Multi-Client Net Spotting: A Better Price Exists for your Corporate Bond

Multi-Client Net Spotting White Paper

INTRODUCTION

Until recently, U.S. corporate bond investors have faced a unique and costly set of challenges due to the spread-based convention of most investment grade credit trading. Historically, this has meant that any purchase (sale) of a corporate bond on spread needs to be accompanied with the sale (purchase) of a U.S. Treasury to offset the interest rate risk inherent in the corporate bond. With traditional line by line workflow, this manual spotting process is clunky and costly at best.

Tradeweb’s Net Spotting solutions, which are exclusive to the Tradeweb platform, instead harness the efficiencies of electronic trading and deep liquidity for both corporate credit and government bonds. In doing so, they have revolutionized this cumbersome, costly and outdated process.

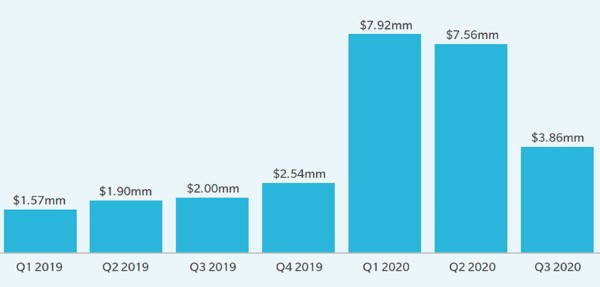

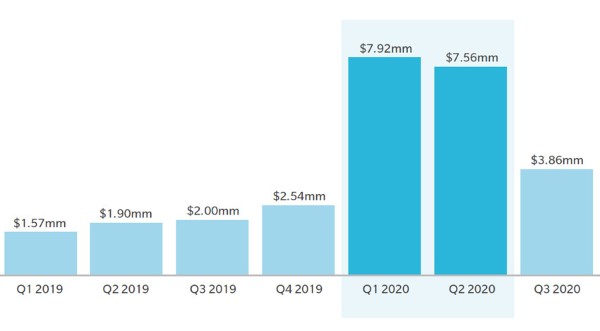

Since launching in early 2019, momentum has grown steadily. During the first three quarters of 2020 alone, Tradeweb market participants saved an aggregate $19.34 million in trading costs. Exhibit 1 breaks down the estimated savings Net Spotting has afforded users since launch.

Exhibit 1: Tradeweb Net Spotting Estimated Savings, $ Millions

TRADITIONAL SPREAD TRADING ISSUES & SOLUTIONS

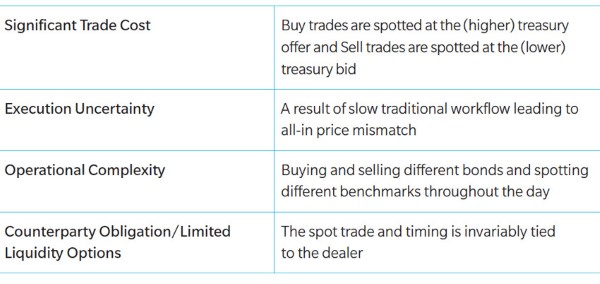

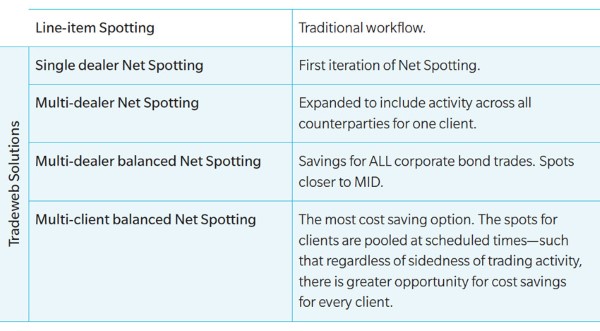

The vast majority of US investment grade credit traded today is done so on spread—traditionally quoted above a benchmark government bond yield. And because cash credit trades are typically spotted on a line by line basis, a firm might execute a significant number of individual trades and spots in the course of a day. As a result, there is a significant operational and cost burden for participants simply trading corporates as status-quo. The table below breaks down the principal challenges firms face as a result of this manual approach:

Manual Spotting Drawbacks

The costs associated with spotting are the result of Treasury bid/offer spreads and inefficiencies embedded in workflows. When investors agree on a spread for a corporate bond, the trade is not always spotted against the corresponding Treasury at the same time. When it is spotted, there is often a delay as the trader on the dealer desk phones her Treasury desk to get a price and then execute. Up to a fifteen-minute time lag is common, which can have a significant impact on the all-in price of the corporate bond.

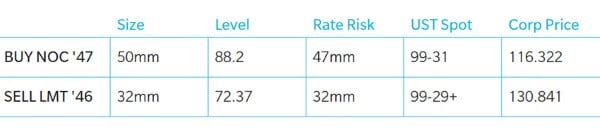

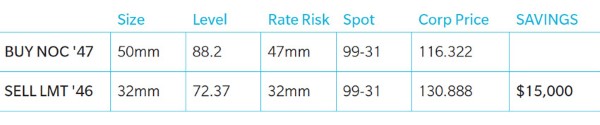

The table below illustrates a ‘traditional’ workflow in which a trader might execute line by line spot trades for $50 million of Northrup Grumman (NOC) and $32 million in Lockheed Martin (LMT).

Traditional Workflow with Two Dealers (no Net Spotting)

In this example, the client is incurring the maximum possible trade cost for spotting, despite the offsetting risk. By spotting SELLs on the BID and spotting BUYs on the OFFER side, the client is paying 1.5/32 on 32mm of offsetting rate risk: $15,000.

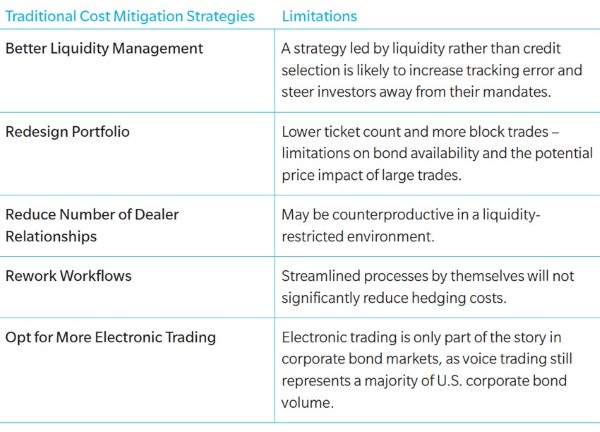

Manual Spotting Drawbacks

NET SPOTTING: A SET OF TECHNOLOGY-LED SOLUTIONS

But tweaking trading patterns to curb the many inefficiencies of the manual spotting process can only go so far. Instead Tradeweb leveraged its robust electronic marketplace to create technology-driven solutions to the problem, which saves both money and time for buy- and sell-side participants.

At its core, Tradeweb’s Net Spotting solutions streamline the cumbersome and repetitive spotting process.

By aggregating trade positions and calculating net interest rate exposure to each Treasury benchmark from the accompanying Treasury hedges across counterparties, a NET position can in turn be calculated, from which the firm is able to spot through a single transaction (for each benchmark tenor). This results in significant cost and time savings for the buy-side, by reducing the cost of paying multiple bids and offers throughout the day to a single transaction.

Net Spotting Solutions Evolution

The benefits of the netting process cuts both ways. Tradeweb ensures that each counterparty is allocated the full amount of their Treasury hedge at the net spot level used to price the corporate bonds. And by fully integrating Tradeweb’s robust U.S. Treasury market into the Net Spotting tool, and linking the hedge level to the corporate bond reference level, liquidity providers are not as exposed to interest rate risk when the trade is spotted.

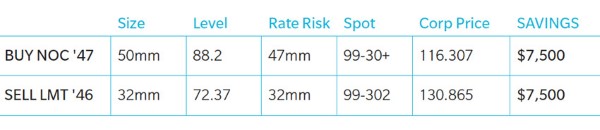

The following table takes the same hypothetical NOC and LMT trades from before and applies a multi-dealer Net Spotting workflow to the process.

Multi-Dealer Net Spotting Workflow

Rather than spotting based on the side of the corporate trade, thereby increasing the price of the buys and decreasing the price of the sells, the client receives a single spot price for all trades against a given Treasury benchmark security. The accounts that are selling see a spot price improvement of 1.5 ticks and savings of $15,000, but the accounts that are buying do not realize any savings.

The latest iteration of this improved workflow is a balanced Net Spotting feature, which further advances the cost savings platform users can avail themselves of by sharing savings among ALL corporate bond trades, rather than those with the smaller interest rate risk. Balanced Net Spotting works by aggregating the Treasury bid risk and Treasury offer risk and applying different spot prices (both of which are at or closer to the Mid and ultimately BALANCED by the NET risk for all buys and sells). The table below lays out a hypothetical Balanced Net Spotting Workflow.

Multi-Dealer Balanced Net Spotting Workflow

In this scenario, the “shorter” side of the risk gets spotted at MID and the “longer” side of the risk is spotted somewhere between mid and the executed umbrella hedge price (as close to mid as possible). Here, the accounts that are buying see the spot improve by ½ of a tick and save $7,500 and the accounts that are selling see the spot improve by ¾ of a tick and save $7,500.

Unlike the original Net Spotting model, all corporate trades in a ‘balanced’ workflow reap some benefit from the Net Spotting mechanism, rather than assigning all of the savings to the trades with the lower net rate risk, thereby treating end accounts more equitably.

MULTI-CLIENT NET SPOTTING: TAKING THE SOLUTIONS FURTHER

The recently launched Multi-Client Net Spotting, which represents the most sophisticated iteration yet of Tradeweb’s industry-exclusive tool, takes the advantages of balanced Net Spotting and affords participants even greater total trade cost savings by pooling net hedging activity across all clients spotting at the same time. In this new methodology, regardless of a client’s size or trading strategy, all benefit from greater spotting savings, even if they are only buyers or only sellers on the day.

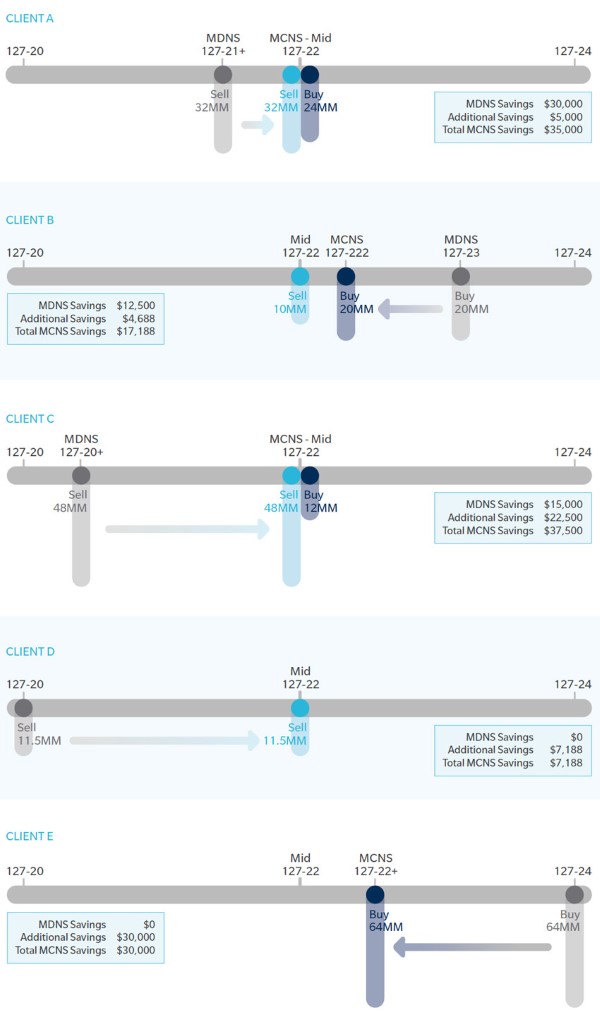

Exhibit 2: Multi-Dealer Net Spotting vs. Multi-Client Net Spotting Savings

Exhibit 2 breaks down the potential savings for five clients, A-E, under two different Net Spotting treatments (Multi-Dealer Net Spotting vs. Multi-Client Net Spotting), with a treasury bid-offer of 4 ticks on the 30Y Treasury, which was commonly seen in slightly stressed rates environments.

Because clients D and E are executing trades in only one direction, neither can reap the benefit of Net Spotting without the Multi-Client Net Spotting innovation. Exhibit 2 shows how the five clients, by opting into a Multi-Client spot, increase the benefit for all by offsetting risk among them all. The additional savings of $69,375 is split evenly between the net buyers and the net sellers, and further divided proportionally among all clients.

The net risk across the market is a BUY, so clients A, C, and D, each of which are net sellers, are spotted at MID, saving an additional $5,000, $22,500, and $7,188 respectively. Tradeweb improves Client B’s Offer spot by 3/4 of a tick and an increased savings of $4,688 and Client E’s Bid spot by 1.5 ticks, who sees a savings of $30,000 that could not be realized through any other trading venue. This improvement in the spot is significantly more than any execution and transaction cost on Tradeweb and other ECNs.

And because the opportunity for savings increases along with the size of the Tradeweb liquidity pools being leveraged, recent data suggests the benefits of net spotting will continue to grow given that recent TRACE as of October 2020 High-grade market share to 19.2% (9.4% fully electronic).

MULTI-DEALER NET SPOTTING VS. MULTI-CLIENT NET SPOTTING SAVINGS

Ultimately, whether a client joins a Multi-Client Net Spotting pool or utilizes the Multi-Dealer net spotting process ad-hoc, the benefits are universal. Regardless of the protocol the bonds are traded under (RFQ, AllTrade all-to-all, electronically processed, portfolio trades), balanced Net Spotting saves time, opens up new operational efficiencies, and provides significant trade cost savings.

NET SPOTTING IN A CRISIS

While global markets suffered prolonged periods of dislocation and volatility during early 2020, the US Treasury market experienced its own acute liquidity crunch. This period of strain, between February and April ’20, had far reaching implications for the wider US market.

At a time when the buying and selling of the safest, most liquid and risk-free asset in the global economy (US Treasury Securities) was strained, it should come as no surprise that the intrinsically linked US corporate bond market was similarly imperiled.

This crisis underscored the extent to which most participants might take for granted their ability to spot and/or hedge every trade.

Between February and April 2020, Tradeweb ran tick data (300,000+ data points) for each Treasury benchmark between 2:58 PM and 3:00 PM (an industry standard time for spotting corporate trades). During peak volatility in March, the 30Y Treasury benchmark bond (first old) was trading at a bid/offer width of between $1.20 and $1.40. This figure represented a 28x growth from bid/offer widths recorded for the same benchmark in February and remained at similar levels for weeks.

These data reveal a direct proportionality between periods of extreme illiquidity with US Treasuries (in which trade costs are at an all-time high) with a trader’s difficulty in spotting or hedging her trade. Participants on Tradeweb’s eTrading platform, however, were at a unique advantage during these times of stress. Because Tradeweb’s offering is one of a few platforms that links corporate bond pricing electronically to the actual hedge reference price, during March when most of the market was forced to navigate uncertain trading waters, both buy-side clients and dealers on the Tradeweb platform enjoyed certainty of execution and protection from price slippage.

Furthermore, the cost saving benefits of the Net Spotting mechanism is at its maximum at these periods of peak volatility. That is, the savings from Net Spotting is proportional to the width of the bid/offer on the underlying Treasury.

As an example, in the most extreme scenario during March when bid/offer spread on the 30Y Treasury benchmark bond reached $1.4375, the Treasury equivalent of 100mm in corporate bond volume would achieve a Net Spotting savings of $1mm (using AAPL 3.450 02/09/45).

LOOKING FORWARD

As the markets continue to tread uncertain waters, the cost savings Tradeweb Net Spotting users have already seen (Exhibit 3) might be justification enough for participants to reconsidering aspects of their ‘traditional’ workflows.

Exhibit 3 breaks down the estimated quarterly savings for Net Spotting users and underscores the enhanced utility of the solutions during times of market stress (Q1 & Q2 2020).

Exhibit 3: Tradeweb Net Spotting Estimated Quarterly Cost Savings, $ Million

These totals boil down to a couple important statistics. Clients using Tradeweb’s Net Spotting solutions in March, on average, saved:

- $100,000 to $140,000 per $10mm of 30yr corporates Netted

- $9,000 to $15,000 on average per $10mm of 10yr corporates Netted

Net Spotting continues to build momentum among Tradeweb users. In the two years since it launched, almost 40.3% of Tradeweb’s institutional volumes traded eligible for spotting have been executed via this spotting methodology. For a client executing $100 billion of risk annually, this would mean savings upwards of $11 million based on a conservative estimate that 60% of the flow is being netted. Tradeweb estimates clients have saved, in total, over $27.35 million since 2019, with the most active traders realizing significant cost savings. As the first multi-dealer RFQ trading platform for U.S. Treasuries and with over $90bn of them executing daily across Tradeweb Markets, Tradeweb brings both liquidity and expertise, to continue to help its credit clients realize cost savings.

Click here to download the whitepaper.