European Credit Update - December 2014

Plunging oil prices and international sanctions continued to take their toll on Russia’s economy in December. The country’s central bank raised its main interest rate from 10.5% to 17% on December 16, in an effort to stem the rouble’s collapse.

Fears over Greece’s potential exit from the eurozone resurfaced, when the country’s governing New Democracy party failed to elect a head of state on December 29. Prime Minister Antonis Samaras was forced to call a parliamentary election scheduled for January 25.

The European Central Bank’s liquidity auction on December 11, the second of its Targeted Longer-Term Refinancing Operations, injected €129.8bn into the eurozone’s banking system. The lighter-than-expected take-up of the ECB’s discounted loans fuelled speculation that the central bank may look to additional measures to boost growth and stave off inflation.

Meanwhile, the EU banking union moved a step closer after eurozone finance ministers adopted a new instrument under the European Stability Mechanism (ESM) on December 8, allowing for direct capitalisation of troubled banks in the region. Previously, the ESM could only provide assistance to banks indirectly, via the government of the euro area member state where they are incorporated.

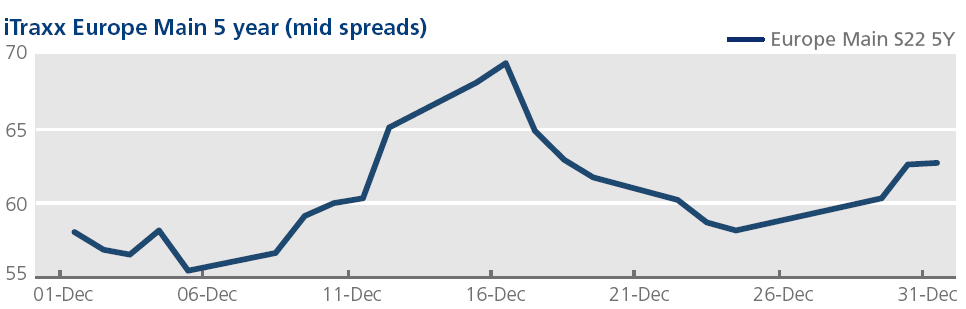

CDS on Tradeweb: December proved to be quite volatile, as sliding oil prices and political developments in Greece dominated headlines. European credit indices started the month reversing November’s tightening trend and reached their widest levels on December 16, with Europe and Crossover at 65 bps and 379 bps respectively. The latter traded as wide as 403 bps intraday.

Spreads for both indices retreated into tighter territory in the second half of the month, ending the year at 63 bps (Europe) and 345 bps (Crossover) on very low volumes.

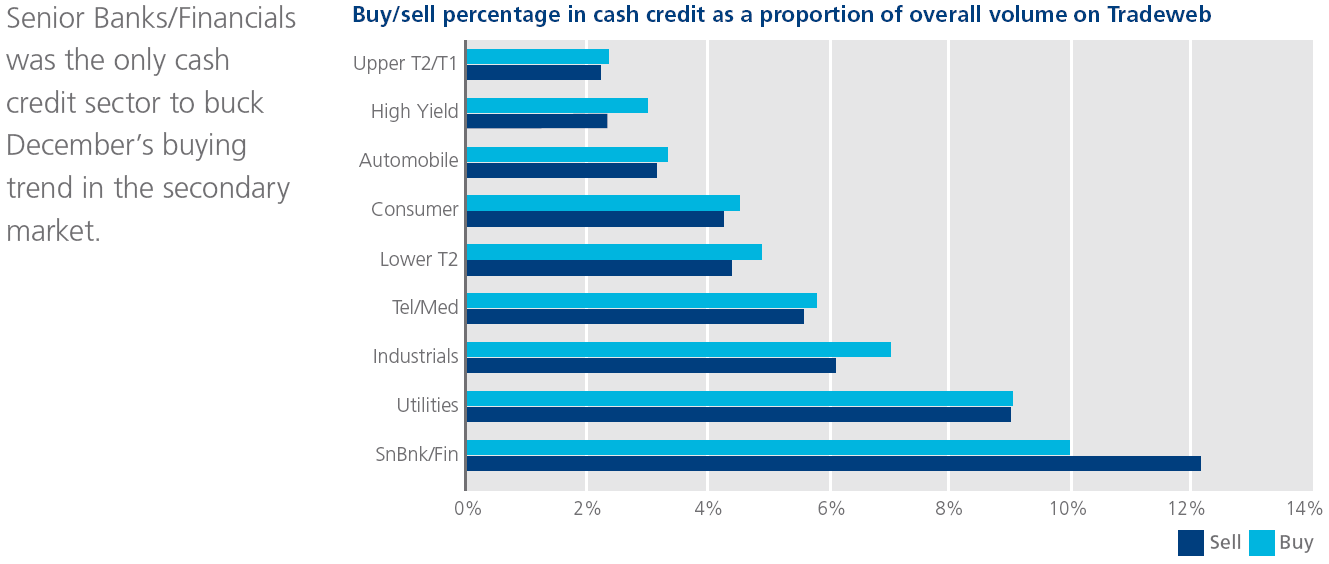

Cash on Tradeweb: Cash credit spreads moved wider in mid December, partly due to seasonal trading patterns as year-end approached. The move wider was initially sparked, however, by concerns over the performance of the world economy, persistent deflationary pressures, and the sustained decline in oil prices.

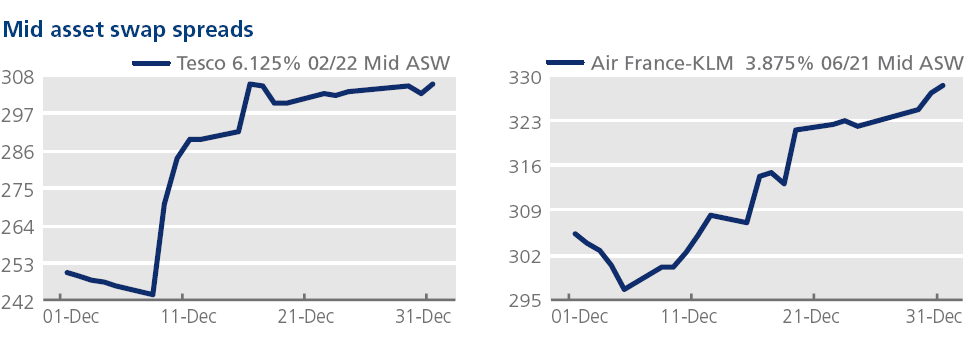

Tesco, the UK’s biggest retailer, issued another profit warning on December 9, as it downgraded its full-year guidance to £1.4bn, £500m below the previous market forecast of £1.9bn. Mid asset swap spreads for its 6.125% 2/22 bond widened by 56 bps to 305 bps over the month.

Nine days later, Franco-Dutch carrier Air France-KLM also cut its earnings forecast by €200m to €1.5-1.6bn. In the secondary market, the company’s 3.875% 06/21 issue widened from 305 bps on December 1 to end the month at just below 329 bps.