Tradeweb Exchange-Traded Funds Update – February 2024

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Trading activity on the Tradeweb European ETF marketplace reached EUR 56.4 billion in February, while the proportion of transactions processed via Tradeweb’s Automated Intelligent Execution (AiEX) tool amounted to a platform record of 87.4%.

Adam Gould, head of equities at Tradeweb, said: “February has been another strong month, with a 10.2% increase year-over-year in traded volume on our European ETF marketplace. There was once again a record-breaking proportion of transactions completed through AiEX at 87.4%, illustrative of an increasing number of our clients turning to automation for their day-to-day trades.”

Volume breakdown

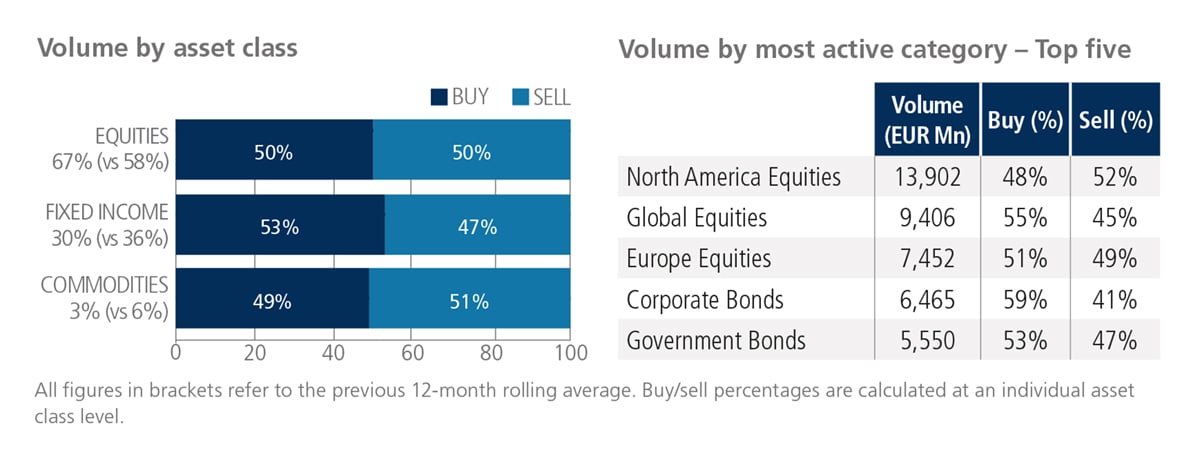

In February, trading activity in equity-based ETFs was around two-thirds of the total traded volume at 67%, while fixed income and commodities were at 30% and 3%, respectively. Once again, commodities was the only ETF asset class where ‘sells’ exceeded ‘buys’, while ‘sells’ equalled ‘buys’ in equities. North American Equities was the most heavily-traded ETF category, with almost EUR 14 billion in total notional volume.

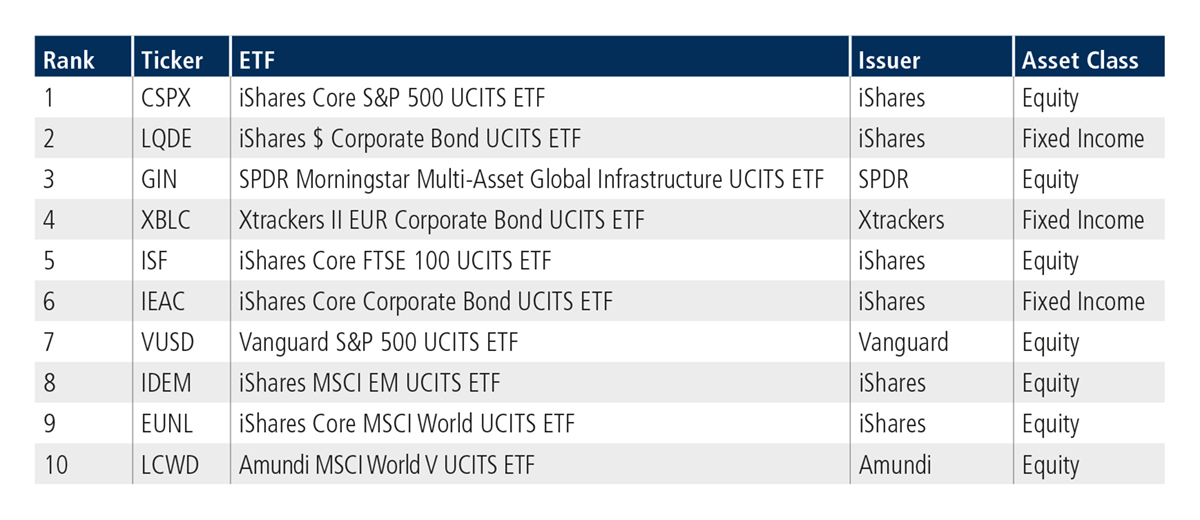

Top ten by traded notional volume

Seven of the top ten spots were occupied by equity-based products in February, and three of these offer investor exposure to global stocks. But, it was a U.S. equity-focused fund that topped the table, the iShares Core S&P 500 UCITS ETF, which took the first spot for the second consecutive month.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in February reached USD 66.0 billion.

Adam Gould, head of equities at Tradeweb, said: “In the U.S., Tradeweb institutional ETF volumes were up 21.7% year-over-year, reflecting strong growth on our platform. This growth is largely driven by continued client adoption of ETF trading via Tradeweb’s electronic RFQ, as well as an uptick in the use of our ETF portfolio trading functionality.”

Volume breakdown

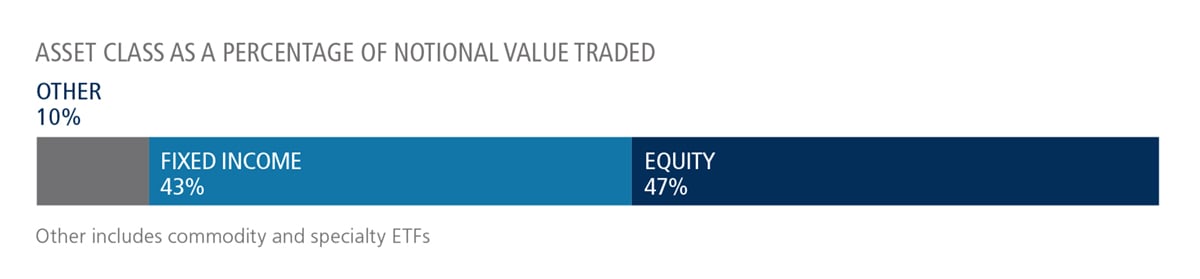

As a percentage of total notional value, equities accounted for 43% and fixed income for 47%, with the remainder comprising commodity and specialty ETFs.

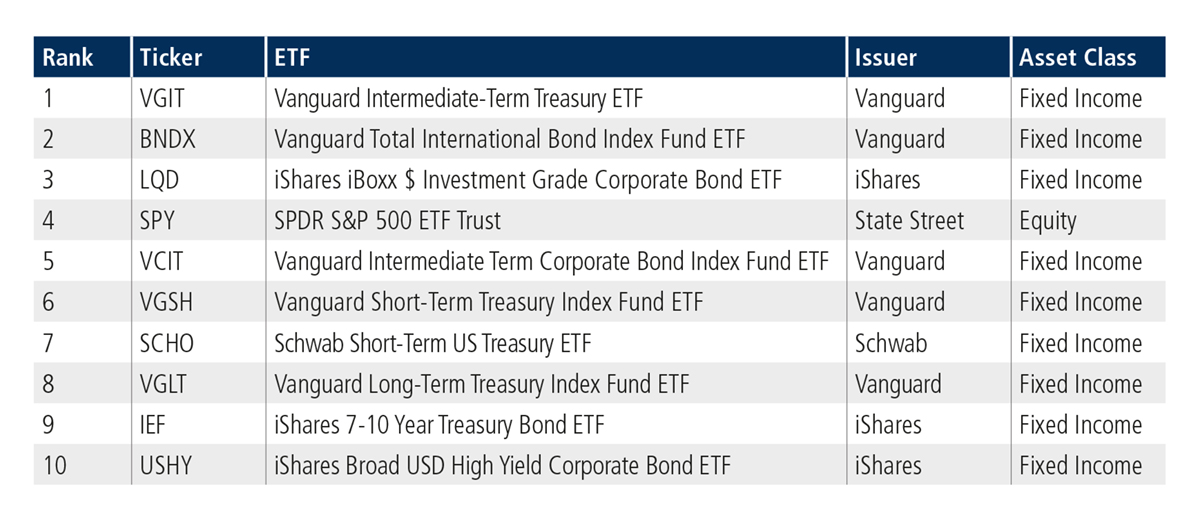

Top ten by traded notional volume

Nine of the top ten ETFs by traded notional volume were fixed income-based. The Vanguard Intermediate-Term Treasury ETF, which last appeared in the top ten in February last year, took first place.

Related Content