Data Points: Government Bond Update - May 2014

Key Points:

- Core Bond Markets Rally

- European Economies Continue Gains

- Portugal Exits Bailout

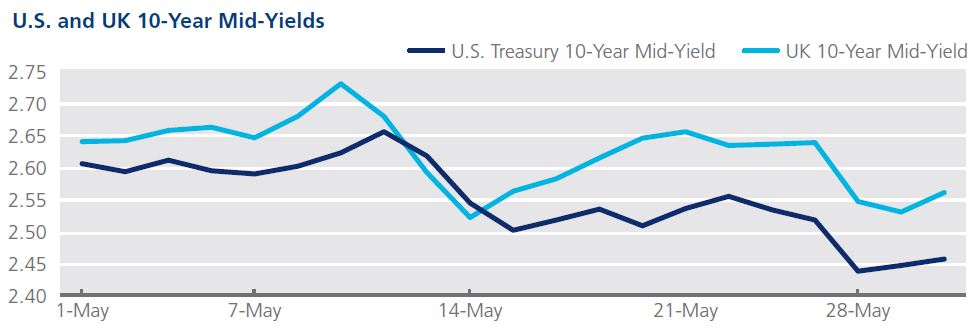

The U.S. economy contracted in the first quarter of the year, with GDP shrinking at a seasonally adjusted rate of 1%, according to the Commerce Department. The mid-yield for 10-year Treasuries fluctuated during the month, starting at 2.59%, hitting a high of 2.65% on May 12 and ending the month at 2.46%. The mid-yield on the U.S. 1-month bill also saw significant volatility, rising 31 basis points from May 1 to finish the month at 0.038%. The UK economy had a strong first quarter marking 3.1% of nominal growth; however, Eurozone inflation remained a concern at 0.7%. Gilts also rose and fell during the month, starting at 2.63%, hitting a high of 2.73% on May 12, and falling to 2.56% at month-end. Germany’s unemployment rate dropped to 6.6% in May, while the country’s economy grew 0.8% in the first quarter of 2014. The benchmark 10-year bund mid-yield started at a month-high of 1.46% and closed May at 1.31%.

Europe’s peripheral economies experienced a month of positive news with credit ratings of two countries being upgraded. Spain’s sovereign debt credit rating was raised one level to BBB by Standard & Poor’s to a stable outlook, citing a “view of improving economic growth and competitiveness.” The mid-yield on Spain’s 10-year bond started at a month-high of 3.01% on May 1 and fell 16 basis points to finish at 2.85%. Greece’s sovereign debt was upgraded to B from B- by Fitch, which stated that “Greece achieved a primary surplus in the general government account in 2013, a key target.” The mid-yield on the Greek 10-year hit a high of 6.77% on May 16 and ended 112 basis points down from May 1 at 6.19%.

Portugal became the second eurozone country after Ireland to exit its bailout program without a precautionary credit line, with €214 billion in debt remaining on its balance sheet. The country will now look to the bond markets to cover its financing needs after the €78 billion EU and IM-assembled rescue package formally concluded. In addition, Moody’s Investor Service raised its credit rating for Portugal’s government debt on May 9 to Ba2 from Ba3 noting the country’s improving financial situation. The country’s 10-year benchmark bond started and ended the month at 3.61%, but saw some volatility hitting a month-high of 3.95% on May 20.

Portugal’s 10-year benchmark bond started and ended the month at 3.61%, but saw some volatility hitting a month-high of 3.95% on May 20