2020 Annual Letter

To our clients, partners and friends:

It seems like most people just want 2020 to end – a global health and economic crisis will get that reaction. The magnitude of lives lost and livelihoods destroyed has been enormous, not to mention the impact it has had on virtually every aspect of society. From education and transportation to housing and mental health – the toll of this crisis has been felt in every aspect of our daily lives.

For all the challenges the pandemic has presented, however, there have also been some bright spots along the way. Chief among these was the resilience of people around the world who rallied in the face of adversity and found creative ways to keep moving forward despite the obstacles. Technology played an important role in making this human tragedy more bearable. Through video conferencing, online shopping, telemedicine and streaming services, we leaned on technology innovations to help us stay connected during a global crisis. Financial markets helped economies around the world fund recovery and growth, and firms like Tradeweb brought technology to bear so markets did not miss a beat.

Let’s not forget where markets were in early March when American Banker described the threat of a liquidity crisis as follows: “The Fed has the same challenges the grocery stores have with dealing with people who are buying toilet paper. Hysteria and lack of confidence is a psychological factor that changes dynamics, and it has in every financial crisis over the last 200 years.”

But the liquidity crunch that everyone had feared didn’t put a stop to global trading activity. A combination of aggressive central bank intervention, record levels of stimulus and Herculean efforts by institutional investors, dealers, trading venues and other market participants, helped keep disaster at bay amid record trading volumes worldwide. By the end of March, Tradeweb had recorded our busiest month ever, moving over a trillion dollars in average daily volume (ADV). This marked a sharp boost in the ongoing secular trend towards electronic trading, a trend that continued as October and November delivered record volumes across a broad range of products and asset classes. It’s a story that would not have been possible without our deep client network and the strong collaboration that helps yield new opportunities in a complex environment.

In addition to accelerated electronification of markets, there are a number of themes that were especially important in 2020, and that we believe will continue into 2021:

Global Debt Issuance Sets New Records

The Institute of International Finance aptly titled its November 2020 Global Debt Monitor report Attack of the Debt Tsunami. While the worst fears of a credit crunch did not materialize in 2020, a worldwide surge in borrowing – driven by both governments and corporate issuers – helped push global debt levels to a record high of $272 trillion through the third quarter. Government bond issuers accounted for $77.6 trillion of that total while nonfinancial corporate issuers accounted for $79.6 trillion. Another $65 trillion in debt was attributable to the financial sector.

The good news is that this glut of inventory has managed to find a market, keeping liquidity levels high throughout the crisis – even as yields on trillions of dollars’ worth of bonds turned negative.

In March, at the absolute peak in pandemic-driven market fears, U.S. government bond ADV on Tradeweb reached $96.4 billion, up 14.7% year-over-year. Likewise, European government bond ADV rose 27.3% to $31.6 billion as market participants navigated unprecedented levels of volatility while transitioning to work-from-home models. This was nothing short of remarkable. With the VIX topping 2008 highs, the world going into lockdown and pundits expecting a global liquidity freeze, technology helped transform dining room tables into trading desks and markets kept doing their jobs.

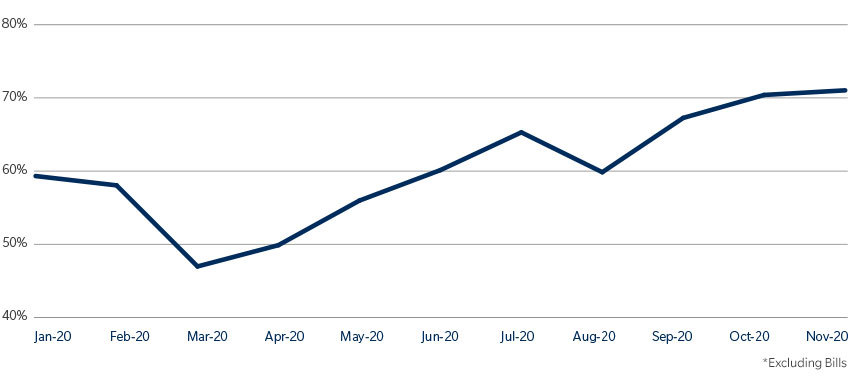

Percentage of European Government Bonds Outstanding with Negative Mid-yield

The trend of high volatility, high volume trading continued throughout the year, even as interest rates were pushed to historic lows. At the end of November 2020, 71.2% of European government bonds were trading at negative yields, and the yields for every single European 2-year government bond were negative. But volumes have continued apace on Tradeweb. In November, we saw the second-highest month of trading on our platform ever, with total trading volume of $18.7 trillion and ADV of $958.7 billion.

ESG Goes Mainstream

Not since the introduction of the ETF has a three-letter acronym had such a significant impact on investment management. Investing with an Environmental, Social and Governance mandate, more commonly known simply

as ESG, has become one of the biggest buzzwords and most significant shifts in investment strategy in decades.

As the COVID-19 pandemic continued to spur investor anxiety and a rising tide of social awareness began to dominate our collective consciousness, the move to ESG only grew. During the second quarter, sustainable fund flows in the U.S. continued at a record pace of $10.4 billion, bringing net inflows for the first half to $20.9 billion, compared with the $21.4 billion of net inflows for all of 2019.

Far more than a marketing angle or an investing fad, ESG has begun to gain significant traction with institutional investors and government issuers. This October, the European Commission announced it would be issuing up to €100 billion social bonds, and within days, attracted the highest demand ever in the history of the EU for a bond sale at over €233 billion. The UK government also announced that it would be issuing green bonds in 2021. On the institutional side, a growing chorus of banks have been pushing even further into ESG, exploring ESG-linked derivatives for use in deal contingent hedges.

At Tradeweb, support for analytics and new technology development to help market participants pursue ESG strategies continues to grow as we continue to focus on helping investors access the securities that meet those goals.

Letting Go of LIBOR

In its heyday, the London Interbank Offered Rate (LIBOR) was known as the “world’s most important number,” serving as the official interest rate benchmark for financial transactions around the globe. Today, three years after regulators announced plans to phase out the benchmark by the end of 2021, LIBOR has lost its luster, but investors are still clinging to it. However, regulators have made it clear that LIBOR will cease, with the Fed most recently stating no new LIBOR-based contracts should be put into effect after 2021. Roughly $200 trillion of debt and derivatives contracts are still tied to the benchmark.

Over the last several months, market participants have focused increasingly on the transition to several alternative benchmarks, including the U.S. Federal Reserve’s Secured Overnight Financing Rate (SOFR), the Bank of England’s Sterling Overnight Index Average (SONIA), the Swiss Average Rate Overnight (SARON), the Tokyo Overnight Average Rate (TONA) and the newly introduced European Central Bank Euro Short-Term Rate (€STR). Tradeweb Markets and Intercontinental Exchange have also introduced an alternative benchmark based on the U.S. Treasury yield curve.

Despite these advances and the looming expiry of the old standard, ICE Benchmark Administration Ltd., the administrator of LIBOR, now says it plans to continue to support the rate until June of 2023. Markets continue to use LIBOR for several reasons. For one, there is habit. Existing risk models, compliance processes and operational technologies that work seamlessly in the LIBOR world need to be modified to the new benchmarks. But there is also the issue of nuance and interpretation that comes along with a time-worn standard. LIBOR remains a highly liquid benchmark and its shortcomings are well-known by market participants who’ve grown accustomed to interpreting its various signals.

Regardless of the marketplace’s attachment to LIBOR, change is coming. Tradeweb is committed to making the transition seamless, supporting all benchmark alternatives throughout the process through the use of advanced technology and optimized trading functionalities. We’re leading the GBP interest rate market’s transition to SONIA, with a growing number of supporting dealers, increasing traded volumes, and new functionality, such as the launch of SONIA Swap vs. Gilt Future Packages. In fact, in Q3 2020 SONIA traded notional volume on Tradeweb surpassed 60% of GBP IRS trading activity for the first time ever.

A Unique Moment for Emerging Markets

A combination of record low yields in major markets around the world and growing reliance on electronic trading created an opportunity for emerging markets in 2020.

Just a few years ago, market participants looking to access emerging markets faced a litany of liquidity and workflow challenges that often created insurmountable obstacles. Disparate systems, language barriers, dozens of different counterparties that include not just traditional large global banks, but also local banks and their clients – these were all good reasons not to get involved with emerging markets.

Access to emerging markets in recent years has become far more seamless, as protocols and tools such as electronic portfolio trading and Tradeweb AllTrade make it easier and more efficient to incorporate emerging markets into a truly global trading strategy. These advances have helped fuel dramatic growth in emerging markets fixed income and derivatives trading.

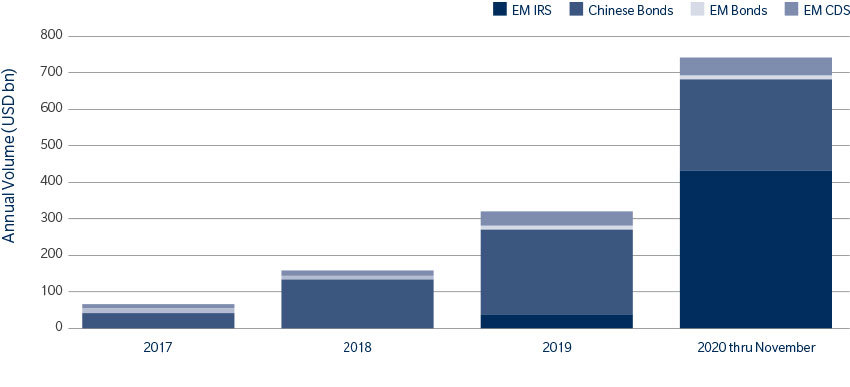

EM Total Trading Volume

Through November 2020, emerging market fixed income trading across interest rate swaps, credit derivatives and sovereign and corporate bonds1 totaled $742 billion on Tradeweb. Perhaps more interestingly, though, Tradeweb has seen a 300%2 increase in the number of portfolio trades that include emerging market line items, showing how market participants are increasingly accessing emerging markets as part of their global trading workflows.

Another major emerging market milestone was reached this year when the Bond Connect platform celebrated its third anniversary. This collaborative initiative, which Tradeweb helped design and implement along with the China Foreign Exchange Trade System (CFETS) and Hong Kong Exchanges and Clearing (HKEX), represented the most ambitious, large scale effort to create an access point to China’s $13 trillion bond market for international investors. Since the launch of Bond Connect, clients have traded more than $656 billion in Chinese Bonds on Tradeweb and activity continues to grow at a rapid pace.

Expansion in China has continued throughout 2020. In August, Tradeweb became the first trading platform to offer electronic request-for-quote (RFQ) trading in the Chinese onshore bond market through its China Interbank Bond Market (CIBM) Direct channel. The move allows institutional investors to trade cash bonds, government bonds, People’s Bank of China bills, financial bonds, commercial paper and medium-term notes using the same, seamless RFQ workflows they have become accustomed to in established markets.

ETFs Pass the Liquidity Test

As long as there have been ETFs, there have been warnings that a liquidity mismatch between the ETF and its underlying products could create a recipe for trouble during periods of heightened volatility. In that regard, the COVID-19 crisis, with its record spike in volatility and prolonged strain on capital markets has given us the perfect test case for the theory. So far, ETFs have passed the test, delivering a critical source of liquidity in an otherwise stressed market.

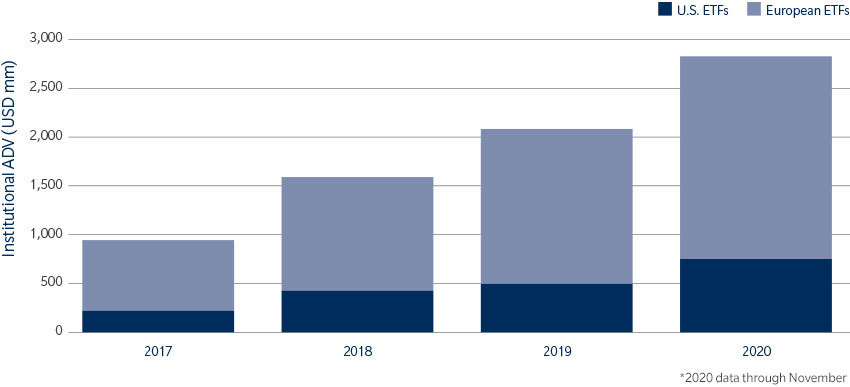

In March, at the height of the COVID-19-driven market volatility, European ETFs were up 190.6% year-over-year to $4.0 billion in ADV and U.S. ETFs were up 242.0% year-over-year to $10.0 billion in ADV. In November, European ETFs were up 66.1% year-over-year to $2.7 billion in ADV and U.S. ETFs were up 87.5% year-over-year to $4.8 billion in ADV, as we continue to see further adoption by institutional clients.

Institutional ETF ADV

Fixed income ETFs functioned as a strategic tool for institutional investors during the crisis – particularly in credit markets – with broker dealers, electronic trading platforms and market makers routinely using fixed income ETFs to manage inventory, facilitate large client trades and hedge risk.

Newer trading technologies also played a role in helping to spur liquidity when markets were severely stressed at the height of the pandemic. We saw a significant uptick in use of our portfolio trading protocol – which allows investors to price hundreds of bonds in one basket, negotiate a single price at a portfolio level with multiple dealers and execute the trade in a single transaction. That was a significant departure from previous crises, where traders would typically revert back to ‘conventional methods of trading’ via voice. With this crisis, traders looked toward technology as the most effective means of finding liquidity.

The Path Ahead

Had the COVID-19 pandemic struck ten or even five years earlier, its impact on the financial markets would have been much more significant. With the benefit of lessons learned during the 2008 financial crisis, financial institutions were in better shape to weather the volatility and central banks were quick to implement quantitative easing strategies to stimulate markets and keep liquidity flowing. Perhaps more importantly, though, the evolution of technology made it possible for institutional investors to keep trading, uninterrupted in virtually every asset class around the world – from their living rooms.

As we look ahead to 2021, we expect to see further expansion of the trends toward multi-asset class expansion and work-from-anywhere flexibility driven by continued advances in electronic trading technology.

From our perspective, one of the biggest proof points for the resilience of electronic trading was the fact that relatively new technologies and protocols did not miss a beat during the pandemic. Our portfolio trading protocol, for example, saw over $20 billion in transactions in October of this year – the highest of any single month since the technology launched in early 2019. Likewise, AiEX, our automated execution technology, and AiPrice, our intelligent pricing technology, were relied upon by market participants at a time when tensions were running high and trust was at a premium.

Electronic trading passed an important test during the pandemic and it will continue to prove its value as we head into an uncertain future. While it’s impossible to know exactly how things will play out in a post-vaccine, return-to-normal business environment, it is clear that the progress made this year will fundamentally change the way we live and work long into the future. For our part, we will stay committed to keeping markets and market participants moving as efficiently as possible regardless of what that future brings our way.

Thank you for putting your trust in Tradeweb. We hope you and your families stay safe and have a happy new year.

|

|

||

|

Lee Olesky |

Billy Hult |

Click here to download the letter.

1 Including Chinese bonds

2 Q3 2020 vs Q4 2019