Yes, 'People' Are Worried About Inflation

Jonathan Rick

Director of Research, Tradeweb

When the U.S. Consumer Price Index (CPI) annual inflation rate hit a decade-plus high last April, we wondered[1] whether renewed interest in inflation-linked securities was a knee-jerk reaction to an anomalous inflation reading. Now, as CPI sets multi-decade records, exceeding 9% year-over-year (YoY) in June, it’s clear that Treasury Inflation-Protected Securities (TIPS) and their like are having their moment.

As economic headwinds intensify, central banks remain disposed to fighting inflation by hiking interest rates, as we saw again last month from the European Central Bank, the Bank of England and the U.S. Federal Reserve. In particular, the U.S. Federal Reserve increased its target by 0.75%, for the second consecutive meeting, and stated it remains “strongly committed to returning inflation to its 2 percent objective.” Inflation products provide a natural hedge against this uncertainty. Judging by volumes, participation levels and improving liquidity, these products are attracting more, and more diverse, attention.

“When inflation averaged sub 2% for over a decade prior to the pandemic, investors were almost paid not to care. Now that it’s at the highest rate since the 1980s, it becomes central to asset allocation decisions. Given the sheer size of the most recent shock, we don’t expect investor attention to shift away any time soon, even if the peak is behind us.”

– Alisher Khussainov, Head of TIPS Trading at Citadel Securities

It’s worth pointing out that these markets are, in many ways, niche and different than the much larger market for vanilla government bonds and swaps. For one, the instruments themselves are structured differently – TIPS and other Inflation Index-Linked Bonds (ILBs), for instance, have adjustable principal. Inflation swaps, meanwhile, pay zero coupons until maturity.

They also trade differently than do their plain-vanilla rates counterparts. For example, inflation instruments have seasonal carry, which is apparent when looking at volumes over the year. Further, cross-market instruments, such as oil futures and ETFs, are used to hedge TIPS – creating a unique link between these products that does not exist for core rates products.

Finally, inflation instruments are typically traded by a niche group of traders distinct from those transacting in nominal rates bonds and vanilla swaps. The liquidity profile of the instruments has generally lagged that of the greater market.

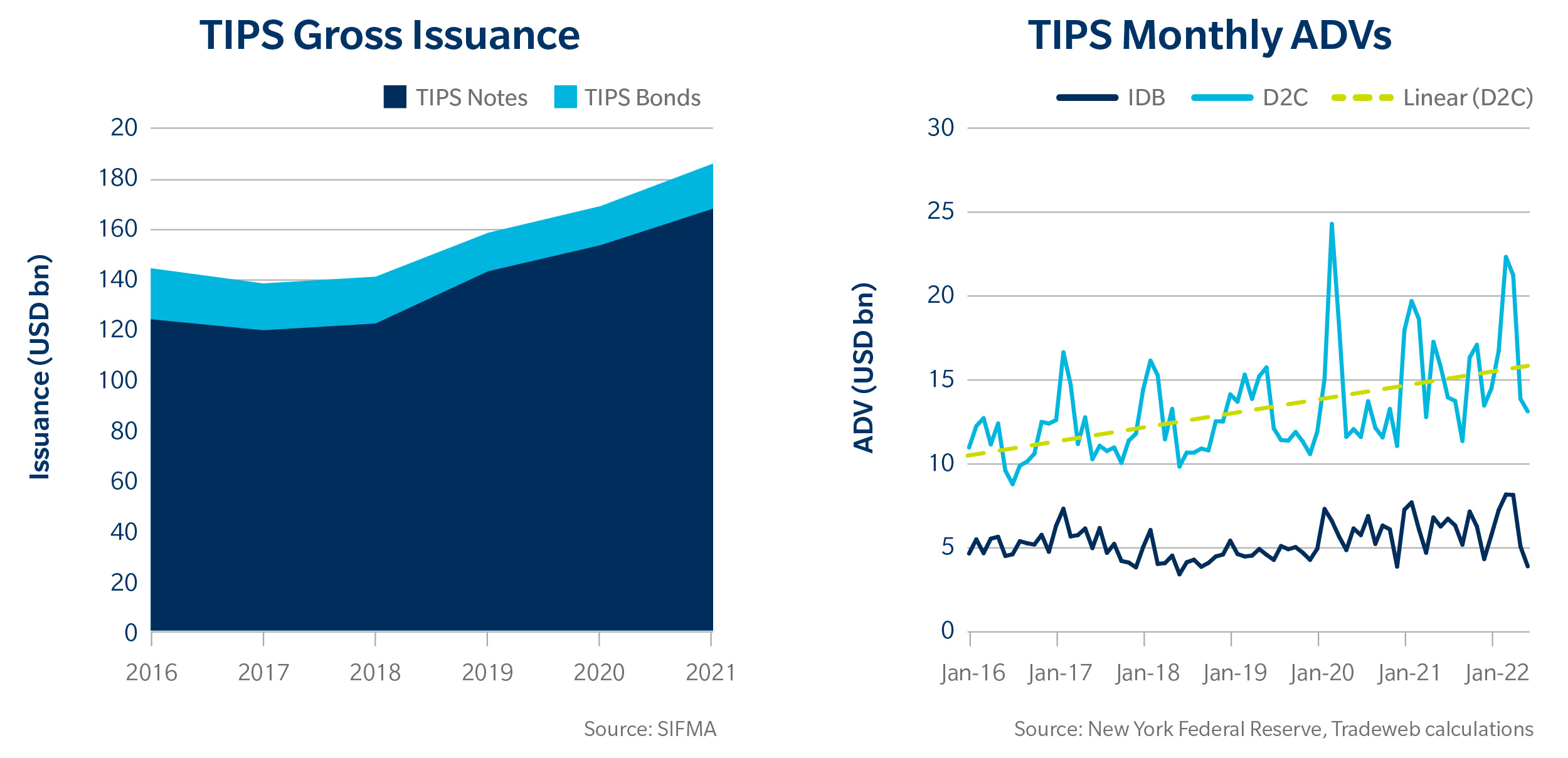

Growing Market Volumes And Participation

However, over the past two years, the TIPS market has started to catch up. Increased TIPS issuance from the U.S. Treasury and the continued electronification of rates markets are fueling this shift. Between 2016 and 2021, there was a 29% increase in TIPS issuance to a level the U.S. Treasury expects to be maintained.[2] From a trading standpoint, the New York Federal Reserve’s Primary Dealer Statistics show similar volume growth for TIPS, with average daily volumes (ADVs) across the market increasing roughly in-line at 34% over the same period. Most of this growth has come from the dealer-to-client (D2C) sector, which was up 40% in the same period compared to just 20% for the inter-dealer brokers sector (IDB). These trends have continued in H1 2022 with ADVs up 9% and 3% vs. FY2021, respectively, for D2C and IDB.[3]

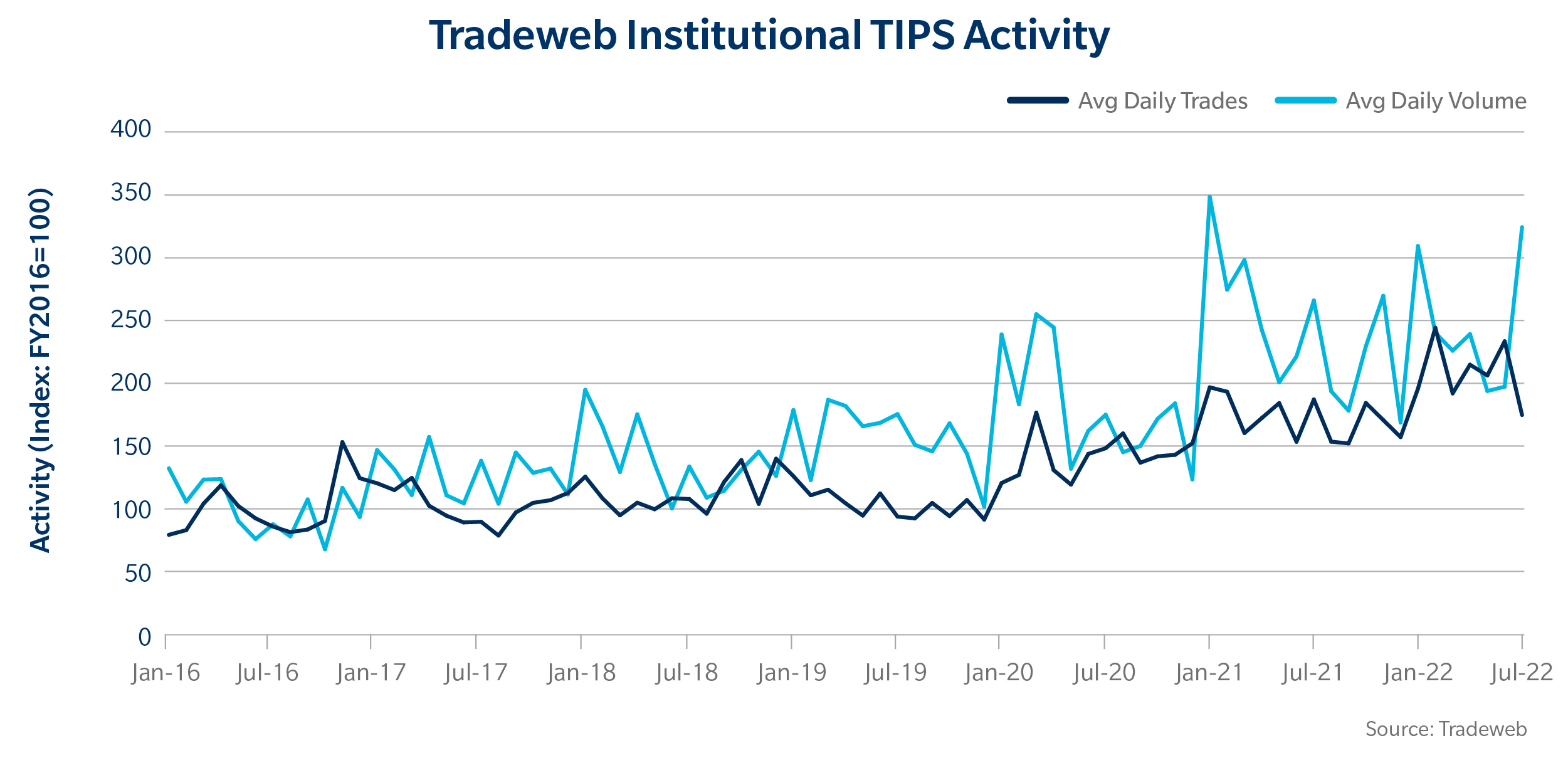

Meanwhile, in the same five-year period, TIPS trading by institutional clients on the Tradeweb platform has more than doubled, easily outpacing the growth in the overall D2C sector. The number of trades has risen a similar amount, with notable growth happening this year. This suggests that electronic trading is helping facilitate this activity in the TIPS market.

The breadth of TIPS clients has expanded, too. The average number of daily trading clients on the Tradeweb platform has increased by 20% since 2018.

Still A Niche Market

For all this renewed attention, it’s worth remembering that the TIPS market is not the nominal market and that liquidity still comes from a relatively small number of specialists. One way to gauge the comparative concentration of the markets is by using the Herfindal-Hirschman Index (HHI)[4], a classic microeconomics measure of market competitiveness. An HHI reading of 0.13 this year for institutional TIPS at Tradeweb confirms what investors already know – that the market is less competitive than the Treasuries market, which has an HHI reading of 0.08.[5]

Further, there are signs of growing competitiveness in the TIPS market. This month, Citadel Securities started market making in TIPS, a natural extension of their institutional Treasuries franchise.

"Being a TIPS dealer is a true market making experience. You have to be creative in how you hedge and comfortable with warehousing risk. We’re very cognizant of that as we launch our market making capabilities. Our unique combination of experienced voice risk taking in TIPS with a platform to develop our systematic capabilities positions us to strategically take risk and provide liquidity for our clients."

- Alisher Khussainov, Head of TIPS Trading at Citadel Securities

Improving Liquidity Through Automation

As had been the trend across rates markets, the shift towards electronic trading has been met with significant investments in infrastructure by TIPS liquidity providers over the last several years. One outcome we’ve observed is faster request-for-quote (RFQ) response times. The percentage of responses to trade inquiries submitted in under a second - a clear sign of auto-quoting - jumped in the second half of last year, standing today at around 70%, versus about 50%, a level it roughly held since the start of 2020.[6]

There has been a similar trend towards automation on the client side, where we have observed an increase in auto-execution trades as well. This suggests that the market is getting comfortable enough with TIPS liquidity to “set it and forget it” through automation. The percentage of tickets executed via Tradeweb’s AiEX technology has risen to over 20%, up from the low teens in 2020. (For those who aren’t familiar with it, AiEX is a rules-based automated-execution engine allowing you to adjust tolerances for factors such as market width and wait time.)

Liquidity Still Lags

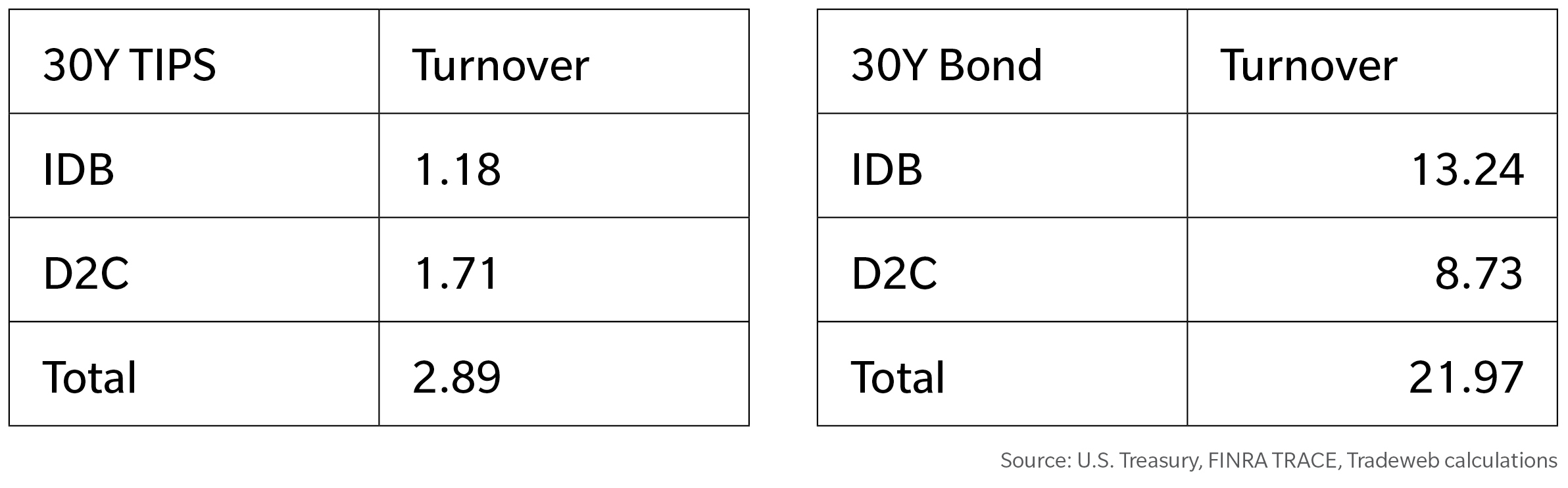

Despite these improvements, liquidity in the TIPS market still notably lags as compared to that of the nominal market. This becomes readily apparent when looking at turnover data from TRACE. Consider the most recent contemporary issuances of the 30Y TIPS and 30Y nominal bond. In the most recent three weeks, when they were both the on-the-run (OTR) bond and neither had a reopening[7], turnover on the two bonds was:

Despite recent concerns about inflation, the TIPS turnover remains an order of magnitude lower than its OTR 30-year nominal Treasury counterpart during the three-week period. It is particularly interesting to see that the ratio between IDB and D2C is flipped between nominal bonds and TIPS, with TIPS having lower IDB turnover than D2C. The lower IDB turnover suggests that it should take a liquidity provider longer to offload TIPS risk stemming from client orders.

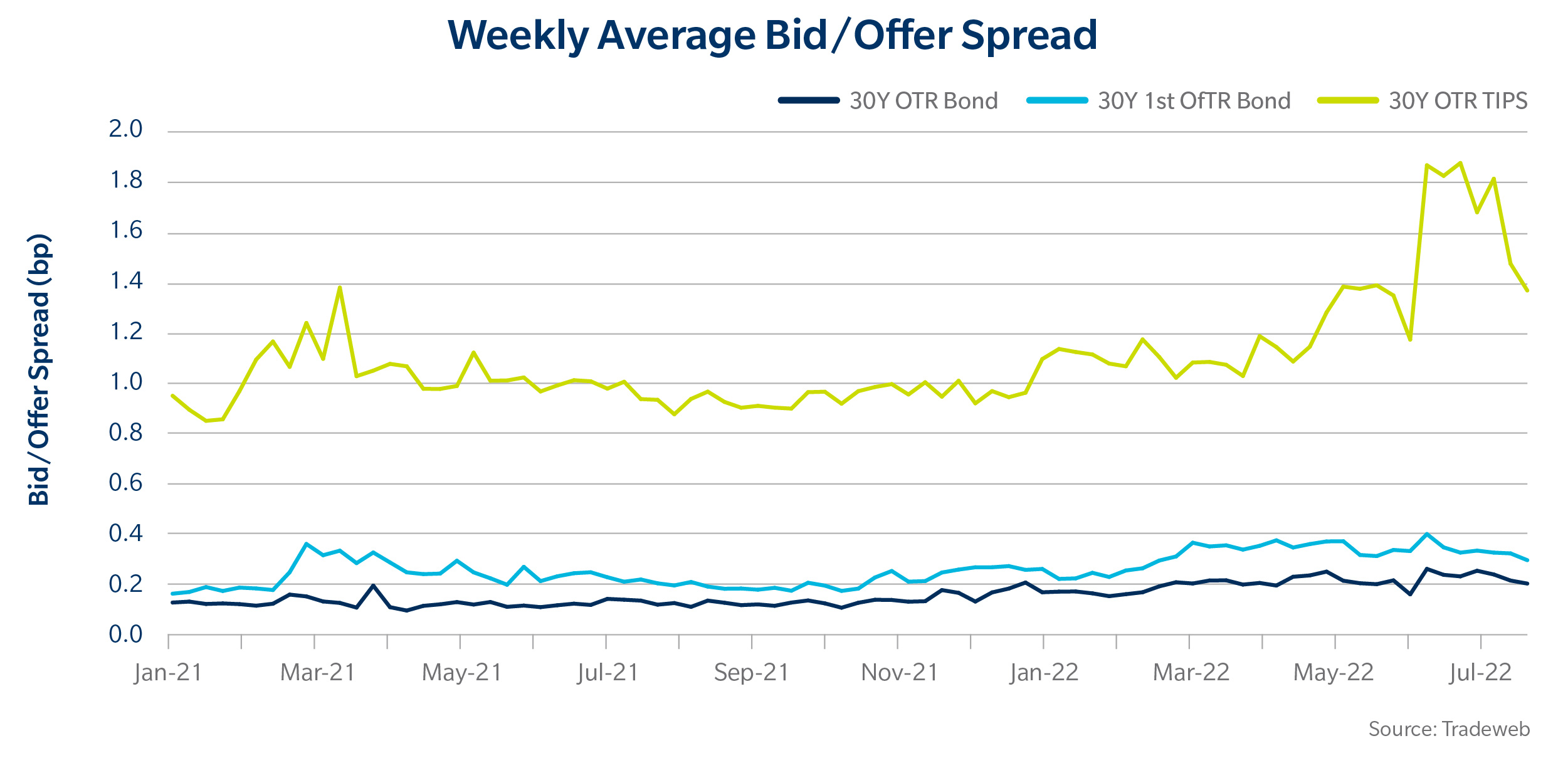

Bid-offer spreads (BOS) provide another perspective into these markets’ liquidity. Inherent in an instrument’s BOS is the cost of offsetting its risk; the wider the spread the higher the cost for liquidity.

BOS in TIPS remain noticeably wider than those in Treasuries. Further, with the recent marked rise in volatility in recent months, BOS TIPS have widened noticeably when compared to nominal bonds in the long-bond sector. This relative widening makes sense given the notably lower turnover for TIPS in the IDB market.

It’s tempting to view this high-inflation environment as a game-changing catalyst for broad structural changes in the inflation-products market, especially with CPI running at a decades-high. And while we are seeing important shifts in market breadth and liquidity the past two years, these markets were already evolving even when inflation was low, thanks to electronification. With inflation appearing to be more persistent than many expected last year, the importance of liquidity in these products remains vital.

[1] https://www.tradeweb.com/newsroom/media-center/insights/commentary/are-people-worried-about-inflation/

[2] Source: Tradeweb calculations based on SIFMA U.S. Treasury Securities Statistics

[3] Source: Tradeweb calculations based on New York Fed Primary Dealer Statistics

[4] Further details for anyone rusty on their microeconomics: https://en.wikipedia.org/wiki/Herfindahl%E2%80%93Hirschman_index

[5] Calculations based on trading delta. Both index values still indicate competitive, unconcentrated markets based on general interpretation.

[6] Source: Tradeweb

[7] The relevant reference weeks are Feb 21, 2022-Mar 11, 2022. There was a reopening of the 30Y nominal bond on Thursday, Mar 10, 2022, but the impact of this on the analysis should be de minimis. Turnover was calculated as (3-week volume for longest maturity OTR bond category in the TRACE data) / (Auction Offering Amount of the relevant 30-year bond)