Data Points: Government Bond Update - October 2015

Key Points:

- U.S. Fed keeps interest rates on hold

- ECB hints at further stimulus measures

- Sweden’s Riksbank expands QE

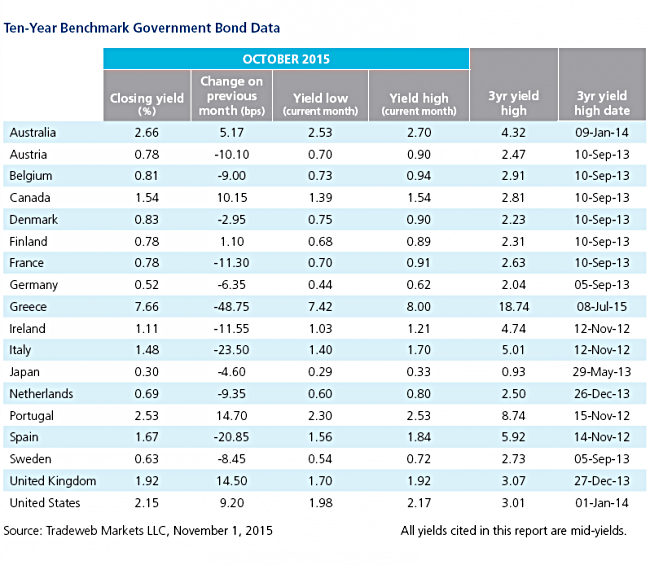

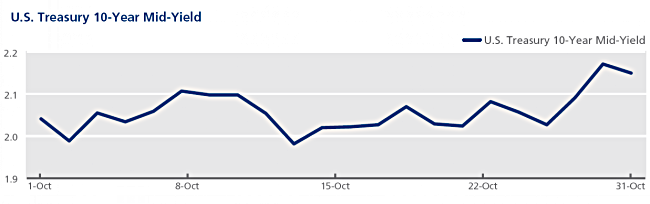

The U.S. economy added just 142,000 jobs in September, the Bureau of Labor Statistics reported on October 2. In addition, figures for August and July were revised downwards by a combined 59,000. Later in the month, the Bureau of Economic Analysis announced that GDP growth had slowed to an annualized 1.5% in the third quarter of 2015, down from the 3.9% expansion recorded between April and June. The U.S. Federal Reserve kept interest rates unchanged; however, it raised the likelihood of a hike as early as December. The Treasury 10-year mid-yield ended the month 9 basis points higher at 2.15%.

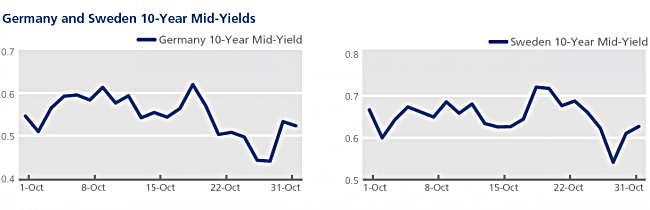

Conversely, the European Central Bank signalled on October 22 that it was prepared to cut interest rates and step up its €1.1 trillion bond-buying program to combat deflationary pressures. As month end approached, yields on two-year government debt closed at record lows in Italy (0.01%) and Ireland (-0.22%) on October 27, followed by Austria (-0.29%), Belgium (-0.30%), Finland (-0.32%), France (-0.29%), Germany (-0.35%), Spain (-0.02%), and the Netherlands (-0.33%) on October 28. October also saw Denmark resume government bond auctions, which had been suspended since January to defend the kroner’s peg to the euro. Meanwhile, Sweden’s Riksbank boosted its bond purchasing plan by another 65 billion kronor (€6.9 billion). The country’s 10-year bond mid-yield finished the month 8 basis points lower at 0.63%.

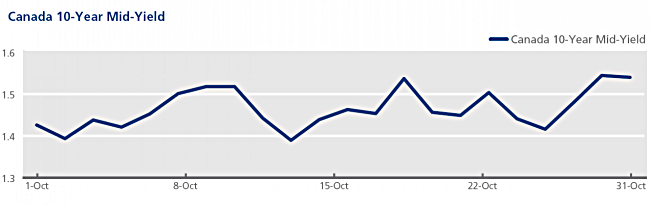

In Portugal, president Anibal Cavaco Silva invited incumbent prime minister Pedro Passos Coelho to form the country’s next government, following the latter’s victory in the October 4 general election. Having lost its parliamentary majority, however, Mr Coelho’s government could be shortlived, if it failed to win a vote of no confidence. The mid-yield on the Portuguese 10-year benchmark bond increased by almost 15 basis points during the month to close at 2.53%. Its Canadian counterpart also rose through October, closing 10 basis points higher at 1.54%. On October 19, Liberal party leader Justin Trudeau was elected Canada’s new prime minister, ending the Conservative Party’s nine-year reign.