Tradeweb Government Bond Update – November 2023

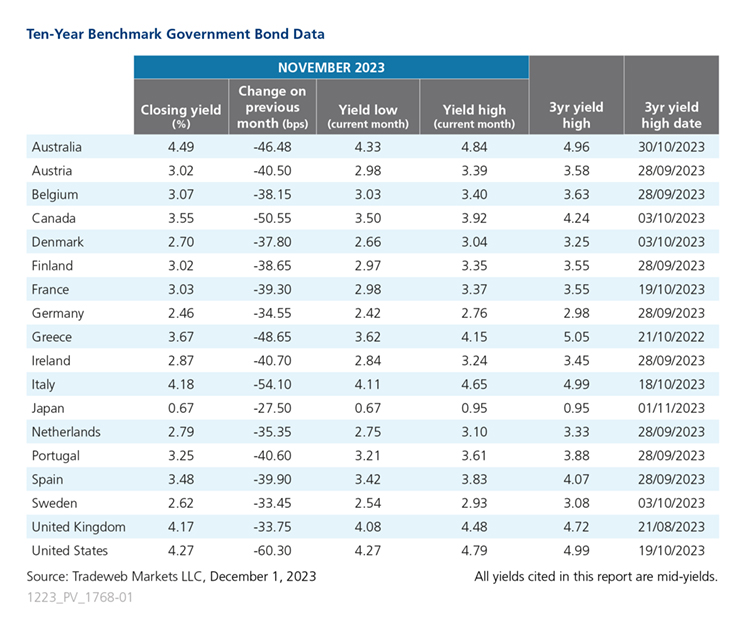

In November, 10-year government bond yields decreased across the board. The biggest mover was the U.S. 10-year Treasury, whose mid-yields dropped 60 basis points to 4.27% from 4.87% the previous month. The country’s inflation rate fell more than expected in October to 3.2%, down from 3.7% in September. In Canada, 10-year benchmark bond yields fell 50 basis points to 3.55%, with annual inflation declining to 3.1% in October from 3.8% in September.

Europe’s biggest mover Italy’s 10-year government bond yields dipped 54 basis points to 4.18% from 4.72% in October. On November 17, Moody’s left Italy’s sovereign debt rating at Baa3, but upgraded the country’s outlook to ‘stable’ from its ‘negative’ rating in August this year. Over in Greece, November’s mid-yield closed at 3.67%, down from 4.16% last month. Meanwhile, the country’s annual inflation rate increased sharply to 3.4% in October from 1.6% in September, marking the highest reading since March.

Elsewhere in Europe, the UK’s 10-year Gilt yield ended November at 4.17%, decreasing 33 basis points from October’s 4.51% figure. The Chancellor of the Exchequer delivered his Autumn Statement on November 22, announcing a GBP 20 billion tax cut, while the country’s inflation rate came in at 4.6% in October, the lowest reading in two years. The GfK Consumer Confidence Index rebounded in November to -24, the sharpest rise since April this year, and the S&P Global/CIPS UK Manufacturing PMI came in at 47.2 from 44.8 in October, rising for the third consecutive month.

In Germany, the 10-year Bund yield closed the month at 2.46%, dropping from 2.80% in October. The country’s inflation rate in November fell to its lowest level since June 2021 at 2.3%, and the HCOB German Manufacturing PMI registered at 42.6, an increase from the previous month’s 40.8, but still remaining within sub-50 contraction territory.

The annual inflation rate in Spain also experienced a decrease to 3.2% in November from 3.5% the preceding month. The mid-yield on Spain’s 10-year government bond finished 40 basis points lower at 3.48%.

Yields on Australia’s 10-year benchmark note fell 46 basis points to 4.49%. The Westpac-Melbourne Institute Index of Consumer Sentiment fell 2.6% to 79.9 in November, and the country’s annual inflation rate fell to 4.9% in October, compared to 5.6% the month prior.

In comparison, Japan’s annual inflation rate rose to 3.3% in October, the highest point since July. The Japanese 10-year government bond yield closed at 0.67%, a 27 basis point decline from the previous month. On November 9, the Governor of the Bank of Japan Kazuo Ueda announced at a conference that the central bank will proceed carefully with raising interest rates.

Related Content