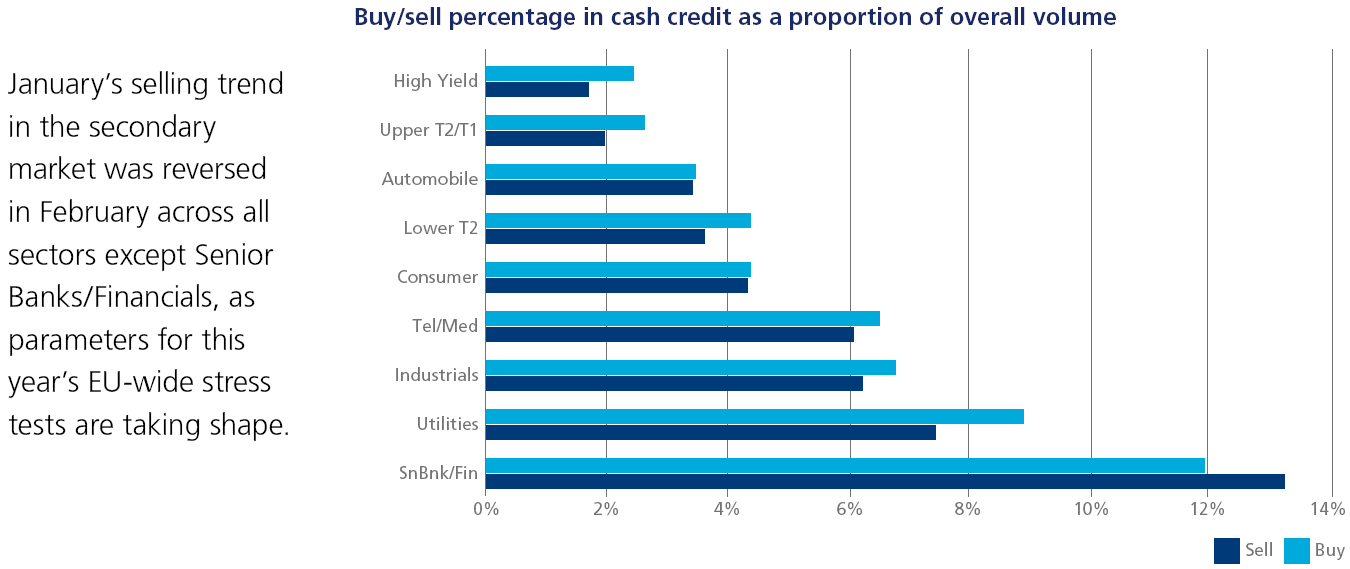

The industry is also facing a comprehensive quality assessment by the European Central Bank in the coming months, while new Federal Reserve rules approved on February 18, will subject overseas banks with a significant US presence to the same capital, risk management and liquidity standards as their local counterparts.

Staying in the US, a bill to extend the debt ceiling to March 2015 was passed by the House and the Senate with no conditions attached, and then signed by President Obama on February 15. Meanwhile, new Fed chair Janet Yellen said on February 11 that only a “notable change” in economic data would sway the central bank from its decision to reduce the pace of its stimulus program. A day later, the Bank of England updated its forward guidance policy indicating that interest rates might stay unchanged until next year’s elections.

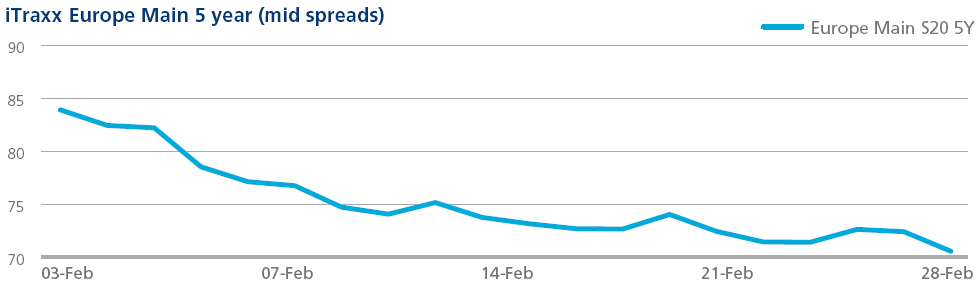

CDS: After a bout of emerging market-related weakness in January, CDS index spreads marched into tighter territory in February, with the Crossover tightening 65 basis points on the month to close at 259 basis points. Similarly, the Main index tightened steadily throughout February; it failed, however, to break through the 70 basis points support level. Financial indices performed in line with 17 basis points of tightening for the FinSen, which closed at 87 basis points, and 13 basis points of Sen/Sub compression.

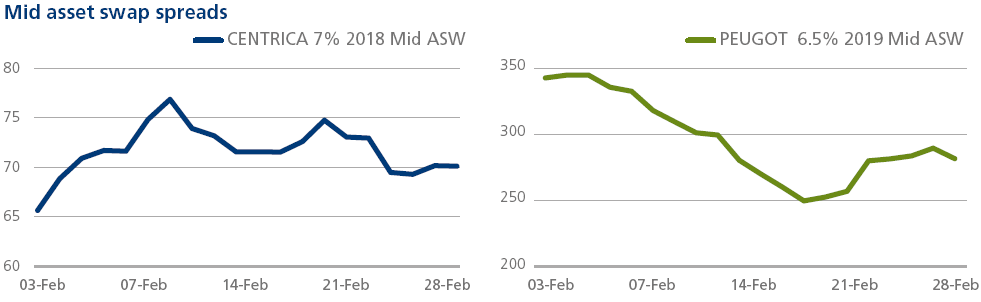

Cash: In the utilities sector, Centrica announced its 2013 preliminary results on February 20. The British Gas owner unveiled a 2 percent fall in operating profit, largely due to rising costs, unusual weather patterns on both sides of the Atlantic, and households switching to other energy suppliers. Mid asset swap spreads for the company’s bond maturing in 2018 widened from 66 to 70 basis points in February.

In high yield, Peugeot confirmed on February 19 a deal to raise €3 billion from China’s Dongfeng Motors and the French state, after reporting an annual net loss of €2.3 billion. On the same day, mid-asset swap spreads for its five-year bond reached their lowest level since launch at 248 basis points, and ended the month 61 basis points tighter from February 3.