500 Billion Reasons to Celebrate the Third Anniversary of Bond Connect

Li Renn Tsai

Head of Product and Sales, Asia, Tradeweb

It’s been three years since the China Foreign Exchange Trade System (CFETS) and Hong Kong Exchanges and Clearing (HKEX) took the historic step of opening up China’s Interbank Bond market to foreign investors via Bond Connect. This collaborative initiative, which Tradeweb helped design and implement, represented the most ambitious, large scale effort to create an access point to China’s USD 13 trillion bond market for international investors.

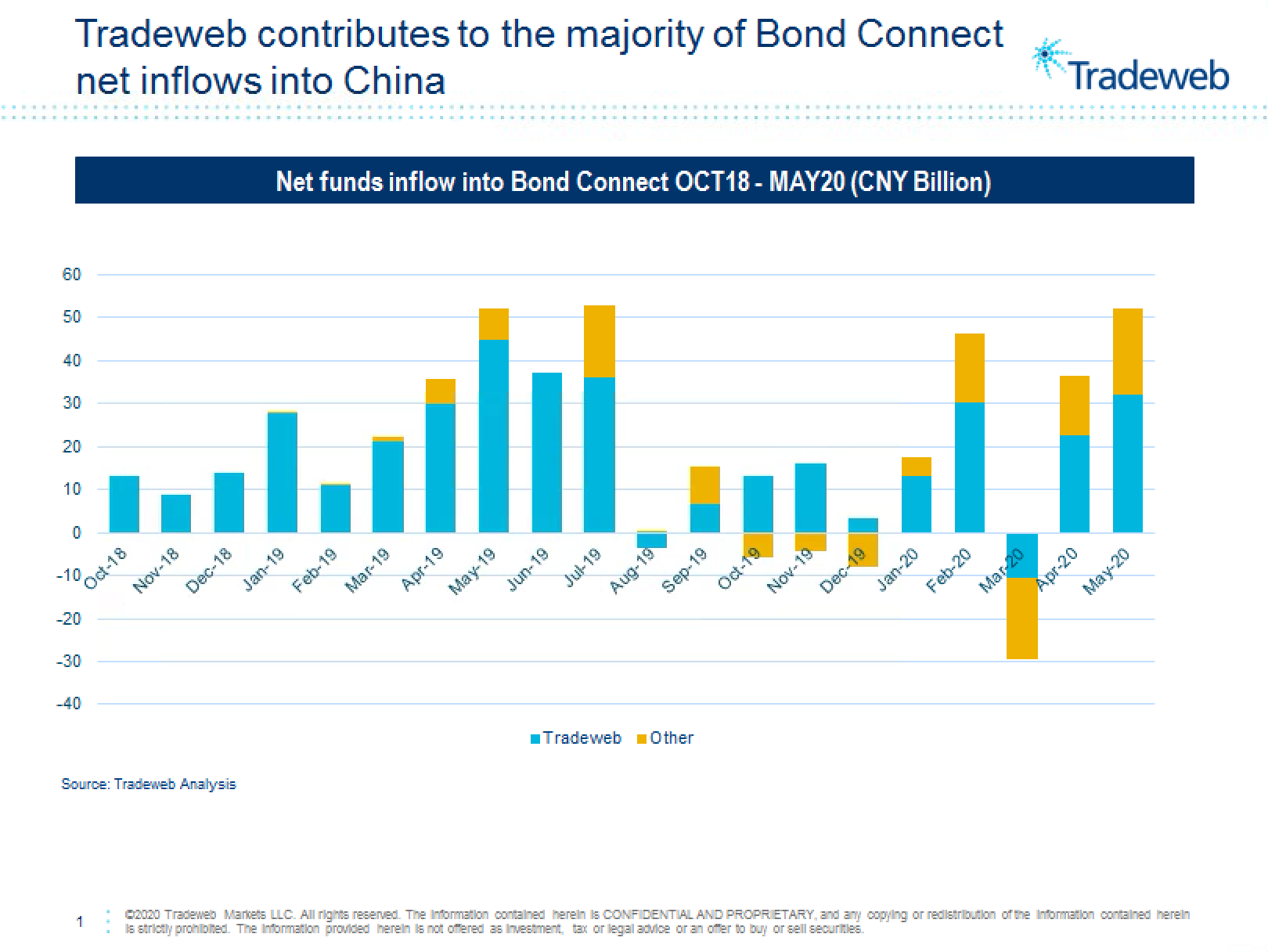

It also created a unique opportunity for Tradeweb clients to become some of the first foreign asset managers to electronically access liquidity in Chinese fixed income products at scale. Tradeweb was the first offshore trading venue to link to Bond Connect in July 2017, and since then, it has accounted for the lion’s share of volume on the platform.

Through June of this year, Tradeweb clients have traded USD 516 billion on Bond Connect and activity continues to grow at a rapid pace. In June 2020, average daily volume (ADV) of USD 1.25 billion for Tradeweb clients on the Bond Connect platform was up 16.15% versus the same month last year. Total notional ADV through the first half of 2020 was USD 934 million, up from USD 875 million in the first half of 2019.

What these numbers show is a steadily growing interest among asset managers to dig deeper into the Chinese fixed income market – even during the period of extreme volatility we’ve been seeing over the past several months. That makes sense when you consider the diversification benefits exposure to Chinese-denominated fixed income instruments can offer, and the ease of incorporating the asset class into an existing electronic trading workflow.

We’ve also continued to enhance and refine the offering with new features, such as dealer streaming prices, block trading and list trading capabilities. With each of these new developments, Tradeweb’s goal has been the same: to improve trading workflows, making it as seamless as possible for offshore investors to access liquidity in Chinese fixed income via the Bond Connect platform.

With the addition of dealer streaming prices, for example, Bond Connect participating dealers are able to contribute live streaming liquidity across all bonds tradable on the Chinese Interbank Bond Market, dramatically increasing price transparency and improving trade counterparty selection. Likewise, with recent enhancements to Tradeweb’s block allocation and list trading solutions, offshore investors can trade on behalf of up to 50 different funds in one block transaction and send up to 40 trades on a single list and receive quotes back within a specified time window.

In terms of investment mix, Tradeweb clients are using these tools to trade primarily in Chinese government bonds and China policy bank bonds with an average tenor of 9.1 years. It is noteworthy that the average tenor has grown quite a bit from an average of 6.5 years in 2019.

Ultimately, the trend we still to see among our clients is that by providing access to Chinese onshore debt instruments with a seamless, familiar workflow and simplified regulatory approval processes, volumes have continued to grow. It’s a trend we expect will persist and one that we are honoured to be able to support through our close work with all participants, including Bond Connect Company Limited (BCCL), PBOC, HKMA, CFETS and HKEX.

We’ve recognised for a long time that China’s fixed income markets represent a fundamental and powerful opportunity for international investors. It is a privilege for us to be able to unlock that potential on behalf of our clients.

To learn more about our market connection to Bond Connect click here.