Tradeweb Government Bond Update – March 2024

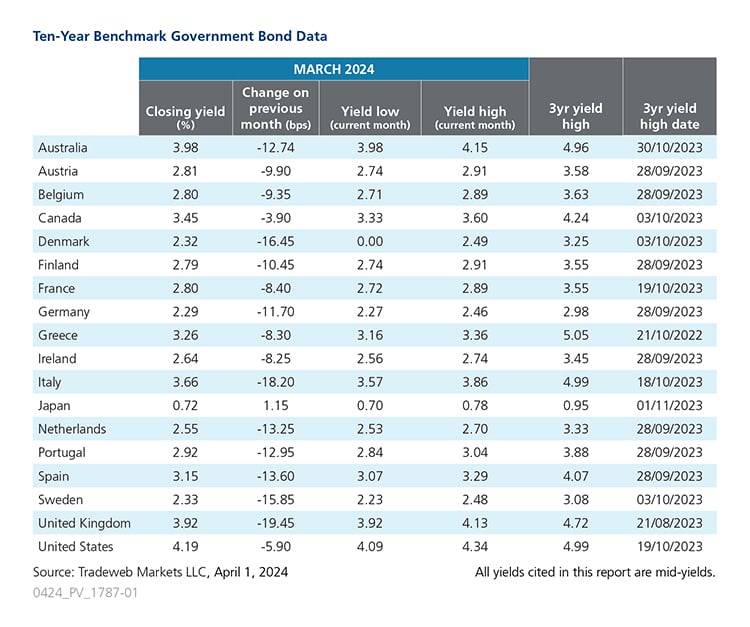

March saw the reversal of the sell-off trend in government debt markets experienced so far this year. Yields on 10-year benchmark notes decreased across the board, apart from those for Japan, which rose by one basis point on the month prior to finish at 0.72%. On March 18, the Bank of Japan ended the world’s only negative rate regime by raising its short-term interest rate to a range of 0% to 0.1% from -0.1%, while also abandoning its yield curve control policy. The country’s inflation rate climbed to 2.8% in February from 2.2% in the previous month.

Across the Pacific Ocean, Australia’s 10-year bond mid-yield fell by 13 basis points to close at 3.98%, whereas the inflation rate remained steady at 3.4% in February. On March 19, the Reserve Bank of Australia announced that its cash rate target would remain unchanged at 4.35%, and the interest rate paid on Exchange Settlement balances also unaltered at 4.25%. The Westpac-Melbourne Institute Index of Consumer Sentiment declined 1.8% to 84.4 in March.

The month’s biggest mover was the yield on the UK 10-year Gilt, which dropped almost 20 basis points to 3.92%. At its March meeting, the Bank of England held interest rates at 5.25%, while the annual inflation rate registered at 3.4% in February, the lowest level since 2021. The GfK Consumer Confidence Index remained the same at -21 in March, and the S&P Global/CIPS UK Manufacturing PMI rose to 49.9 from 47.5 the previous month.

The Italian 10-year government bond yield closed the month at 3.66%, decreasing by 18 basis points from February’s figure of 3.84%. At the same time, the inflation rate decreased slightly to 0.75% in February. In neighbouring France, the country’s benchmark note mid-yield fell by eight basis points to 2.8%. On March 26, French Finance Minister Bruno La Maire announced that the budget deficit had widened to 5.5% last year, higher than the 4.9% forecasted figure. In contrast, the inflation rate decreased to 3% in February from 3.1% in January.

Germany’s 10-year Bund yield ended the month at 2.29%, down from 2.41% in February, while its inflation rate eased to 2.3% in March. In the same month, the HCOB German Manufacturing PMI registered at 41.9, slightly lower than February’s number of 42.5.

In the U.S., the 10-year Treasury mid-yield came in six basis points lower in March at 4.19% from 4.25% in February. The U.S. annual inflation rate increased to 3.2% in February. Following its two-day policy meeting in March, the Federal Reserve announced it would hold its benchmark overnight borrowing rate in a range between 5.25% to 5.5%. Similarly, the Bank of Canada held its interest rates at 5% in March, with the nation’s 10-year bond yield dropping four basis points to 3.45%.

Related Content

Tradeweb Government Bond Update – February 2024