Market Snapshot: Government Bond Yields Continue To See Gains

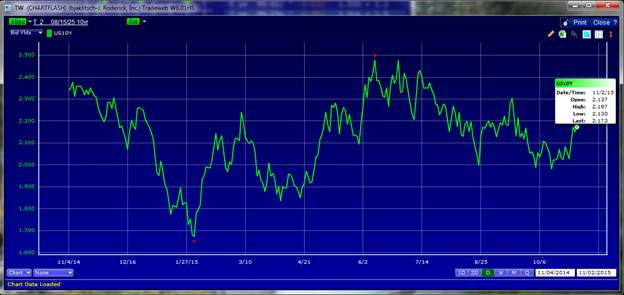

Yields on 10-year U.S. Treasury notes increased today, according to data from Tradeweb.

The bid yield on the 10-year U.S. Treasury note was 2.173% as of 2:33 PM EST, up 2.2 bps from Friday’s close of 2.151%. Today’s intraday high was 2.187%, while the intraday low was 2.130%.

The bid-yield on the 3-month U.S. Treasury bill was 0.064% as of 2:33 PM EST, down 1.5 bps from Friday’s close of 0.079%. Today’s intraday low was 0.064%, while the intraday high was 0.109%.

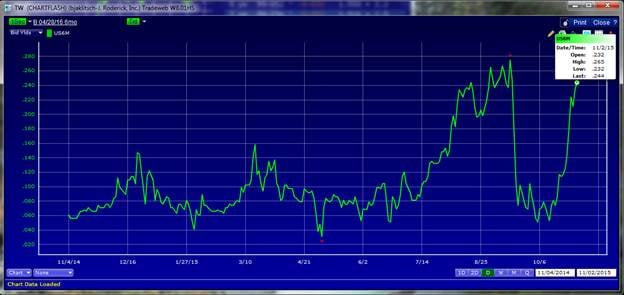

The bid-yield on the 6-month U.S. Treasury bill was 0.244% as of 2:33 PM EST, up 1 bps from Friday’s close of 0.234%. Today’s intraday high was 0.265%, while the intraday high was 0.232%.

These moves follow ongoing speculation of a December rate hike from the Federal Reserve and a report showing the ISM Manufacturing index decreased to 50.1% from 50.2% in September.

Below are the yields on some core and peripheral European government bonds following ECB President Mario Draghi’s comments that further stimulus in December might be unnecessary:

- 10-Year German Bund: 0.559%, up 3.4 bps from Friday’s close of 0.525%

- 10-Year U.K. Gilt: 1.940%, up 2.3 bps from Friday’s close of 1.917%

- 10-Year Spanish Bond: 1.767%, up 8.5 bps from Friday’s close of 1.682%

- 10-Year Italian Bond: 1.567%, up 8 bps from Friday’s close of 1.487%

- 10-Year Portuguese Bond: 2.608%, up 5.9 bps from Friday’s close of 2.549%

- 10-Year French Bond: 0.852%, up 6.5 bps from Friday’s close of 0.757%

- 10-Year Irish Bond: 1.173%, up 4.5 bps from Friday’s close of 1.128%

The charts below are based on indicative, real-time data from Tradeweb.

CHART 1: U.S. 10-Year Treasury Yields – November 4, 2014 – November 2, 2015 (12 Month View)

CHART 2: U.S. 3-Month Treasury Yields – November 4, 2014 – November 2, 2015 (12 Month View)

CHART 3: U.S. 6-Month Treasury Yields – November 4, 2014 – November 2, 2015 (12 Month View)