Tradeweb Exchange-Traded Funds Update – March 2024

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Trading activity on the Tradeweb European ETF marketplace reached EUR 55.6 billion in March, while the proportion of transactions processed via Tradeweb’s Automated Intelligent Execution (AiEX) tool amounted to 86.1%, the second highest figure on record.

Adam Gould, head of equities at Tradeweb, said: “The first quarter of the year was full of milestones for ETF trading on Tradeweb. In Europe, we saw total traded volume reach EUR 163.6 billion, the platform’s third best quarterly performance ever. This is testament to the flexibility and liquidity benefits ETFs have to offer to trading desks.”

Volume breakdown

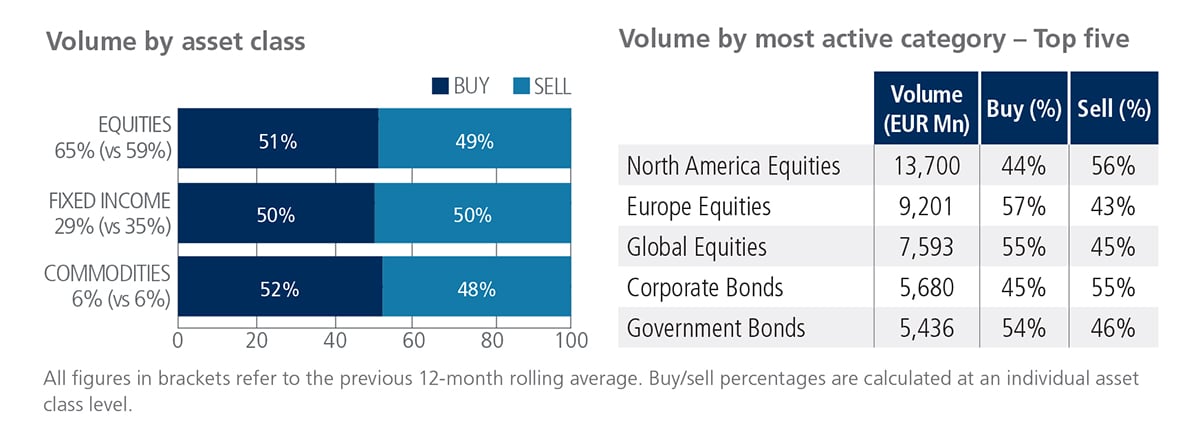

In March, trading activity in equity-based ETFs was just under two-thirds of the overall platform flow at 65%, while fixed income and commodities were at 29% and 6%, respectively. Fixed income was the only ETF asset class where ‘buys’ mirrored ‘sells’. In contrast, equity and commodity products saw net buying during the month. North American Equities was the most heavily-traded ETF category, with EUR 13.7 billion in total notional volume.

Top ten by traded notional volume

Six of the top ten spots were occupied by equity-based products in March, and three of these offer investor exposure to U.S. stocks. The Invesco Physical Gold ETC featured in second place; the last time the product appeared in a top three spot was August 2020.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in March reached USD 60.2 billion.

Adam Gould, head of equities at Tradeweb, said: “It was a record-breaking quarter for U.S. ETF institutional activity on Tradeweb, totalling USD 195.8 billion, reflecting continued strong growth on our platform. Volumes have continued to move higher, as we’ve seen more clients embracing our electronic RFQ protocol.”

Volume breakdown

As a percentage of total notional value, equities accounted for 55% and fixed income for 35%, with the remainder comprising commodity and specialty ETFs.

Top ten by traded notional volume

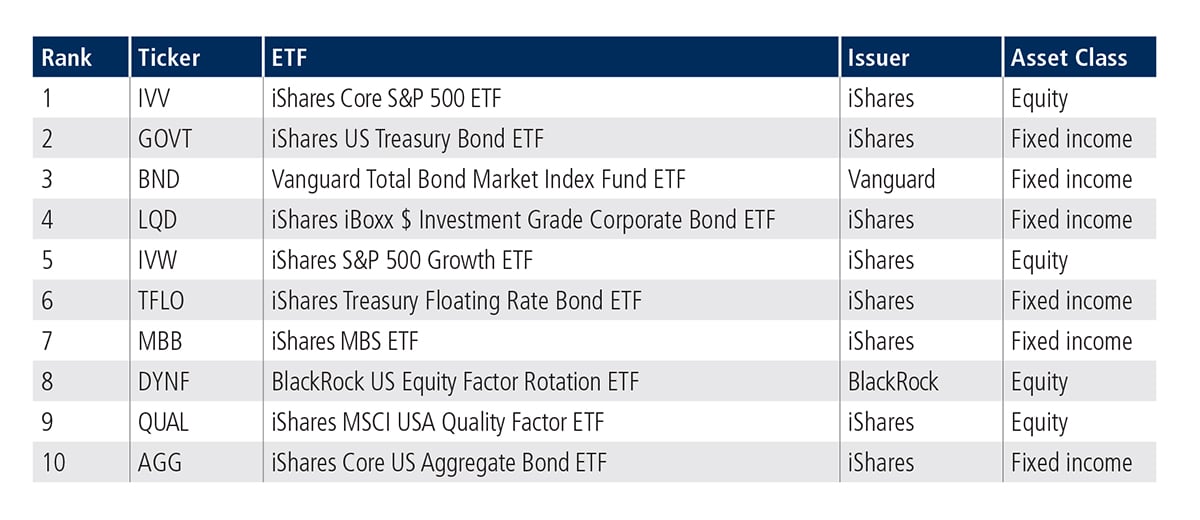

Six of the top ten ETFs by traded notional volume were fixed income-based; however, it was the shares-based iShares Core S&P 500 ETF which took the first place. Ranked second, the iShares U.S. Treasury Bond ETF last appeared in the list in December 2023.

Related Content