Tradeweb Government Bond Update – February 2024

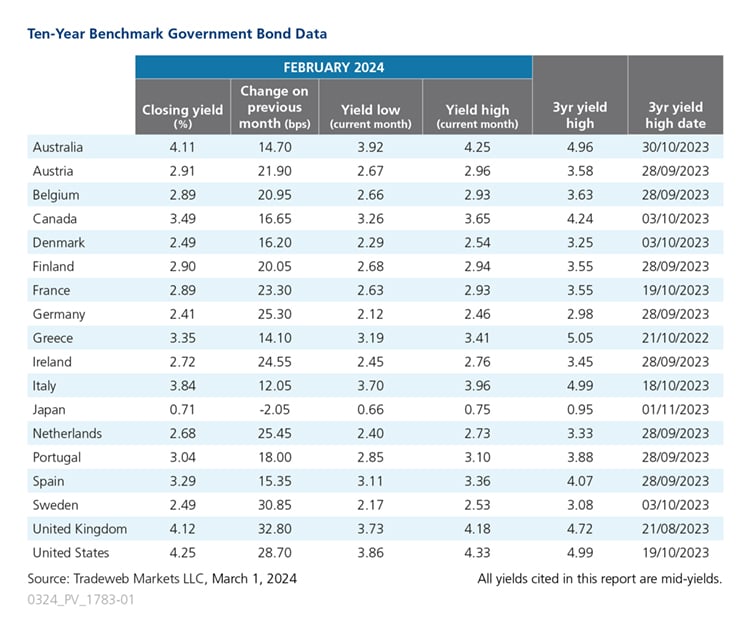

Continuing January’s trend, government bond markets experienced another sell-off in February. Yields on 10-year benchmark notes saw double-digit increases apart from those for Japan, which dropped by two basis points on the month prior to finish at 0.71%. The country’s inflation rate dropped to 2.2% in January, the lowest figure since March 2022, while the Consumer Confidence Index was 39.1 in February, the highest level since December 2021.

Conversely, Australia saw its 10-year bond mid-yield rise by almost 15 basis points to 4.11%. According to the Australian Bureau of Statistics (ABS), the annual inflation rate registered at a two-year low of 3.4% in January. The Westpac-Melbourne Institute Index of Consumer Sentiment rebounded to a 20-month high of 86 in February, a 6.2% increase on January’s figure.

Europe’s biggest mover was once again the yield on the UK 10-year Gilt, which climbed 33 basis points during the month to close at 4.12%. The UK’s inflation rate held steady at 4% year-on-year in January. Meanwhile, the GfK Consumer Confidence Index fell to -21 in February from -19 the previous month, and the S&P Global/CIPS UK Manufacturing PMI advanced slightly to 47.5.

In Sweden, the 10-year government bond yield closed February at 2.49%, up 31 basis points from 2.18% in January. On February 1, the country’s central bank announced it would maintain interest rates at 4%, while the inflation rate rose to 5.4% in January, up from 4.4% in December 2023. In contrast, the inflation rate in Italy remained stable at 0.8% on the year, with the yield on its 10-year government bond rising by 12 basis points to 3.84%.

The Dutch 10-year benchmark note yield increased by 25 basis points to 2.68%. The annual inflation rate for the Netherlands eased to 2.8% in February from a six-month high of 3.2% the month prior. In neighbouring Germany, the 10-year Bund yield ended the month at 2.41%, up from 2.16% in January, while its inflation rate eased to 2.7% in February. In the same month, the HCOB German Manufacturing PMI registered at 42.5, slightly lower than January’s number of 45.5.

Across the Atlantic, the U.S. 10-year Treasury mid-yield finished the month 29 basis points higher at 4.25% from 3.96% in January. According to the Federal Reserve, the country’s inflation rate fell to 2.4% in January. The Canadian 10-year government bond yield rose by almost 17 basis points to 3.49%, and the country’s inflation rate slowed to 2.9% in January from 3.4% in December.

Related Content