Data Points: Government Bond Update - July 2015

Key Points:

- IMF warns Fed against 2015 rate increase

- Greece strikes last-minute debt deal

- Government bonds rally amid volatility

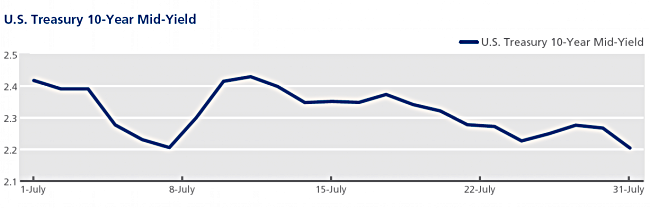

According to data published by the U.S. Bureau of Labor Statistics on July 2, total nonfarm payroll employment increased by 223,000 in June, while the jobless rate declined to 5.3%. Five days later, the International Monetary Fund warned the Federal Reserve against increasing policy rates this year. The central bank left interest rates unchanged on July 29, saying it would need to see “further improvement in the labor market” before raising them. The mid-yield on the 10-year Treasury fell to 2.21% on July 7, before rising to 2.43% on July 13, but then closing the month 23 bps lower.

European government bond markets rallied in July amid widespread volatility, as Greece struck a last-minute deal with its creditors on July 13 to avert financial collapse. In order to receive the €86 billion bailout package, the country will have to implement a series of economic reforms agreed by both sides. Greek banks re-opened on July 20, although capital controls remained in place. The country’s 10-year government bond mid-yield spiked at 18.74% on July 8 – the highest closing value since October 4, 2012 – but closed the month much lower at 11.85%. The 10-year Bund mid-yield also experienced volatility during the month: it fell 17 bps to 0.63% between July 1 and July 7, before rising 26 bps by July 10 and dropping again to 0.61% at month end. Its UK Gilt counterpart followed a similar pattern, first falling to 1.82% on July 7, before rising to 2.14% on July 15 and then dropping to 1.88% by the end of the month. In a statement to the Treasury Select Committee on July 14, Bank of England governor Mark Carney said that an interest rate hike was “moving closer”.

Euro area annual inflation held steady at 0.2% in July, a Eurostat flash estimate showed on July 31. Meanwhile, Ireland’s economy advanced 1.4% in the first quarter of the year compared to the previous three months, thanks to stronger exports and consumption. Year on year, the country’s gross domestic product expanded by 6.5%. The mid-yield on the Irish 10-year benchmark bond dropped 43 bps over the month to close at 1.19%.