Tradeweb Government Bond Update – December 2023

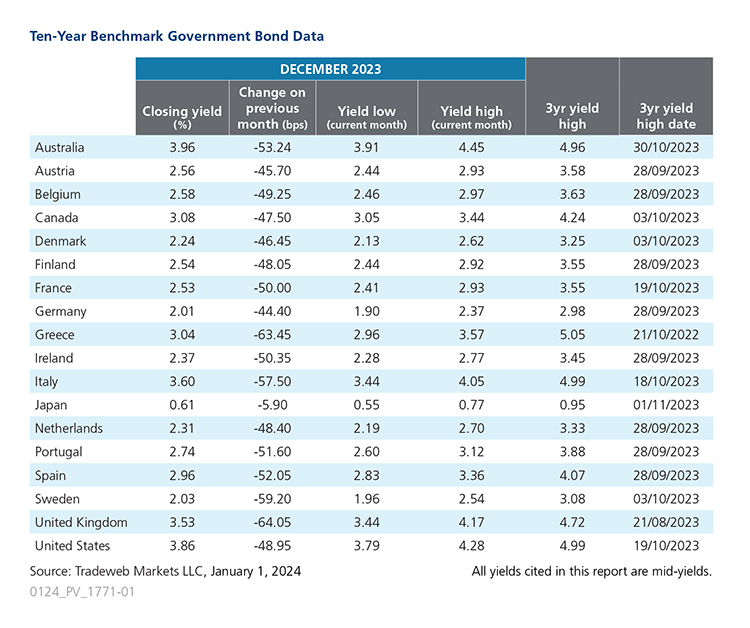

In December, 10-year government bond yields once again decreased across the board. The month’s biggest mover was the yield on the UK 10-year Gilt, which fell 64 basis points to 3.53% from 4.17% in the month prior. On December 21, it was revealed that UK public sector borrowing was higher than expected in November at GBP 14.3 billion. However, the country’s annual inflation rate fell to 3.9% in the same month, the lowest level in more than two years. The GfK Consumer Confidence Index increased to -42 in December, while the S&P Global/CIPS UK Manufacturing PMI weakened to 46.2, following three consecutive months of improvement.

On December 1, the credit rating agency Fitch lifted Greece’s long-term debt to investment grade. The country’s 10-year bond mid-yield closed the month at 3.04%, a 63 basis point decrease from November’s 3.67% figure, while its Italian equivalent dropped 57 basis points to 3.60%. Italy’s annual inflation rate fell to 0.7% in November from 1.7% in the previous month, marking its lowest reading since February 2021.

Elsewhere in Europe, Germany’s 10-year Bund yield finished December at 2.01%, a 44 basis point decrease from 2.46% in November. The country’s inflation rate fell to 3.20% in November from 3.80% in the previous month, and the HCOB German Manufacturing PMI registered at 43.3 in December, slightly higher than November’s 42.6 figure. The yield on Sweden’s 10-year government bond declined by 59 basis points to close December at 2.03%. Data published during the month showed that the annual inflation rate was 5.8% in November, down from 6.5% in October.

Across the Atlantic, the U.S. 10-year Treasury mid-yield ended December 49 basis points lower at 3.86%. The country’s annual inflation rate fell to 3.2% in November from 3.4% in October. In contrast, Canada’s annual inflation rate remained at 3.1% in the same month, with the country’s government bond yields dropping 47 basis points to 3.08%.

In the Asia Pacific region, yields on Australia’s 10-year benchmark note fell 53 basis points to 3.96% from 4.49% in November. The Westpac-Melbourne Institute Index of Consumer Sentiment rose 2.7% to 82.1 in December, up from 79.9 in November. In comparison, Japan’s government bond mid-yield decreased just six basis points to 0.55%, with the country’s annual inflation rate registering at 2.50% in November, rising at the slowest pace since the summer of 2022. On December 19, the Bank of Japan announced at its final meeting of the year that it would maintain interest rates at -0.1%.

Related Content