Data Points - ETF Update - June 2019

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

June proved to be the third strongest month for the Tradeweb European ETF marketplace since its launch in late 2012, with total traded volume reaching EUR 28.36 billion. Meanwhile, 65.4% of transactions were processed via Tradeweb’s Automated Intelligent Execution Tool (AiEX), a new monthly record.

Adriano Pace, head of equities (Europe) at Tradeweb, said: “June marked the end of the best performing quarter for European ETF trading on Tradeweb. Total notional value traded in Q2 2019 was EUR 84.30 billion, up EUR 1.4 billion from Q1 2019. This was largely thanks to increased platform adoption by institutional clients coupled with continued bouts of volatility, particularly around May’s market correction and its subsequent recovery in June.”

Volume breakdown

Trading activity in fixed income ETFs increased to 43% of the overall platform flow in June, beating the previous 12-month rolling average by nine percentage points. The asset class saw net buying for the eighth consecutive month, in contrast to equities ETFs, which saw ‘sells’ surpass ‘buys’ by four percentage points. North America Equities was the most heavily-traded category during the month, after last holding the top spot in March 2019.

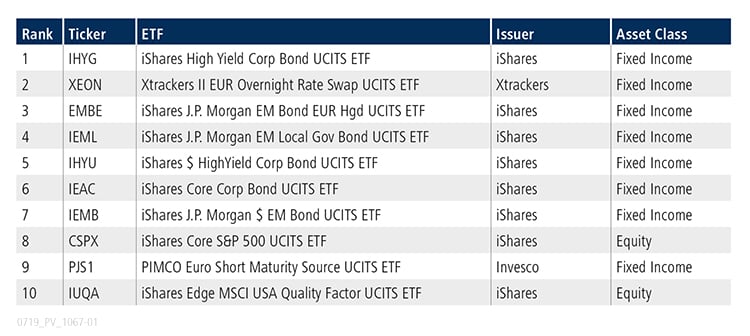

Top ten by traded notional volume

Fixed income products dominated June’s most actively-traded ETF list, with the iShares High Yield Corporate Bond UCITS ranked first. The only two shares-based products to feature in the top ten offer investors exposure to U.S. Equities.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in June 2019 was USD 10.51 billion.

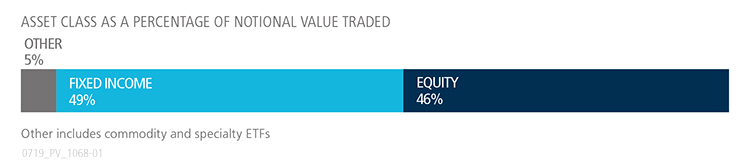

Volume breakdown

As a percentage of total notional value, equities accounted for 46% and fixed income for 49%, with the remainder comprised of commodity and specialty ETFs. More than 54% of U.S. ETF trades were executed via the Tradeweb AiEX tool.

Adam Gould, head of U.S. equities at Tradeweb, said: “June was a strong month for the U.S. equity market, with the VIX declining 19% and the S&P 500 rising 7% from the end of May. Investors clearly were in ‘risk-on’ mode due in part to expectations that the Federal Reserve would cut rates at its July meeting. In turn, we continued to see elevated volumes in fixed income ETFs of varying durations, as investors positioned themselves accordingly. Trading was particularly active in funds benchmarked to the short end of the curve, with SHV, SHY and BIL comprising three of the platform’s four highest volume ETFs.”

Top ten by traded notional volume

During the month, 476 unique tickers traded on Tradeweb’s U.S. ETF platform. Equity and fixed income ETFs were equally represented in the top ten list by traded notional volume.