Derivatives trading rules need to evolve to improve liquidity

Jennifer Keser

Head of Market Structure & Regulation, Europe & Asia at Tradeweb

This article orginally appeared in IFLR here.

To address structural changes in the global marketplace, derivatives regulations across different jurisdictions must align

The $20 trillion over-the-counter (OTC) derivatives market plays an important role in the global economy, offering numerous and flexible ways for investors to hedge risks, gain exposure to interest rates, and improve market liquidity.

It is also a case study in understanding the critical links between large-scale financial reform and underlying market structure and liquidity. In the wake of the 2008 financial crisis, OTC derivatives became the subject of significant reform by regulators, following a build-up of large counterparty exposures between market participants.

These reforms included the introduction of the Derivatives Trading Obligation (DTO) and Derivatives Clearing Obligation (DCO), both of which were designed to bring greater transparency and efficiency to OTC derivatives markets. The DTO requires transactions in specific contracts to be executed on regulated trading platforms, while the DCO requires EU market participants to centrally clear certain classes of derivative contracts through specific EU Central Counterparty Clearing (CCPs). Alignment of the EU’s DTO and DCO provides greater consistency in the trading and clearing aspects of the derivatives market and its corresponding obligations. It enables additional security, the immediate flow of transactions, and better communication between trading platforms and clearing houses, therefore enabling firms to conduct pre-trade credit checks with ease.

Initially, the DTO and DCO served as prime examples of effective reform and global coordination. The US was the first to mandate the new rules as part of the Dodd- Frank Wall Street Reform and Consumer Protection Act of 2010, which led to the creation of swap execution facilities (SEFs) to support trading of interest rate and credit default swaps. Japan was next with the launch of Electronic Trading Platforms (ETPs) in 2015, followed by Europe in 2018 as part of its Markets in Financial Instruments Directive (MiFID) II / Regulation (MiFIR).

More recently, however, cracks have begun to show in the foundation of this global coordination due to the considerable structural and technical changes necessitated by these reforms. Changes in underlying market structure resulting from the UK’s exit from the EU and the gradual phase-out of the London Interbank Offered Rate (LIBOR) as the industry standard reference rate for derivatives contracts have exposed weaknesses in the DTO and DCO regimes, particularly in Europe. Here’s what needs to happen to fix that.

Lack of UK/EU equivalence creates artificial impediment to liquidity

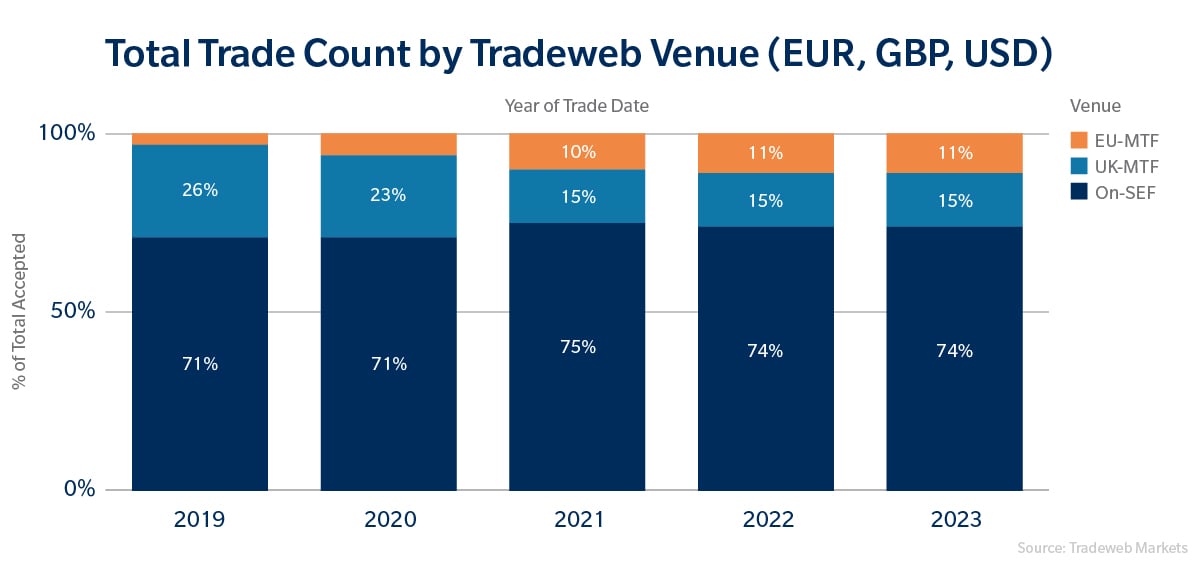

The EU’s DTO includes a requirement to execute derivatives transactions on either a European Multilateral Trading Facility (MTF) or a third-country trading venue that has been assessed as equivalent by the European Commission. After the UK’s transition from the EU ended on December 31 2020, market participants in Europe found themselves unable to transact on UK MTFs. Without an equivalence arrangement in place, EU and UK entities could only trade with one another in some of the most common derivatives on US SEFs. According to Tradeweb data, which tracks overall derivatives trading volumes on our US SEF, the total trade count executed has grown from 71% in 2019 to 74% in 2023. Over that same period, the percentage of trades executed on our UK MTF has dropped from 26% to 15%, illustrating how the lack of equivalence is driving trading activity away from UK MTFs.

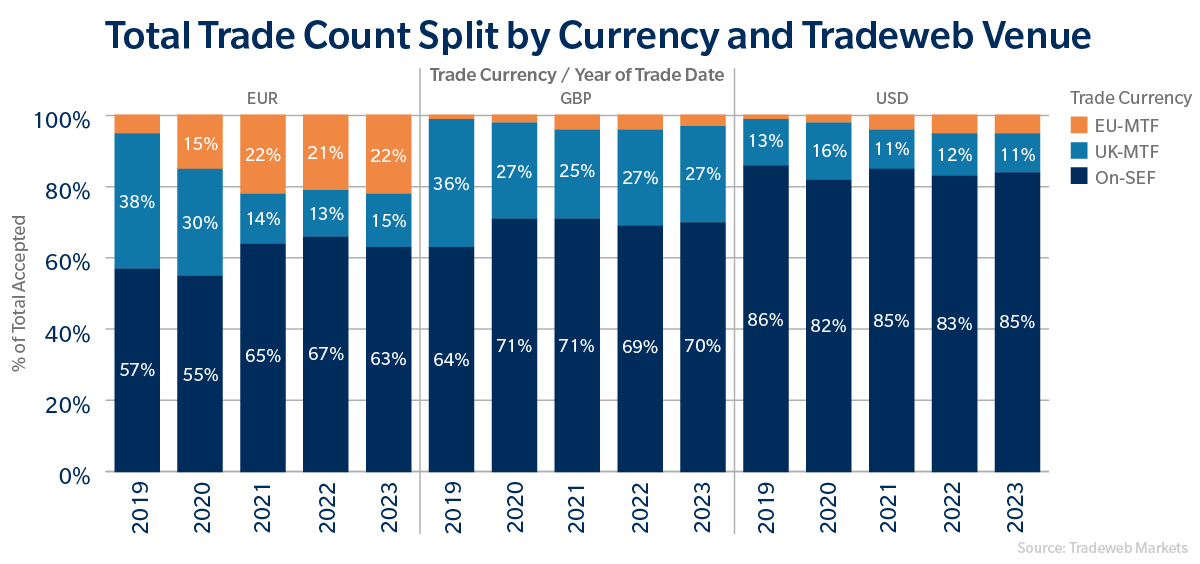

The Financial Conduct Authority (FCA) made a statement on December 31 2020 granting UK liquidity providers permission to trade with or on behalf of European clients on EU trading venues. However, the UK branch of a European firm is caught by the original trading obligation in its home jurisdiction, which currently disallows it from providing liquidity on a UK trading venue, preventing a link to crucial market liquidity. Furthermore, while the EU is considering an exemption to the DTO that would allow European banks to trade derivatives on UK trading venues, a resolution is not expected anytime soon. The trade count of EUR Swaps executed on Tradeweb’s UK-MTF has dropped from 38% in 2019 to 15% in 2023. While on the EU-MTF, the proportion of trades has grown from 5% to 22% during the same period; On-SEF, it has also increased from 57% to 63%, demonstrating how trading activity has moved away from the UK-MTF.

Ultimately, the lack of equivalence between the EU and UK is unnecessarily hindering liquidity in the global derivatives markets. Desperate for a solution, market participants are trading away from their home venues, slowly undoing much of the global harmonisation and the important liquidity pool that came from the original regulations.

LIBOR phase-out exacerbates challenges

Another exogenous event that has put a strain on the global DTO and DCO regimes has been the move away from LIBOR as the benchmark reference rate for the global derivatives market. Initially announced in 2017, the LIBOR phase-out was completed in 2023 when US markets officially converted to the Secured Overnight Financing Rate (SOFR) as the standard benchmark reference for OTC derivatives trades. Meanwhile, the UK adopted the Sterling Overnight Index Average (SONIA) and the EU adopted the Euro Short-Term Rate (ESTR) as their respective derivatives benchmarks.

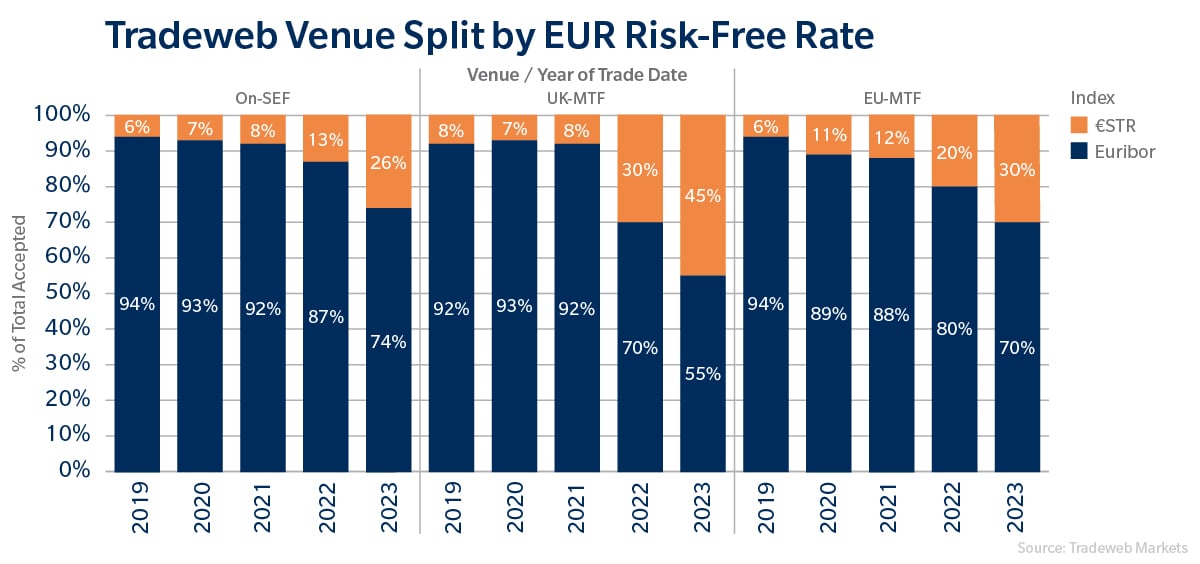

Unfortunately, this introduction of three separate reference rates has created some confusion in the marketplace when it comes to identifying which securities are subject to DTO and DCO trading requirements. Currently, the list of products that must be traded on platforms in the EU differs from the equivalent list of products that must be traded electronically in the US and UK, which is creating particular challenges for cross-border trades into and out of Europe. That structural anomaly is showing up in trading volumes. The proportion of volume accepted of ESTR trades on Tradeweb’s EU MTF has grown from 6% in 2019 to 30% in 2023, however this index falls outside of the EU’s DTO. The obvious fix, of course, would be to include derivatives benchmarked to ESTR, SOFR and SONIA under the EU DTO scope, but regulators have yet to do so. To help contribute to healthy levels of liquidity and improved pricing in the derivatives market worldwide, a mutual recognition between regulators of standardised reference rates trading within the scope is essential.

A missed opportunity

The overarching purpose of the DTO has always been to protect market participants and ensure the integrity and efficiency of financial markets. Today, structural changes to the underlying marketplace have created an impediment to achieving that goal. The very focus on efficiency and accuracy that was celebrated as an initial result of derivatives market reform, such as improved transparency and straight-through processing, as well as the reduction of operational risk and seamless post-trade information processing, is now being compromised by a set of regulations that has not kept pace with the marketplace.

In the context of the current ongoing negotiations of the European Market Infrastructure Regulation (EMIR) 3.0 and the Markets in Financial Instruments Regulation (MiFIR) review that was finalised towards the end of last year, there is no better time for the EU to bring the alignment and scope of the DTO back to the top of its agenda. Before Brexit, there was a positive contagion effect where other jurisdictions around the world, such as Singapore and Hong Kong, wanted to model the same benefits of a DTO regime as were exhibited in Europe. Hong Kong went as far as to consult on the implementation, but made the decision to wait to see further progress in existing DTO jurisdictions, while Singapore went live with its equivalent DTO regime in 2020, mandating the trading of derivatives contracts on organised markets.

The misalignment between the global derivatives regulation and the omission of certain derivative instruments from the scope is significantly stalling progress on moving the global derivatives market forward. It is a missed opportunity for regulators to continue to drive a key regulatory initiative that has provided significant benefits to the market globally, and it is time to bring it back into focus.

Related Content

What’s driving greater adoption in electronic swaps trading across Asia Pacific?