Japan Government Bond Update - June 2016

Key Points:

- Shinzo Abe delays sales tax hike until 2019

- The IMF urges Japan to “reload Abenomics”

- The JGB yield curve turns negative out to 18 years

A sales tax hike scheduled for April 2016 will be delayed until October 2019 to avert deflationary risks and boost GDP growth, Japan’s prime minister Shinzo Abe announced on June 1. The move prompted Fitch to revise Japan’s outlook from stable to negative. The ratings agency said that the revision reflected its “decreased confidence in the Japanese authorities’ commitment to fiscal consolidation.”

Similarly, the International Monetary Fund warned that the consumption tax postponement could negatively affect medium-term fiscal targets, and recommended a gradual increase to at least 15% instead. The IMF also stressed that a “more substantial, coordinated policy upgrade” would be required to achieve Abenomics’ ambitious targets.

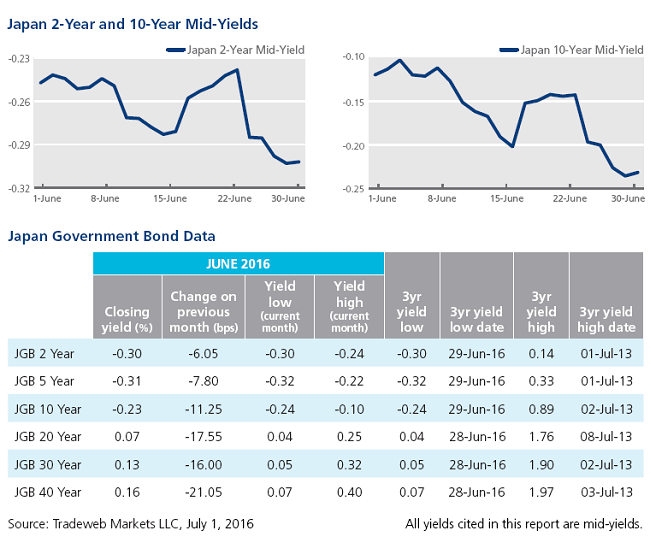

Meanwhile, Japan’s finance minister Taro Aso said that he was “extremely concerned” about the impact of Britain’s decision to leave the European Union on global financial markets, as the yen surged against the US dollar. Yields on Japanese government debt continued to drop to new record lows, with the JGB yield curve ending the month negative out to 18 years. The 10-year JGB mid-yield fell 11 basis points since May month-end to close at -0.23% on June 30.