Shining a Spotlight on Diverse Dealers: Q&A with Chris Bruner

Chris Bruner

Head of U.S. Institutional Fixed Income, Tradeweb

Tradeweb recently announced the launch of its Spotlight Dealer Diversity Program, a new initiative designed to promote the capabilities of woman-, veteran-, disabled-, and minority-owned dealers on the Tradeweb platform. This initiative supports buy-side engagement with Tradeweb’s diverse dealer community through direct consultation, dealer visibility and specific trading protocol enhancements.

We sat down with Chris Bruner, Head of U.S. Institutional Fixed Income, to find out more about the program.

Why is Tradeweb launching this program, and why now?

We’ve actually been developing the Spotlight Program over the past year, working closely with members of our buy-side and dealer communities to find ways to maximize the power of Tradeweb’s network to create new opportunities for diverse dealers. It’s one thing for us to issue statements and voice our support for a more equitable and inclusive financial services industry. It’s another for us to take a hard look at the underlying systems and processes that drive our financial markets and work towards removing barriers to access.

How does the program work; how is it removing barriers?

A big part of the program is focused on facilitating increased awareness of liquidity providers owned by women, veterans, individuals with disabilities and members of underrepresented racial and ethnic groups on the Tradeweb platform. We’re doing that through a combination of direct consultation, dealer profiles and increased visibility on the platform and on our website. But this is much bigger than just a marketing or promotional exercise. We’re also making enhancements to our RFQ protocol that make it easier for diverse dealers to expand their direct trading relationship with buy-side clients as well as provide opportunities for them to intermediate A2A trades on AllTrade anonymous network. This functionality is launching for U.S. Credit users but the Spotlight Dealer Program will ultimately expand to additional asset classes with new functionality introduced for other securities as needed.

Why is Tradeweb uniquely positioned to meet this need?

We talk a lot at Tradeweb about our network effect. That is the phenomenon whereby our platform continues to grow in value and utility as more market participants trade on Tradeweb. We continually see better pricing, more liquidity and faster settlement times as we grow. By introducing the Spotlight Program, we can immediately address the marketplace awareness and visibility challenges that confront diverse dealers operating in fixed income markets by plugging them directly into our massive ecosystem so they too can benefit from that network effect.

What makes the Spotlight Dealer Diversity Program different?

This program was developed with both our buy-side and diverse dealers in mind, built on the notion that genuine benefit to each is not mutually exclusive. With a base in providing our dealers with exposure to our network, the program is elevated by building directly into our trading workflows, and leveling the playing field for all market participants in a practical and meaningful way. Tradeweb has always focused on preserving the core, critical elements of the trading workflow – the ability to maintain close personal relationships, the flexibility to trade with multiple counterparties, the ability to take the pulse of the market in real-time – while continually making technological tweaks and enhancements that improve that process. This program is no different. We’re injecting the principles of diversity, equity and inclusion directly into the workflow without changing market structure or disrupting proven ways of doing things. This is all about making it seamless for market participants to do the right thing.

Which dealers have signed onto the program so far?

| Academy Securities | Loop Capital Markets LLC |

| American Veterans Group | Mischler Financial Group |

| Bancroft Capital, LLC | Multi-Bank Securities, Inc. |

| Cabrera Capital Markets, LLC | Penserra Securities LLC |

| CastleOak Securities | Roberts & Ryan Investments, Inc. |

| C.L. King & Associates | R. Seelaus & Co., LLC |

| Drexel Hamilton | Samuel A. Ramirez & Co. |

| Falcon Square Capital | Tigress Financial Partners |

| Great Pacific Securities |

To check out the profile of each dealer, click here.

Could you provide more detail on the U.S. Credit trading protocol enhancements? How does it all work?

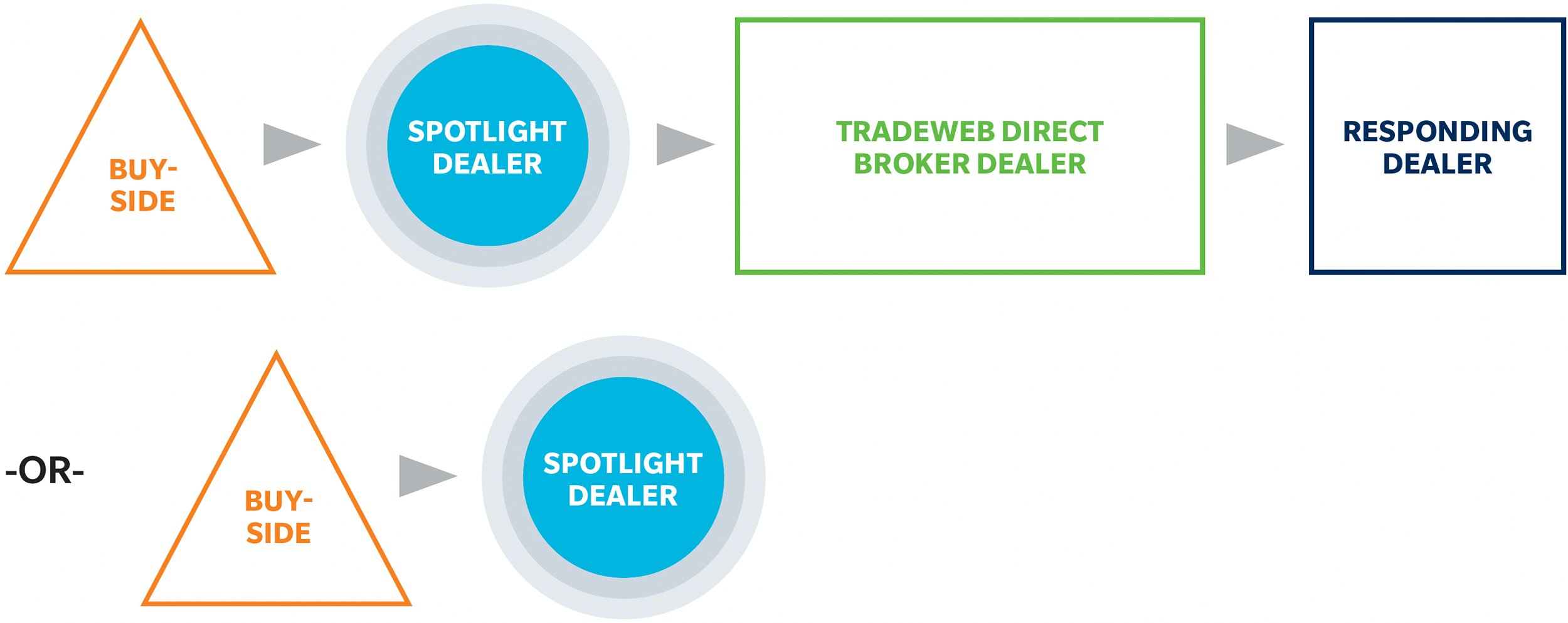

We’ve created the ability for Spotlight Dealers to be involved directly or indirectly in RFQ trades initiated by the buy-side using the Spotlight protocol. A buy-side trader can enable the protocol within their RFQ ticket and select a specific Spotlight Dealer for which they are enabled for disclosed trading on Tradeweb’s U.S. Credit platform. Once a Spotlight Dealer is chosen, and the RFQ is sent, it simultaneously goes disclosed to the chosen Spotlight Dealer and anonymous to the AllTrade network.

The chosen Spotlight Dealer will have the option to respond directly to the Buy-Side client on the RFQ, but does not have to. Responses will come back and the trade will be executed at the best price. If best level is an anonymous AllTrade response, the selected Spotlight Dealer will intermediate the trade. If the best level is from the Spotlight Dealer, then the trade executes directly with the Spotlight Dealer.

Either way, the selected Spotlight Dealer is uniquely and always a disclosed participant in the trade and has full transparency on the RFQ from the moment the inquiry is initiated using the U.S. Credit Protocol.