Ai-Price: Creating an Edge in Credit Trading

"Trying to price a large portfolio of corporate bonds such as corporate bond ETFs that provide intraday and instantaneous liquidity in real-time in a volatile market is singularly difficult without significant resources to assist." - Chris Bruner, Head of U.S. Credit

Introduction

Fixed income products are among the most actively traded in the world, and global notional outstanding of rates and credit stands at approximately $611 trillion1 according to the latest available data. Still, despite their size, these markets can be illiquid – less than 5% of U.S. corporate bonds, as an example, change hands on a daily basis. In addition, there’s further variance across issuers, maturity dates, coupons, structures and contract terms.

These two factors – illiquidity and diversity – mean that fixed income traders face a significant challenge in one of the most fundamental aspects of their craft; arriving at the right price. Empirically, the best price should reflect the most information and ideally, calculated on a real-time basis. On a practical level, traders need pricing to be as objective, fast and realistic as possible. How to do that, then, when the fixed income universe is so vast?

Machine learning – which by its nature is designed to process and parse vast data sets - presents a practical path forward. This paper considers its usage in the U.S. corporate bond market, but its application is obvious across assets.

"Technology has made it simpler and cheaper to build a pricing model that can provide a general indication of where a bond might, could or should trade. But a model is only as good as its inputs, and its inputs only as broad as the model flexible."

How Traders Price Corporate Bonds

To price a bond, participants on both sides of the trade run through a similar set of questions:

1. Has the bond TRACE’d today?

2. Has the bond TRACE’d recently?

3. Has another bond by the issuer TRACE’d today/recently?

4. Have credit conditions or business conditions for the issuer changed?

5. Does the desired bond have unique features that cause it to trade rich/cheap to the issuer’s spread curve?

6. Has there been any change in macroeconomic conditions since the last TRACE print?

7. Has there been any change in overall credit market conditions?

8. How have liquidity conditions been recently?

9. Does the other side agree with my price?

These individual steps lead to five key areas of challenge, particularly when market participants are considering more complex trades:

Scaling

Pricing individual bonds is tricky enough. Even more complex is deciding on multiple prices across multiple bonds. Without real-time prices, however, portfolio trades and list trades must rely on stale prices – both on a bond by bond and consolidated basis.

Inaccurate pricing in this context impinges on processes beyond simply transferring ownership. For example, portfolio and list trading power the create-and-redeem market for corporate bond ETFs. Over the past 15 years, passive assets have gained in popularity, reflecting increased investor confidence in index strategies. Passive funds now account for approximately 35% of mutual fund holdings in the US.2 Still, the typical benchmarks for pricing these trades in many cases are updated only once a day.

Cost

Across the buy-side and sell-side it is extremely expensive to run a trading desk. On the sell-side, for example, the team is divided into high-grade and high-yield traders and subdivided by sector. The traders are supported by desk analysts who provide in-depth research on specific issuers and their bonds. In addition, a quant team is often in place to develop proprietary pricing models. If pricing the bonds can become more cost-effective, it may enhance liquidity for both large and small providers.

Time

Each of the pricing steps is time consuming, irrespective of its ease or difficulty or the expertise of the participants. It can take minutes to arrive at an initial price for a corporate bond. This puts the corporate bond markets at odds with peers such as equities and futures, in which trades are often executed in millionths of a second. Compressing this turnaround time would make for a more efficient market and prices that better reflect the market as it is now, versus how it was minutes or hours ago.

Objective Pricing

The arrival of TRACE in the corporate bond market has led to sweeping change and significant progress toward greater transparency. But when it comes to pricing, TRACE can only tell you where a bond has traded. There is no indication of where the bond will trade, and the lack of broad streaming updates spanning thousands of CUSIPs in this segment of the market means it’s tough to find a truly representative composite price.

This shortfall – while not necessarily a flaw in the design of TRACE – has knock-on effects, not least on prices themselves. Unlike the equities market, it is difficult to identify fat-finger trades or a bad price for a bond that trades noticeably wide or tight to an issuer’s curve. And without an independent price, best execution and TCA – nascent services in the corporate bond market – become less scientific exercises.

Modeling

Technology has made it simpler and cheaper to build a pricing model that can provide a general indication of where a bond might, could or should trade. But a model is only as good as its inputs, and its inputs only as broad as the model is flexible. A black box that cannot be adjusted in response to client or dealer feedback is likely to be inefficient and impenetrable to its users, both of which inhibit arrival at an informed price.

How Ai-Price Works

Ai-Price utilizes data from TRACE (filtered to reduce noise, including ignoring smaller tickets3), information aggregated from Tradeweb Direct, and Tradeweb’s real-time proprietary US Treasury Composite, as well as CDS and US swap spread composite prices from TW SEF.4

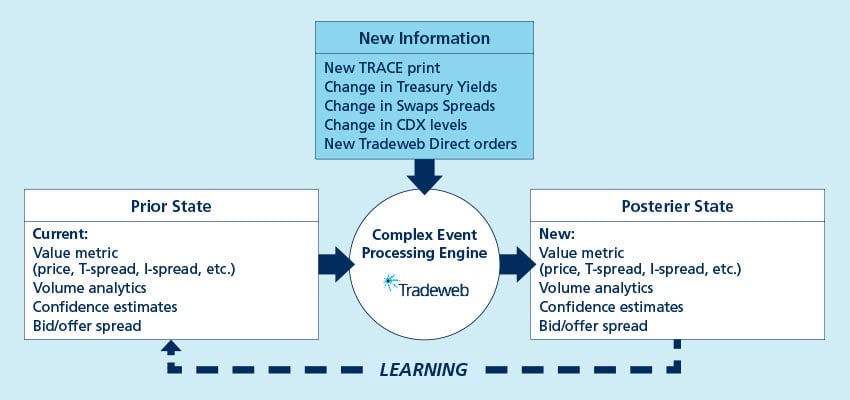

At its core Ai-Price is a Bayesian state space model process that updates prior estimates with the latest information. The Ai-Price model adjusts levels based on relevant new data, taking into account confidence levels, covariance and term structure. A blending algorithm is applied to reflect the relative strength of different inputs. The model takes into account the size of the trade, counterparties, the side of the trade (buy/sell), and bid/ask imbalances and width. The estimator is unbiased and converges quickly.

In addition, the model employs a dynamic beta structure incorporating liquidity, maturity, and price confidence for each bond. This ensures that when an update occurs the change is appropriately reflected across related bonds.

The model is designed to be agile and uses machine learning to filter noisy TRACE prints, and identify and alleviate issues from fat-fingers and off-market trades, as well as regularized to avoid overfitting. Much like a market-maker would do, the bid/ask spread algorithm incorporates liquidity scores, trading imbalances and execution costs. By using real trading data in computing the bid/ask spread the algorithm can estimate probable execution costs for an entire portfolio.

Tradeweb is working to make the algo respond even more dynamically to market conditions and calibrate for aggregate error. In addition, model parameters are tuned on a nightly basis to minimize this error in the system. The end result is an algorithm that is exceptionally nimble, a particular benefit in more volatile markets.

This model has several additional advantages over alternative pricing sources. For example, the most recent information is heavily weighted, making the model more responsive to paradigm shifts such as macroeconomic data or idiosyncratic repricing. Additionally, the model has more degrees of freedom than rival methodologies, such as those using decision tree pruning. This allows for more granularity when estimating the price of a bond, incorporating unique factors that can impact a particular issue. Further, the model outputs 150 unique factors including confidence intervals.

Of course, the ultimate price of any security is that agreed by two parties. As with other composite, or indicative prices, Ai-Price is a reference. However, it is designed to be unbiased, market calibrated, dynamic, and converges quickly for real-time updates. By design it is an effective and accurate guide for trading purposes.

Ai-Price: A Reference Price Built for Traders

When we thought about how to build Ai-Price, we asked the same questions as when we built our credit platform: how can we meet our clients where they are, understanding the situation from desk to desk and firm to firm and acknowledging that each journey to the “right” price is different? We aimed to meet traders’ requirements across the aforementioned five key areas:

Scaling

Every day, Ai-Price provides quotes across 19,000 of the most-traded corporate bonds. For both buy- and sell-side traders, this reliably answers where the market is at the point of trade. Ai-Price also significantly reduces the time to quote prices for portfolio and list trades. A single basket reference price is available in seconds, freeing up traders on both sides of the trade to negotiate individual component bonds and their relative value or price. With Ai-Price it is possible to trade portfolios in excess of $1 billion in a matter of moments, versus the days it may have taken previously.

Cost

With desks far leaner than they were pre-crisis, a solid reference price allows traders to hone in on the elements and impact of a trade itself, rather than deploying significant resources to arrive at an appropriate price. In addition, it frees up time to support client relationships. A more precise price allows traders to better position the bank’s portfolio and to provide clients with the liquidity and balance sheet they need. More time can also be spent on accounting for the risk of the trade and pricing that risk.

Cost effects can take different forms. For example, liquidity providers can more readily compete in RFQs with less infrastructure and overhead, which creates a more competitive, nimble landscape for the buy-side.

Time

The less traders spend pricing, the more time they can spend trading, which in turn feeds liquidity. Moreover, a more confident assessment of price helps market participants cut the time they need to appraise responses to an RFQ. It also opens opportunities to leverage rules-based trading systems such as Tradeweb’s Automated Intelligent Execution (AiEX). As long as the inquiring desk receives enough responses to its RFQ, using Ai-Price as a live market reference, the trade can be executed automatically.

Objective Pricing

Objective pricing brings prima facie benefits to both the buy-side and sell-side.

Buy-side

Ai-Price’s unique combination of reference prices and historical trading records allows buy-side traders to better analyze trading strategies. These factors may include market conditions, the size of the trade, and underlying liquidity. This allows for a more incisive answer into questions including when markets are selling; whether it is best to go voice or electronic; and the most useful protocol to limit market impact and get the trade done.

Sell-side

Post-crisis an accurate assessment of risk is critical. Ai-Price offers risk managers an independent input to evaluate risk exposure. With price history for more than 19,000 bonds and increasing precision of pricing for each bond, it is far easier to analyze trading positions and understand the impact of various risk scenarios, including correlations. Besides, good prices are good for business: it becomes a lot easier to justify where books were marked if there’s an additional objective data point to prove for accuracy.

Modeling

Much like a trader would adjust his approach based on market color, so Ai-Price can be adapted to respond to feedback. As a Bayesian state space model, Ai-Price is nimble to market conditions. Moreover, procedures exist to correct exogenous deviations in the current state for particular bonds. It benefits from a network effect; the more users, the more potential sources of proposed enhancements.

Conclusion

U.S. corporate bond markets are some of the most diverse and active in the world. The growing impact of technology is leading to faster trading, more velocity and opportunities to use advanced analytics to make smarter decisions. Against this dynamic background, Ai-Price represents a new frontier. Right now, it is providing a reliable reference for matching sessions, automated execution, error reduction (e.g., fat fingers), portfolio trading and independent price verification. Given these are early days in Ai-Price’s development, we expect the list to grow over time.

There is no such thing as a “perfect price” – price is ultimately what different market participants will pay. However, we hope to provide market participants with high-quality context that can inform a range of trading-related activities. In this respect, Ai-Price is a decisive step forward on the road toward much more specific, and widely-available pricing.

"A more precise price allows traders to better position the bank's portfolio and to provide clients with the liquidity and balance sheet they need."

To learn more about the Tradeweb Credit platform, click here.

1 SIFMA, TRACE, TRAX, CLARUS, AFME, JSDA, BIS, ETFGI, ISDA and the Federal Reserve Bank of NY.

2 Global Asset Management 2019, Will These ‘20s Roar, Boston Consulting Group, 2019.

3 Current minimum trade sizes are $500k for high-grade and $250k for high-yield.

4 Tradeweb is a leader in institutional US Treasury trading and TW SEF is the largest SEF for Vanilla Interest Rates Swaps and second largest SEF for Credit Default Swaps.

Related Products

Corporate Bonds , Transaction Cost Analysis (TCA)