Are ‘People’ Worried About Inflation?

Jonathan Rick

Director of Research, Tradeweb

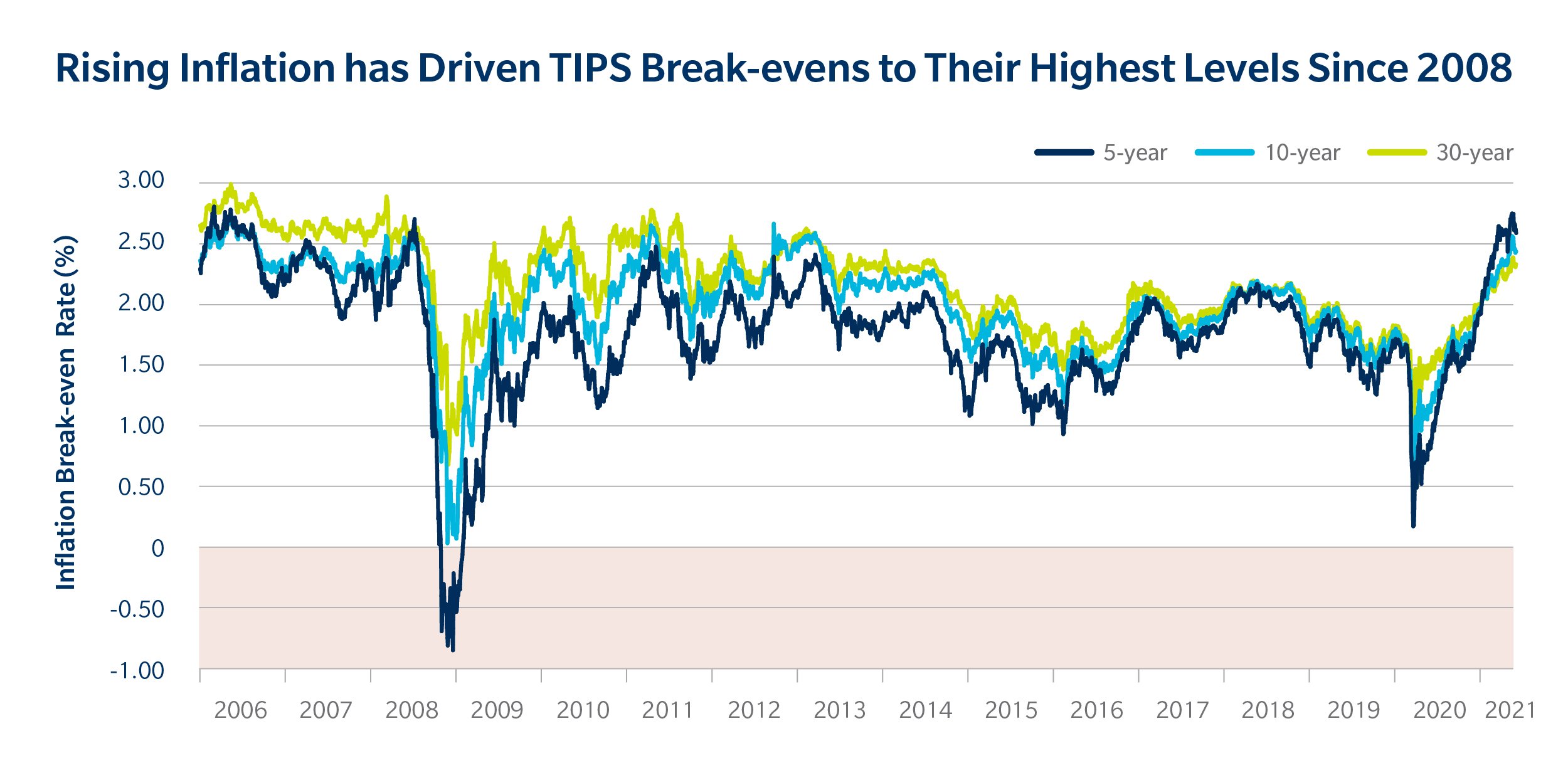

Headline inflation in the U.S. hit 4.2% annualized in April, a level we’ve not seen since 2008. The data surprised economists, stoked rate fears and raised the specter of a market revolt by so-called “bond vigilantes”– fabled as sentinels of the U.S. Treasury market in times of increased government spending and borrowing. Since the late 1990s, Treasury Inflation-Protected Securities (TIPS) have provided an alternative to plain-vanilla Treasuries for re-positioning during times of rising inflation.

Activity in TIPS has picked up noticeably in recent months at Tradeweb. With that rising interest, we’ve seen traditionally active clients become more involved in these bonds.

The effect on bid-offer spreads has been a net positive in an asset typically owned by a specialized niche of buy-and-hold investors. The added liquidity has created more opportunities to adjust to the realities of the highest break-even inflation data we’ve seen in more than a decade.

Source: Tradeweb

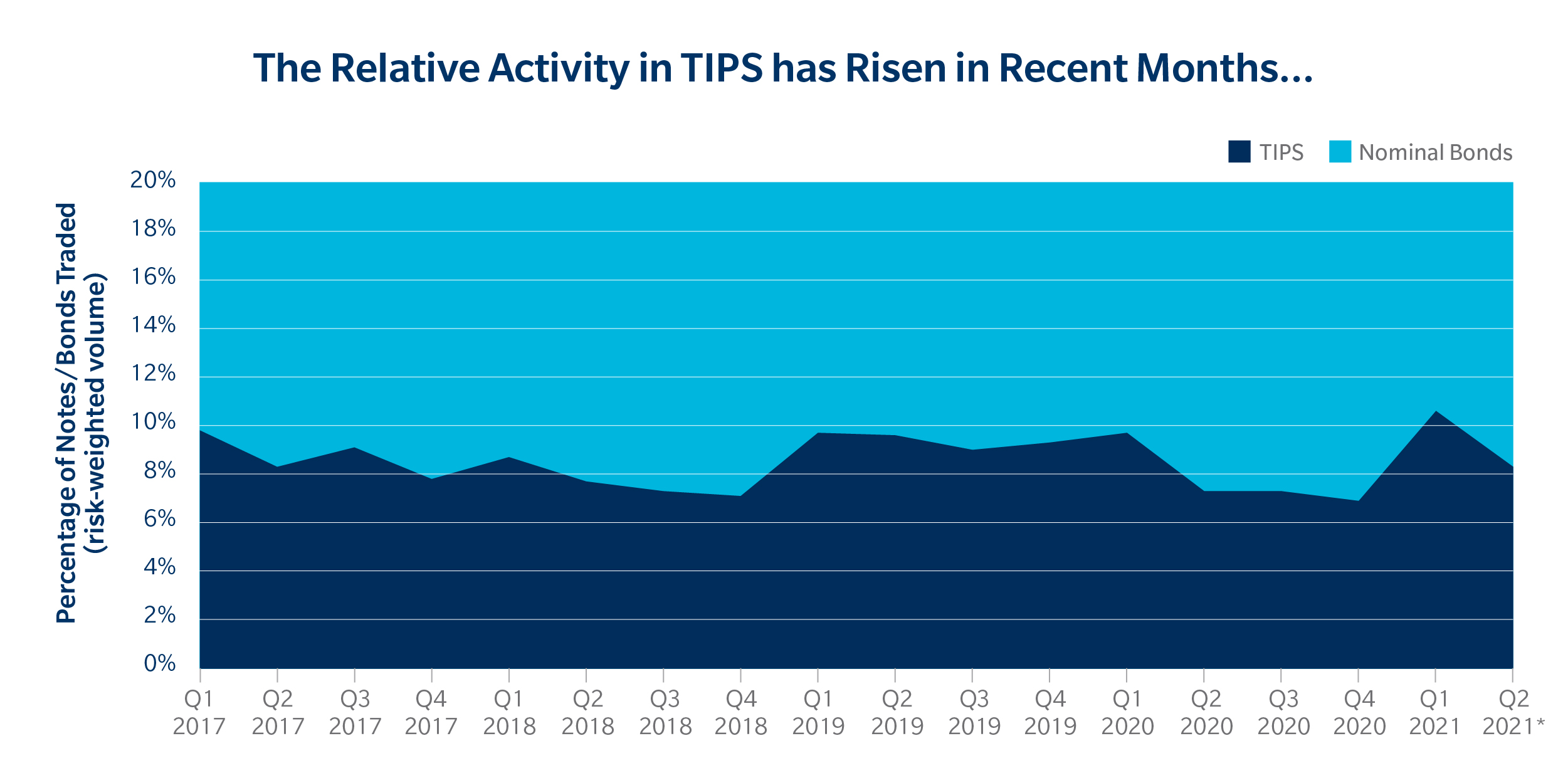

Since 2014, TIPS have represented a fairly consistent 10-11% of total Treasuries debt outstanding[1] (excluding bills and floating-rate notes). Still, on the Tradeweb institutional platform, TIPS trading has, on average, represented just 6%[2] of overall quarterly notional volume.[3]

That changed in the first quarter of 2021. TIPS trading accounted for 8.9% of volume, or 10.6% on a risk-weighted basis.

* Data through May 2021

Source: Tradeweb

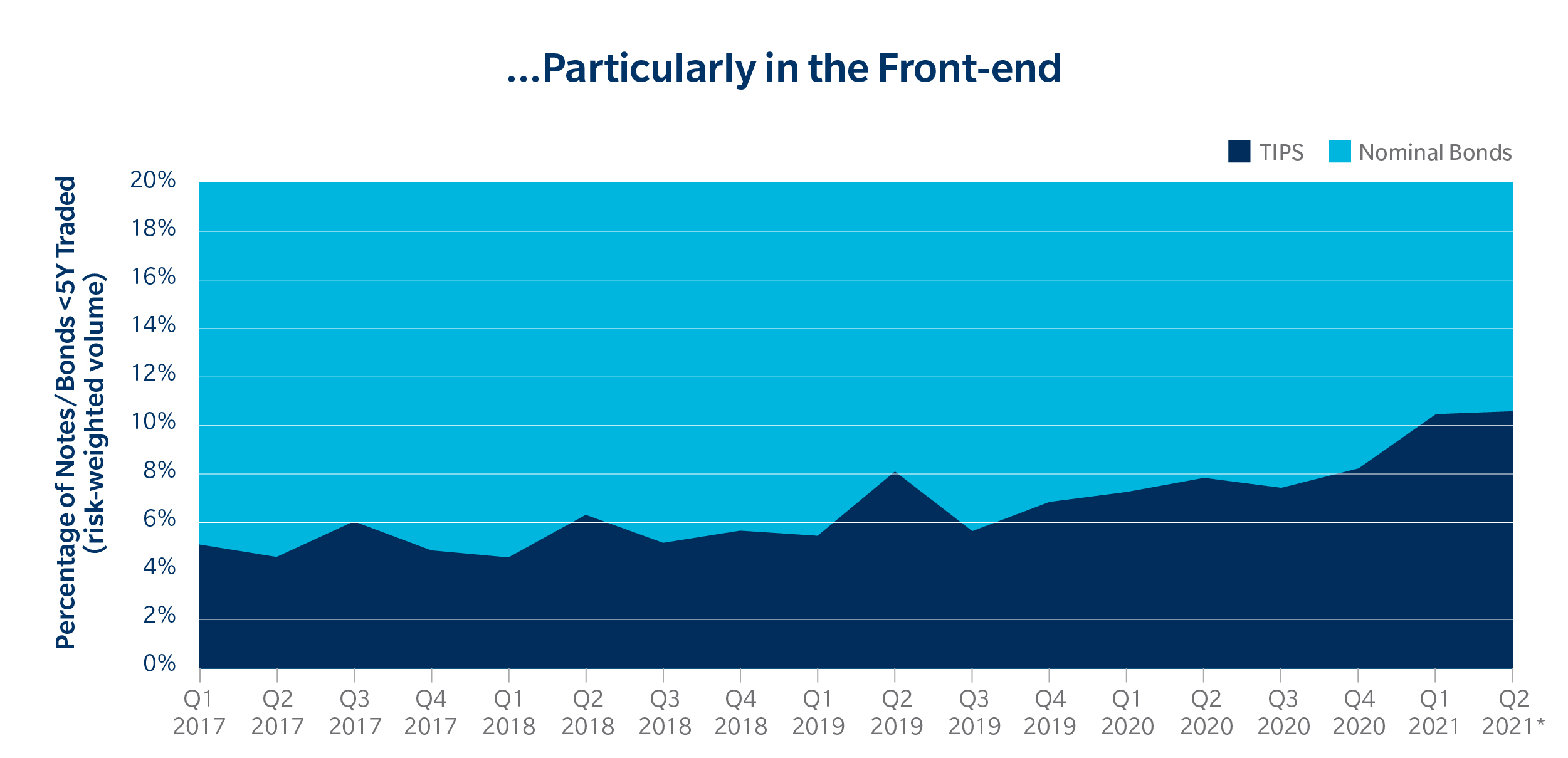

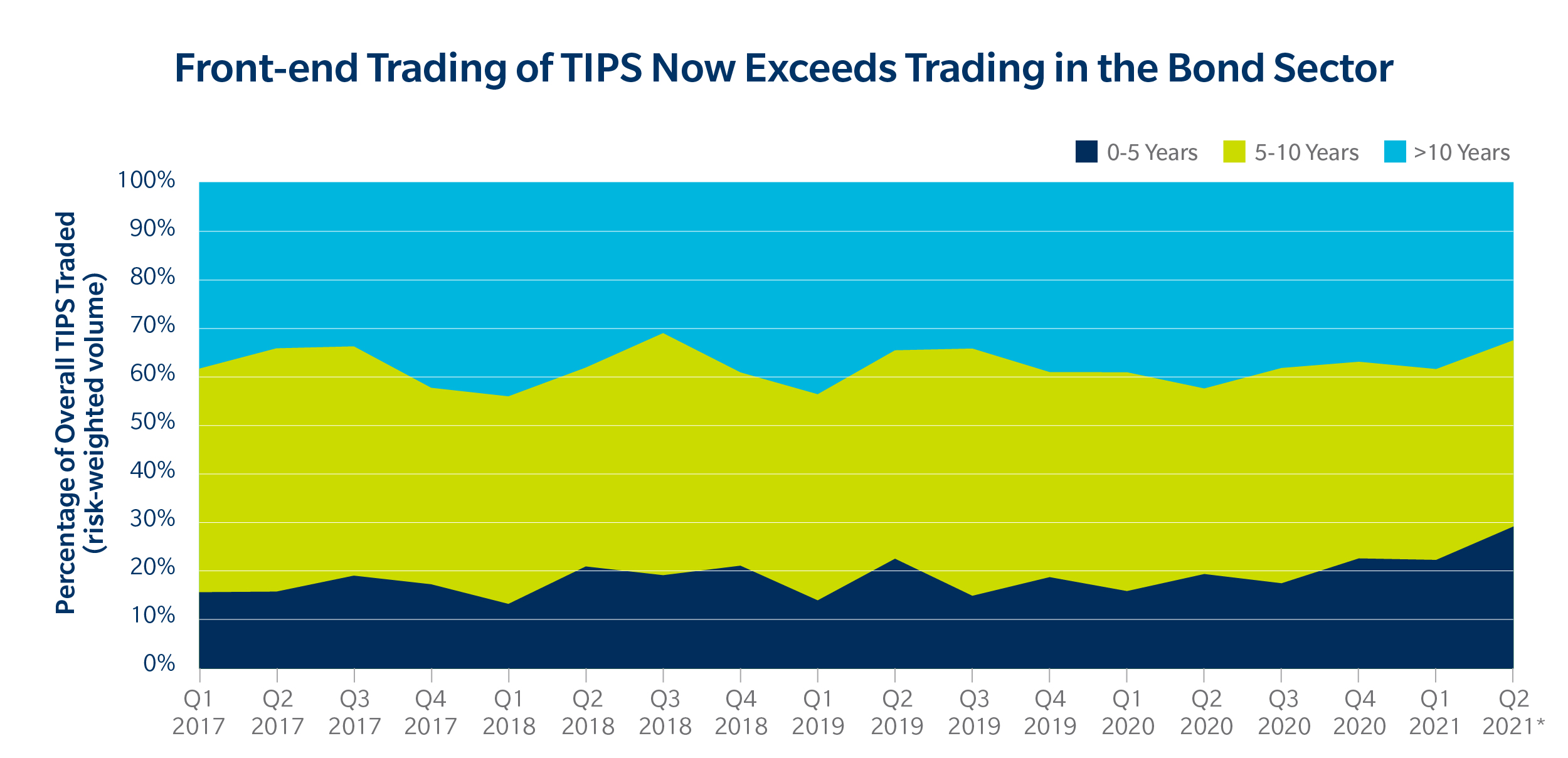

At the front-end of the curve, the uptick is more pronounced. So far this quarter, trading in TIPS with maturities under five years has jumped to 8.7% (10.6% risk-weighted), from an average of 5% per quarter over the past seven years. We saw an acceleration in trading of those TIPS, exceeding 30% of overall TIPS volume (risk-weighted), having averaged about 20% per quarter since 2014. This is the first quarter in which their activity will likely surpass activity in the bond sector.

* Data through May 2021

Source: Tradeweb

* Data through May 2021

Source: Tradeweb

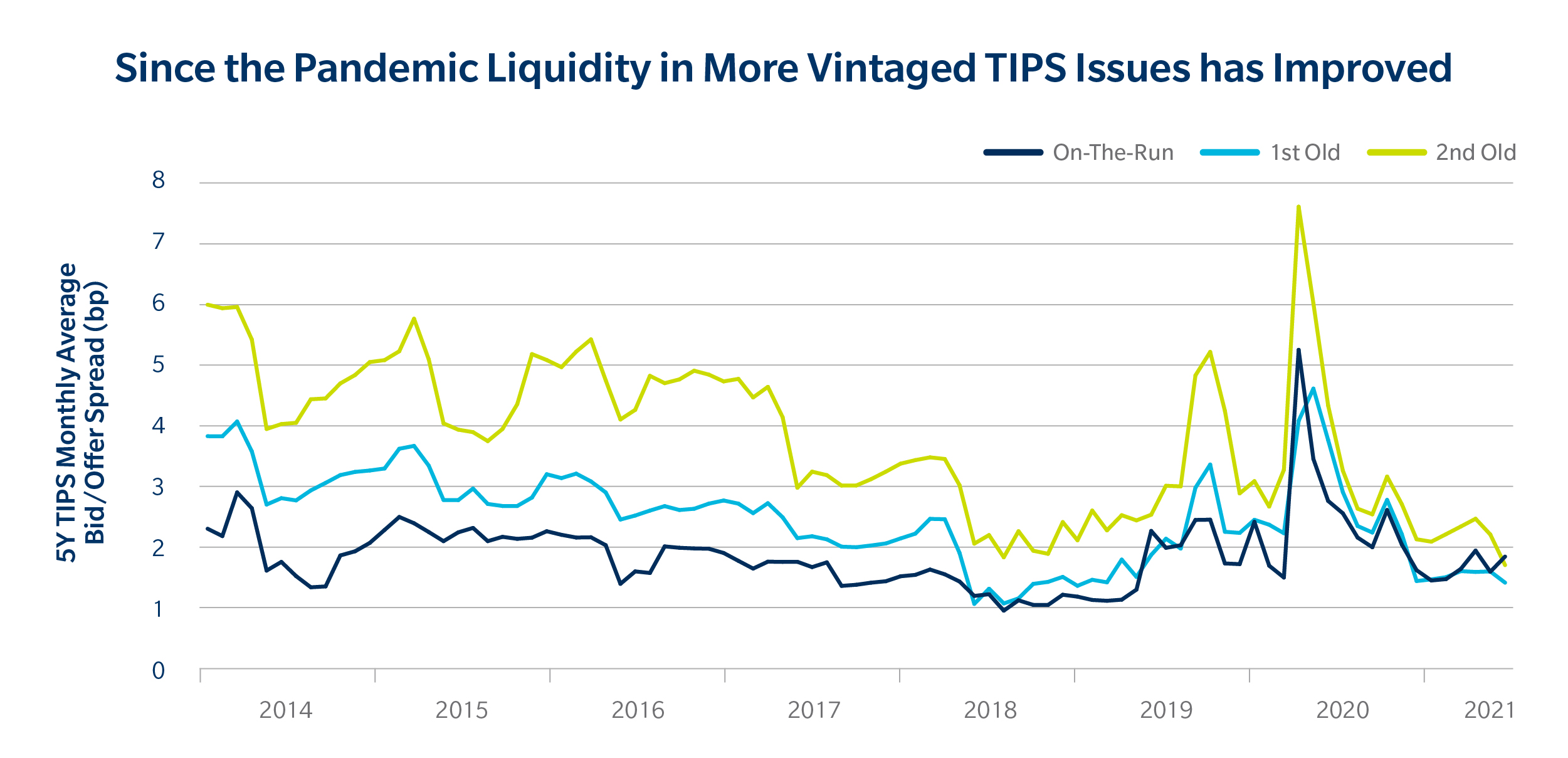

Given that concerns, at least for now, are on shorter-term inflation, the focus on TIPS maturities of five years and under is not surprising. As a result, bid-offer spreads on off-the-run versus on-the-run issues in that part of the curve have compressed, while traditionally active clients have become a greater proportion of volume in those tenors. As an example, bid-offer spreads for the first and second old[4] five-year TIPS have tightened noticeably since 2019 and are now roughly aligned with the on-the-run security.

That said, on-the-runs still dominate trading, accounting for about 50% of volume on a risk-weighted basis.

Source: Tradeweb

It remains to be seen whether this interest is ephemeral at a time most economists expect inflationary pressures to be transient. Whether bond vigilantes are returning to markets is a further unknown for the TIPS market and Treasuries in general.

[1] Based on data from SIFMA and the U.S. Treasury.

[2] All trading data reflect Tradeweb institutional client activity.

[3] All activity exclusive of bills and FRNs, as well as non-Treasury hedging activity.

[4] The first old note/bond is the penultimate new issue bond in the sector, issued prior to the current on-the-run. The second old is the one issued prior to that.

Related Content

EU Issuance and the Evolution of European Bond Markets

What a Long Strange Trip It's Been

Record Fixed-Income Issuance Spurring Changes in Trading, Market Dynamics

This communication is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. This communication has been provided to you for informational purposes only and may not be relied upon by you in evaluating the merits of investing in any securities or interests referred to herein or for any other purpose. This communication is not intended as and is not to be taken as an offer or solicitation with respect to the purchase or sale of any security or interest, nor does it constitute an offer or solicitation in any jurisdiction, including those in which such an offer or solicitation is not authorised or to any person to whom it is unlawful to make such a solicitation or offer. Before making any investment decision you should obtain independent legal, tax, accounting or other professional advice, as appropriate, none of which is offered to you by Tradeweb or any of its affiliates.

This information is for institutional investor use only and may not be redistributed without the prior written consent of Tradeweb or its subsidiaries. Under no circumstances may this information be distributed to retail investors.

In the United Kingdom, this communication may constitute a financial promotion for the purposes of the Financial Services and Markets Act 2000. Accordingly, it is issued only to, or directed only at, persons who are: (i) investment professionals within the meaning of Article 19 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the "FPO"); (ii) high net worth companies and certain other entities falling within Article 49 of the FPO; and (iii) any other persons to whom it may lawfully be communicated. Tradeweb Europe Limited (“TWEL”) is authorised and regulated by the Financial Conduct Authority of the United Kingdom (the "FCA") under No. 193705. To the extent that this communication is issued by TWEL, it is being issued inside and outside the United Kingdom only to and/or is directed only at persons who are professional clients or eligible counterparties for the purposes of the of the FCA's Conduct of Business Sourcebook.

For the purposes of clients accessing Tradeweb services from EU27 countries, this information is provided by Tradeweb EU B.V. ("Tradeweb EU") which is authorised and regulated by the Dutch Authority for the Financial Markets ("AFM"), as appropriate.

Although the information in this communication is believed to be materially correct as at the date of issue, no representation or warranty is given as to the accuracy of any of the information provided. Furthermore no representation or warranty is given in respect of the correctness of the information contained herein as at any future date. Certain information included in this communication is based on information obtained from third-party sources considered to be reliable. Furthermore, to the extent permitted by law, Tradeweb and its affiliates, agents and service providers assume no liability or responsibility and owe no duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.