2013: The Top 10 Observations in the Global Fixed Income Markets

Over the past year, the global fixed income community has experienced one of the most exciting and challenging market environments amid a period of broad financial reform. Volatility in government bonds, record issuance of corporate debt, quantitative easing and new regulation all served as major themes in 2013 as markets evolved in new and innovative ways. From our view as a leading electronic marketplace across the spectrum of fixed income and derivatives products, here are our top trends and stories from the past year:

Quantitative Easing Endures

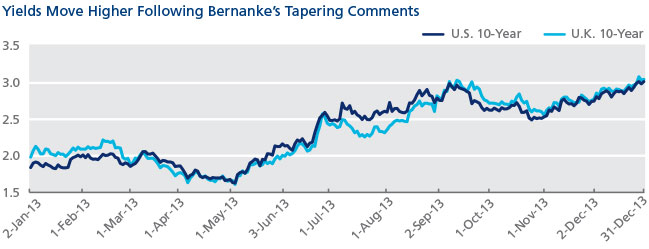

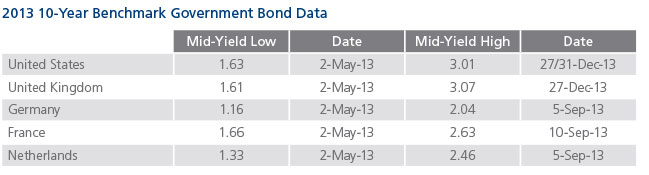

Quantitative easing (QE) remained a key monetary policy tool used by central banks to stimulate economic growth. The U.S. Federal Reserve’s balance sheet grew to $3.8 trillion in 2013, as its monthly bond-buying program of $85 billion in Treasurys and mortgage-backed securities continued. Following Chairman Bernanke’s comments in May on the “step down” of QE, Treasury yields climbed higher than two percent for the first time since March. The Fed later announced on December 18 that it will pare back its Treasury purchases by $10 billion a month starting in January, a change in policy which coincides with the end of Chairman Bernanke’s term. Treasury yields closed above three percent for the first time in 2013 on December 27, reversing the yield trend following the Fed’s tapering announcement. Chairman Bernanke’s successor, former Fed vice chair Janet Yellen, also indicated she’s in favor of continuing the Fed’s QE program until the economy sees a robust recovery.

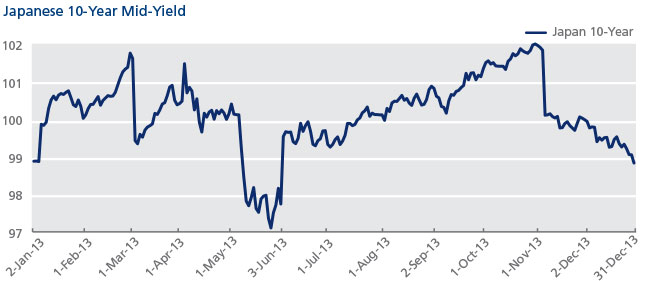

Japan’s central bank announced in April it would more than double its bond buying program to ¥190 trillion by the end of 2014. The move is part of a set of policies aimed at restoring the country’s economic health often referred to as “Abenomics,” named after Japanese Prime Minister Shinzo Abe.

Similarly, the Bank of England’s (BOE) Monetary Policy Committee voted to keep its bond-buying program stable at £375 billion. Nonetheless, the BOE left interest rates at record lows, noting that it would not raise them until unemployment falls to or below 7 percent. The unemployment rate for the UK at the end of 2013 was 7.4 percent, its lowe

The U.S. Government Shutdown

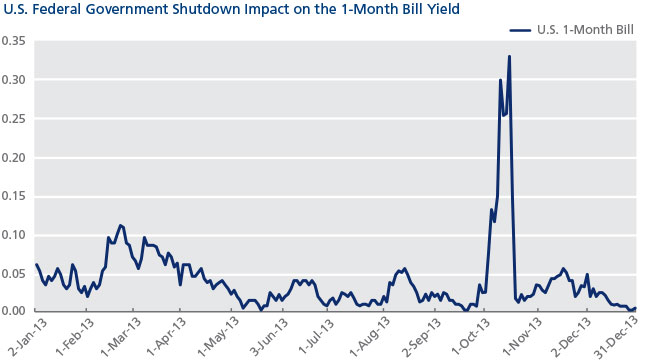

One of the year’s main stories was the 16-day U.S. federal government shutdown in October following a Congressional stalemate. Yields on U.S. short-term debt saw significant volatility that month with those for 1-month Bills climbing to levels not seen in over three years, and the mid-yield for the 1-year bill rising 26 basis points from 0.07 percent on October 1 to 0.33 percent on the 15th. However, yields quickly fell to 0.2 percent by October 17 after Congress reached a deal to prevent a default on U.S. debt payments. The mid-yield on the 1-month bill has remained relatively stable since October, closing at 0.005 percent on December 23.

Congress negotiated and approved a bipartisan budget deal, which was later signed by President Obama on December 26. The budget plan is an agreement to fund the government until 2015 and reduce the federal deficit by up to $23 billion, helping to mitigate the threat of another shutdown. However, Congress is expected to resolve the issue of raising the debt ceiling in early 2014 to avert a U.S. default.

The government shutdown resulted in yields for 1-month Bills climbing to levels not seen in over three years.

Markets React to Political Turmoil

Political instability dominated headlines in 2013. Italy experienced a turbulent year after February’s general elections led to a two-month political stalemate. The deadlock finally ended with the formation of a coalition government on April 27 headed by Enrico Letta. Italian 10-year mid-yields peaked at 4.88 percent on February 26 and stayed above 4.5 percent until April 5. Letta went on to win two confidence votes on October 2 and December 11, while ex-Premier Silvio Berlusconi was expelled from Senate in November.

Similarly in Greece, the conservative-led coalition government narrowly survived a no-confidence vote in November, brought by the main opposition party to protest the eviction of staff from defunct state broadcaster ERT.

Portugal’s political crisis re-ignited in July when disagreements over prolonged austerity measures resulted in the resignation of two prominent ministers. On July 12, opposition leader António José Seguro demanded a re-negotiation of the bailout deal with Brussels causing a stir in the markets. Mid-yields for Portuguese 10-year bonds increased 62 basis points that day to reach their highest level for the year at 7.41 percent.

Italy experienced a turbulent year after February’s general elections led to a two-month political stalemate.

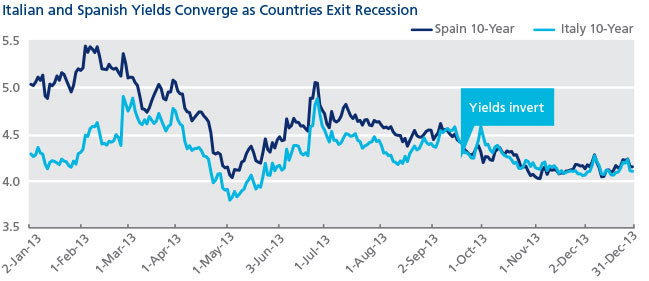

European Peripherals: A More Positive Outlook

Italy’s longest recession since World War II is technically over according to flat third-quarter gross domestic product figures published by the national statistics institute Istat on December 101. The good news came after two credit rating downgrades earlier in the year: first in March by Fitch and later in July by Standard & Poor’s. Portugal and Spain also emerged from recession in 2013. However, Spanish unemployment remains at 26 percent, while deflation concerns are growing. Italian and Spanish 10-year benchmark bond yields inverted in September for the first time since March 2012, but both ended the year close to the 4 percent mark.

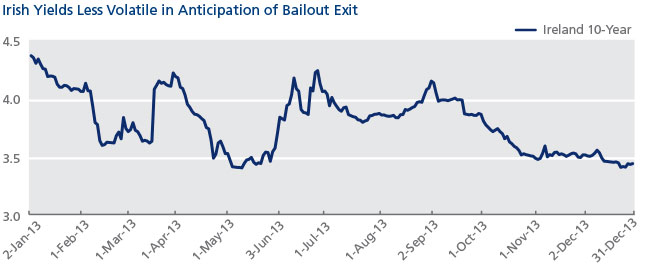

Ireland became the first eurozone country to exit its EU/IMF bailout program on December 15, notably without a precautionary credit line. This was made possible by large state cash reserves, good public finances and historically-low sovereign bond yields. Ireland is now able to fully return to the international lending markets with control over its economic policy. Irish 10-year mid-yields stood at 3.45 percent on December 16, a drop of 92 basis points from their 4.37 percent level at the start of 2013.

Greece and Portugal are scheduled to exit their bailout agreements in 2014 and regain full access to debt markets, although this will depend on the countries’ ability to implement key reform measures.

Italian and Spanish 10-year benchmark bond yields inverted in September for the first time since March 2012.

Mixed Fortunes for the World’s Core Economies

When Moody’s downgraded the United Kingdom’s credit rating in February and Fitch followed suit in April, the government’s economic strategy was called into question by the opposition. Fast forward to November and the UK economy is the fastest growing in the developed world, according to OECD data. Upgraded growth forecasts for 2013 and 2014 by the BOE and the Office for Budget Responsibility have increased speculation that UK interest rates could increase as early as 2015. Gilt volumes on the Tradeweb government bond marketplace grew by 48.7 percent in 2013 compared to the year before.

In November, S&P downgraded credit ratings for France and the Netherlands to AA and AA+ respectively. But while growth in the eurozone remained subdued, Germany seemed to be on track for growth driven by domestic spending and capital investment, offsetting a slowdown in exports and escaping a recession in the first quarter. Consequently, the country’s central bank, Bundesbank, raised its growth forecasts for 2013 and 2014 on December 6.

Across the Atlantic, upbeat U.S. economic numbers were consistent with a recovery. In August, the Conference Board Consumer Confidence Index reached a high of 81.5 points, while non-farm payrolls have been generally positive throughout the year. The shutdown in October, however, raised concerns about Washington’s debt ceiling issue amongst those holding U.S. debt, such as China.

Upbeat U.S. economic numbers were consisten with a recovery.

Banking Crisis in Cyprus

Cyprus had to call upon fellow eurozone members for a bailout, after its banks became heavily exposed to Greek debt and non-performing private sector loans. On March 16, a €10 billion rescue plan involving a hefty tax on bank deposits raised concerns that this setup would become a blueprint for future bailouts. Although a second deal a week later focused only on very large depositors, the news highlighted the issues around the eurozone debt crisis, and further shook the European public’s faith in the banking system.

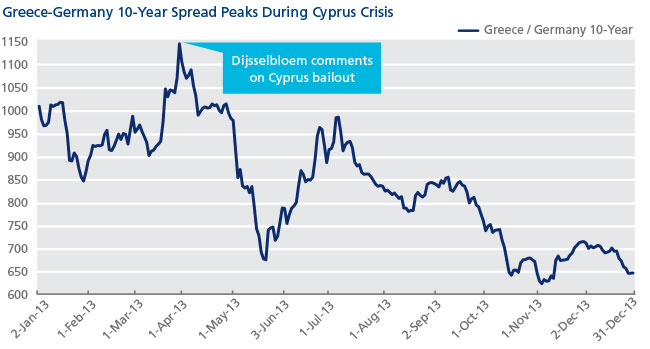

These fears were exacerbated on March 25, when Eurogroup President, Jeroen Dijsselbloem, said measures similar to the levy agreed on big depositors in Cyprus may be a viable option going forward to fix future banking crises in the eurozone. Two days later, the spread between the Greek 10-year and German 10-year bonds jumped by more than 80 basis points, reaching 1140.8 basis points as seen in the chart below.

Municipal Bonds Stumble

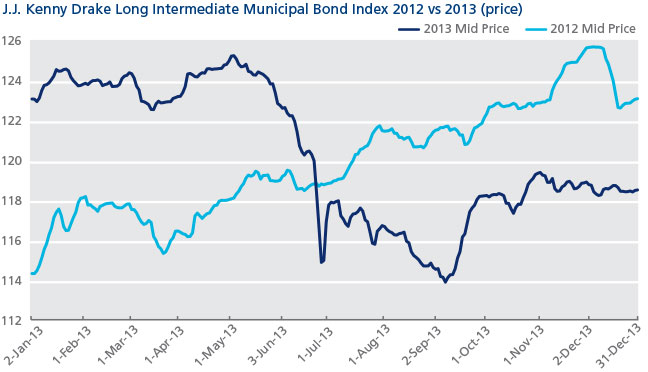

Municipal bond yields grew in popularity throughout 2012, but in 2013 Detroit’s Chapter 9 bankruptcy and Puerto Rico’s rising debt amid unfunded pension liabilities took center stage. The nearly $4 trillion municipal bond market may be destined for dramatic changes according to the Chicago Federal Reserve2, as Detroit’s bankruptcy has already caused an increase in the costs of borrowing by other counties and cities around Michigan. Puerto Rican bonds have drawn potential concern with higher yields, and a credit rating of Baa3 that’s under review for downgrade by Moody’s Investor Service.

Investors have been pulling money out from municipal bond funds since March 2013 resulting in the redemption of nearly $50 billion. In addition, new municipal bond issuance through September was down 13 percent from last year, according to BlackRock.

In comparison to 2012, municipal bonds had a challenging 2013, which saw a fall in prices as shown in the JJ Kenny Municipal Bond Index chart below comparing year-over-year data.

The nearly $4 trillion municipal bond market may be destined for dramatic changes.

Robust Corporate Bond Issuance

Corporate bond issuance in the U.S. reached record levels in 2013, surpassing $1 trillion by the end of November. The market saw $678 billion in investment grade issues and $325 billion in high-yield issues as companies rushed to secure debt at low interest rates ahead of the Fed taper, according to S&P. The biggest corporate-bond issue ever took place in September, as Verizon Communications issued $49 billion in bonds to finance the buy-out of Vodafone’s stake in its wireless operations. That number shattered the previous record, Apple’s $17 billion issue earlier in the year.

European corporate bond issuance also surpassed $1 trillion through the end of November. According to S&P, Europe saw $750 billion in investment grade bond issues and $317 billion in high-yield bond issues3. Global corporate bond issues were also strong with issuance exceeding $3 trillion, which was made up of over $1.7 trillion in investment grade bonds and over $1.3 trillion in high yield bonds.

Credit Market Liquidity

There was a great deal of discussion surrounding liquidity in the cash credit markets last year, both in Europe and the U.S. Under the current market structure, regulatory changes (Basel III, Volcker rule etc) and the increasing cost of holding inventory have fuelled buy-side concerns about the availability of liquidity when the next period of market stress occurs – very possibly linked to a turn in the rate cycle. This has given rise to a wide-ranging debate on alternative trading solutions.

Despite this uncertainty about what conditions may lay ahead, in Europe there has been a continued growth of electronic trading in vanilla credit products – interestingly reflecting historically strong levels of liquidity in trade sizes and in market segments, where electronic trading is most prevalent.

In 2013, total volumes on the Tradeweb European cash credit platform increased by 9.4 percent compared to 2012. The asset manager “hit-rate” – the percentage of price requests resulting in trades and a demonstration that buy-side clients are highly confident in the liquidity available to them – was 82 percent versus 76 percent in 2012.

In Europe there has been a continued growth of electronic trading in vanilla credit products.

A Changed Derivatives Landscape

Over the past several years, the Commodities Futures Trading Commision (CFTC) focused on the radical revamping of the U.S. derivatives market as mandated by the Dodd-Frank Act. The agency’s efforts were based on its goal to implement the transition of OTC derivatives trading towards electronic platforms and exchanges, aimed at bringing more transparency and competition to the market. March 11 signaled the mandatory clearing of certain IRS and CDS transactions, and on October 2, swap execution facilities (SEFs) came into existence, as part of the shift in derivatives trading onto centralized, electronic and transparent marketplaces. Initial trading on SEFs has begun in the U.S. with volume data being posted daily.

In addition, in 2013, CFTC Chairman Gary Gensler and Commissioner Bart Chilton announced their plans to leave the agency within weeks of each other. Their departure leaves the CFTC with just two of the five member commission posts filled by Scott O’Malia and Mark Wetjen, after Jill Sommers left the agency in July.

Treasury official Timothy Massad was nominated to fill the chairman’s seat, while Chris Giancarlo of GFI Group and Sharon Bowen, a partner at Latham & Watkins LLP, were nominated to fill commissioner posts. The appointments are contingent on the approval of the Senate Banking Committee, and speculation on details for several regulatory rules continues as Mark Wetjen has been named interim Chairman going into 2014.

Following “made available to trade” designations being made by SEFs, mandatory trading will begin on the platforms in February 2014.

Another Good Year for ETF Inflows

Thanks to their non-complex structure, transparency and low costs, exchange traded funds (ETFs) have managed to weather the financial crisis and see their assets consistently grow year after year. As at end of November 2013, global ETF assets reached $2,211 billion, $457 billion up from end of December 2012. The US was the driving force behind this increase with $365 billion, while the European ETF market grew by a more modest $57 billion (ETFGI data).

Fragmentation in on-exchange liquidity is the biggest challenge Europe needs to overcome before it can achieve its full potential. As at end of November 2013, there were 1,370 European ETFs spread across 5,005 listings and traded on 24 exchanges in multiple currencies (ETFGI data). Accordingly, around two-thirds of the trading volume has been carried out over-the-counter, while, more recently, electronic multi-dealer trading venues have allowed investors to trade in size in a way that is recorded. This has helped to improve perceptions of liquidity and to boost confidence in the depth of the European ETF market.

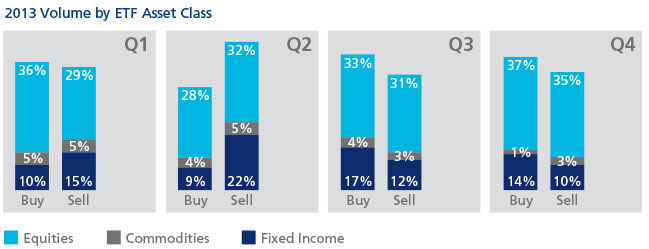

Data derived from trading activity on the Tradeweb European-listed ETF platform shows some interesting trends for 2013, such as the impact of Ben Bernanke’s comments on May 22 about the potential tapering of the Fed’s stimulus efforts. “Sells” in fixed income went up to 22 percent in the second quarter, compared to 15 percent in the first and 12 percent in the third quarter. In addition, we saw the proportion of volume in commodity ETFs decrease from 10 percent in the first quarter to just 4 percent in the last quarter of the year.

At end of November 2013, global ETF assets reached $2,211 billion, up $457 billion from the end of December 2012.

1 Italian National Institute of Statistics, Quarterly National Accounts http://www.istat.it/en/archive/106711 (December 10, 2013)

2 Gene Amromin and Ben Chabot, Chicago Fed Letter, Detroit’s bankruptcy: The uncharted waters of Chapter 9 http://chicagofed.org/digital_assets/publications/chicago_fed_letter/2013/cflnovember2013_316.pdf (November 2013)

3 S&P Ratings Direct Report, "Credit Trends: 2013 Global Corporate New Bond Issuance Poised to Top 2013 Levels and Remain Strong in 2014"; December 11, 2013