Exchange-Traded Funds Update - November 2015

The following data is derived from trading activity on the Tradeweb European-listed ETF platform.

ETF total traded volume

Total traded volume on the Tradeweb European-listed ETF platform reached €9.64 billion in November. In line with previous months, activity in fixed income ETFs surpassed 30 per cent, as a proportion of the overall traded volume.

November also saw the addition of the sixth liquidity provider posting ETF axes to the platform. Axes functionality provides an indication of whether a dealer is a buyer or seller of a specific ETF. This allows investors to select the most relevant dealers to put into competition for each trade. On the Tradeweb platform, the likelihood of an axed dealer winning a request-for-quote (RFQ) auction is twice as high compared with a non-axed dealer. This indicates that pricing is stronger when dealers have an offsetting interest in the ETF.

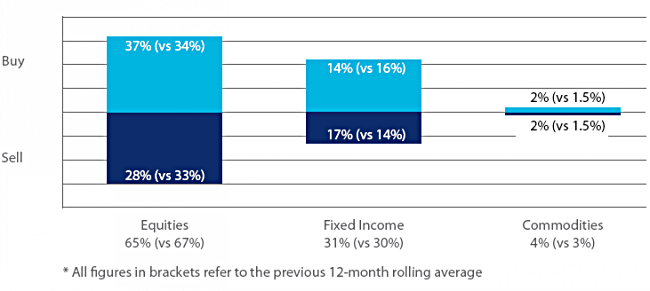

Volume by ETF asset class

Equity-based ETFs saw net buying in November, with “buys” outstripping “sells” by nine percentage points. In contrast, “sell” requests for fixed-income products increased to 17 per cent, outperforming “buys” by three percentage points. Trading activity in commodity-based ETFs beat the 12-month rolling average by one percentage point.

Top ten ETFs by traded volume

Eight equity-based products were among November’s most heavily-traded ETFs, with a fund tracking the performance of the MSCI World index ranked first. In seventh place, the Amundi ETF MSCI EMU UCITS ETF made it into the top ten for the eighth time this year.