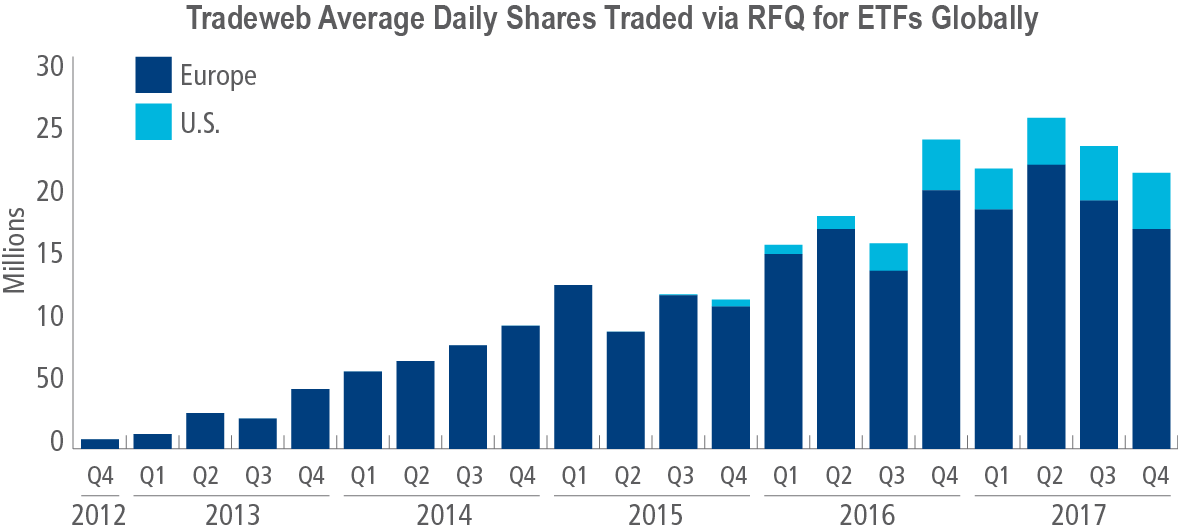

Institutional ETF Trading Volume Doubles Annually on Tradeweb over Five Years

Tradeweb Average Daily Shares Traded via RFQ Consistently Exceeds 20 Million

NEW YORK, N.Y. (January 17, 2018) - Tradeweb Markets, a leading builder and operator of global fixed income, derivatives and ETF marketplaces, announced that more than $660 billion has traded across its global, institutional ETF offering, with a compound annual growth rate of 120% since launching in October 2012. The Tradeweb electronic request for quote (RFQ) platform for exchange traded funds now provides access to competitive pricing from 39 liquidity providers worldwide, enhancing transparency and efficiency for investors in an automated, compliant workflow.

"The sustained growth of our global ETF offering demonstrates the real value RFQ trading provides institutional investors in accessing liquidity with competitive pricing," said Adriano Pace, Managing Director at Tradeweb. "Tradeweb has firmly established itself as a leader in electronic OTC trading for ETFs, leveraging technology in new and innovative ways to help unlock ETF liquidity for market participants."

Activity on the Tradeweb global ETF platform continues to increase with record investment into the ETF marketplace, driving more than 20 million shares in average daily trading for each of the last four quarters:

Tradeweb has streamlined access to significantly greater levels of ETF liquidity for institutional investors via RFQ trading, putting up to five liquidity providers in competition for both block and net asset value trades. The platform also provides real-time axes from market makers that highlight prices or indications of interest to buy or sell particular securities, allowing investors to leverage the information when requesting quotes. Market participants benefit from aggregated pre-trade transparency, efficient execution, and electronic audit trails for compliance and best execution - all in an automated workflow.

"We set out to deliver an alternative method for accessing institutional ETF liquidity with greater efficiency and transparency, providing clients with immediacy in filling their entire order via RFQ trading," said Adam Gould, Managing Director at Tradeweb. "By delivering a solution that helps protect institutional investors against information leakage, with quality pricing for larger size trades, we're excited to see our platform keep growing."

Tradeweb offers RFQ trading for both U.S. and European-listed ETFs, and is one of the largest ETF trading venues in Europe. Since launching in 2012, more than €500 billion in European-listed ETFs and over $85 billion in U.S.-listed ETFs have traded on Tradeweb. In Q4 2017, average daily trading volume of ETFs exceeded $980 million across Tradeweb. Clients have successfully executed single block ETF trades in excess of 12 million shares on Tradeweb, with more than 90% of trades executed within the best bid-offer prices from exchanges in 2017.

About Tradeweb Markets

Tradeweb Markets builds and operates many of the world's most efficient financial marketplaces, providing market participants with greater transparency and efficiency in fixed income, derivatives and ETFs. Focused on applying technology to enhance efficiency throughout the trade lifecycle, Tradeweb pioneered straight-through-processing in fixed income and now supports marketplaces for more than 20 asset classes with electronic execution, processing, post-trade analysis and market data in an integrated workflow. Tradeweb Markets serves the dealer-to-customer markets through the Tradeweb institutional platform, wholesale trading through Dealerweb, and the U.S.-based retail fixed income community on Tradeweb Direct. Customers rely on Tradeweb to drive the evolution of fixed income and derivatives through flexible trading architecture and more efficient, transparent markets. For more information, visit www.Tradeweb.com.