A Brave New World: Fixed Income Trading Breakthroughs Charting the Course in 2021

This article originally apeared on Tabbforum.com here.

A recent fixed income conference, focused on technology and best execution, addressed the most pressing issues facing buy side traders in a post-Covid market. A recurring theme was how the buy side has yet to take advantage of or adopt new technology or data-driven solutions to enhance traditional trading and workflows, writes Colby Jenkins, a TabbFORUM contributor. In this article, Mr. Jenkins explains that the market is at a turning point, where the technology and solutions available are now adept enough to bridge the (technology) gap between asset classes, desks, or data ecosystems.

In the run-up to the global market rattling Covid-19 pandemic, the fixed income market might have seemed to be steadily marching forward on its journey of ongoing electronification. Looking closely at what lies beneath the broad umbrella of US fixed income, though, different asset classes have clearly been marching to the beat of different drums — if not different instruments entirely. To take the analogy as far as it should go, high yield US credit is still playing the harpsichord while on-the-run treasuries are jamming to Steely Dan on a keytar.

Nonetheless, the buy side has, until now, largely managed to navigate this growing disparity by leaning into what has always worked within each trading silo – be it long-established execution protocols such as voice-based trading, request-for-quote (RFQ), or labor-intensive correlated processes such as manual treasury spotting for investment grade trades. The result has been a fragmented trading ecosystem in which it has been difficult – if not impossible – to deploy new technology and leverage data and analytics solutions across marketplaces internally.

At a recent fixed income summit, a technology-focused best execution panel took a deep dive into some of the biggest issues facing buy side traders in a post-Covid market. A recurring theme was the extent to which the buy side has yet to take advantage of or adopt new technology or data-driven solutions to traditional trading and workflows.

After all, the rapid rate at which the complexity of the fixed income universe (both in terms of trading venues but also the suite of execution and workflow options available) has grown recently poses as much of a challenge as it does opportunity to the buy side. Legacy technology, non-complimentary, and fragmented ecosystems across desks and a natural reluctance to adopt new technology and workflow within many institutions has created something of a proficiency gap that institutions are eager to address. It should come as no surprise then that several significant innovations with respect to fixed income trading over the past few years has stemmed from the ongoing collaboration between the buy side and electronic vendors driving the evolution of the markets forward.

Speaking to this trend, Tradeweb’s Head of U.S. Institutional Fixed Income, Chris Bruner explained:

“I would say what we’ve seen and been very pleasantly surprised by is there’s been a real drive towards innovation by our clients. Some might be at an early stage, but I think their mindsets definitely changed in the last few years, and certainly the last year, where they’re actively looking at all these different tools and trying to figure out what their peers are doing? They’re asking themselves: what’s my process? How can I improve not just my trading desk process, but my upstream process to the portfolio managers as well, to take charge of the data, as already mentioned, but also how it links into execution?”

Indeed, the market is now at something of a turning point, where the technology and solutions available are now adept enough to bridge the (technology) gap between asset classes, desks, or data ecosystems.

While this has been years in the making across markets- and still certainly a work in progress when looking through the lens of a specific asset class- now that we are halfway into 2021 it seems that some of the short-term adaptations that market participants made as a result of work-from-home mandates, and principally the adoption (or at least exploration) of new electronic workflows, is here to stay.

The next logical step in the market’s electronic evolution, then, is a matter of infrastructure. To borrow from Henry Ford, “Coming together is the beginning. Keeping together is progress. Working together is success.” That is, if one of the core advantages of electronic trading is to better leverage the network effect of trading within an individual liquidity pool or asset class, the next leap would be to leverage the network of those networks.

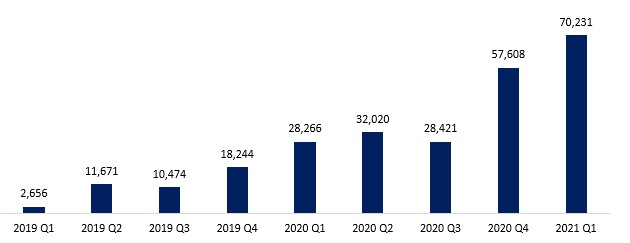

One growing trend that underscores the integrated markets narrative that has grown significantly in recent years- and by most indications will continue to build momentum- is portfolio (or basket) trading of corporate bonds. By leveraging the culmination of new data access, algo pricing, and the rise of fixed income ETFs (by way of the create/redeem mechanisms), it has become increasingly common for dealers and clients to trade large baskets of possibly otherwise illiquid bonds in a single trade, for a single consolidated price. Historical electronic portfolio trading statistics provided by Tradeweb, which was the first platform to offer the solution for corporate bonds, suggests the market has caught on to the advantages of the process (Exhibit 1).

Source: Tradeweb

The dramatic rise of portfolio trading within credit can be viewed as just one interesting facet of a lager trend taking hold of fixed income trading- automation by way of leveraging data.

Speaking to the trend, Michael O’Brien, Director of Global Trading at Eaton Vance suggested that, “Yes, there is more data available. But if you’re not consuming it, it’s hard to tell what’s quality- and what isn’t. As an asset manager, as you look to automate more of the execution process, you inevitably come across more data, because as you try to electronic find more of what you’re doing, you’re consuming more prices, you’re electronically having more data related to the actual executions … there’s just so much of it that the challenge right now is getting your arms around it and deciding what is relevant for you and what isn’t.”

As the adoption of electronic trading grows, so it follows that the suite of automation/efficiency tools available would grow too. Given the vast liquidity networks and scope of internal data generated as a result of facilitating electronic trading across many asset classes, the potential supply of building blocks for data-focused innovation is nearly endless. These new opportunities, however, come at a cost. With this constant influx of ‘relevant’ data and new trading opportunities, the once clearly defined lines of traditional best execution standards will continue to blur. That is, as more variables are introduced into the execution equation the unavoidable result is increased best-ex entropy. Speaking to the issue, one panelist explained, “Best-ex is really what the root of the problem is. Best-ex is a process, not a number. And so, to the extent that you can fortify your processes with these tools and create a reasonable Mosaic…That’s where the debate is right now- figuring out where the right lines are as we navigate through the traditional processes and workflows for fixed income trading.”

Electronic trading venues seem best suited to solve this issue. Taking Tradeweb as an example, in addition to the wide adoption of its portfolio trading solution, several other workflow and trading solutions have found resonance within the wider buy side trading community. Tradeweb’s Net Spotting -which automates the cumbersome Treasury spotting process for corporate bonds – has undergone several iterations of advancement and continues to gain traction. Already close to 50% of spread-based volume YTD has taken advantage of this time and cost saving tool.

While Net Spotting is an example of how platforms might leverage internal liquidity networks, automated execution tools, such as Tradeweb’s Automated Intelligence Execution systems (AiEX), leverage platform-specific data alongside external sources and have had a fundamental impact on the day-to-day responsibilities and efficacy of buy side traders. By streamlining trading activity in a scalable fashion for the easiest trades through rules-based automation, buy side traders are freed up from low touch responsibilities to focus on larger, difficult trades-which ultimately should save time and cost and potentially yields better performance.

It appears almost inevitable that even the most stubbornly analog members of the buy side will have to learn to leverage new tools and trading solutions to navigate today’s markets. After all, the old ways of meeting best execution requirements simply do not align with the complexities of an increasingly electronic and fragmented market.

In terms of the buy side’s responsibility in seeing this progress move forward, Eaton Vance’s O’Brien put it succinctly, “What I’m looking forward to most over the coming year – particularly as we exit from some of our Covid travel and gathering restrictions – is more engagement from the buy side on these topics. Lots of changes are coming – particularly around data and trading protocols. I think the buy side needs to be more engaged and push this innovation forward. It’s great to have the innovation and tech there – but if no one is using it, it isn’t going to push everyone in this ecosystem such that everyone benefits.”