Market Snapshot: U.S. 1mo, 2yr, 10yr Yields Decline Following Yellen Comments

U.S. Treasury yields fell following Federal Reserve Chairwoman Janet Yellen’s remarks that uncertainty in global markets warranted a slower pace of interest rate increases, according to Tradeweb data.

At the Economic Club of New York, Ms. Yellen contrasted volatility in China and oil prices, stress in manufacturing and exports, and her concern that upticks in inflation signals were temporary with an improved labor market. The Fed now believes it will raise rates by half a percentage point for 2016 instead of a full percentage point.

The bid yield on the 1-month Treasury bill fell to 0.137%, down 6.8 bps from yesterday’s close of 0.205%. Intraday yields ranged from a low of 0.117% to a high of 0.198%.

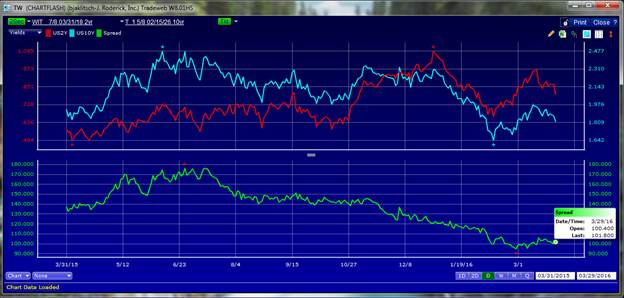

The bid yield on the 2-year Treasury note was 0.800%, down 6.9 bps from yesterday’s close of 0.869%. Intraday yields ranged from a low of 0.796% to a high of 0.883%.

The bid yield on the 10-year Treasury note was 1.819%, down 5.3 bps from yesterday’s close of 1.872%. Intraday yields ranged from a low of 1.818% to a high of 1.897%.

The spread between the 2-year and 10-year notes was 101.800 bps, up 1.7 bps from yesterday’s close of 100.100 bps. The 12-month high for the spread was June 26, 2015, at 176.100 bps, while the 12-month low was on February 29, 2016, at 94.900 bps.

Yields were taken at 2:25 PM.

The charts below are based on indicative, real-time data from Tradeweb.

CHART 1: U.S. 1-Month Treasury Yields – March 31, 2015 – March 29, 2016 (12 Month View)

CHART 2: Spread Between 2-Year and 10-Year Treasury Yields – March 31, 2015 – March 29, 2016 (12 Month View)