European Exchange-Traded Funds Update - September 2016

The following data is derived from trading activity on the Tradeweb European-listed ETF platform.

ETF total traded volume

Trading volume executed on the Tradeweb European-listed ETF marketplace reached €8.82 billion in September, up 10% from the previous month. Adriano Pace, managing director for equity derivatives at Tradeweb said, “In a month characterised by few market-moving catalysts and a general lack of investment direction, our platform continued to provide an efficient mechanism for transacting ETFs.” Pace added, “September also saw the addition of the 14th liquidity provider posting axes to the platform, as the functionality is adopted across an increasingly wide range of ETF instruments.”

Meanwhile, overall activity in Q3 2016 amounted to €29.56 billion, the platform’s fourth strongest quarterly notional volume since its launch in October 2012.

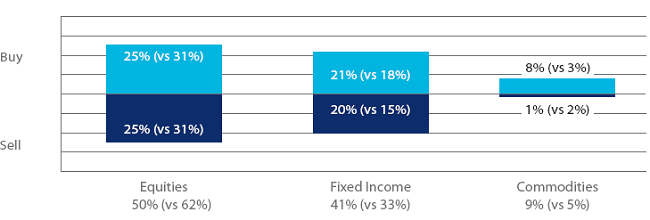

Volume by ETF asset class

Equity Europe, Equity North America and Equity Emerging Markets proved to be the most popular sectors during both the third quarter and September. Monthly ‘buys’ nearly mirrored ‘sells’ across equity and fixed income ETFs. Activity in the latter surged to 41%, as a proportion of the overall traded volume, against a 12-month rolling average of 33%.

In contrast, there was a clear buying trend in commodity-based ETFs, which saw their overall volume increase to 9%, beating the previous 12-month rolling average by four percentage points.

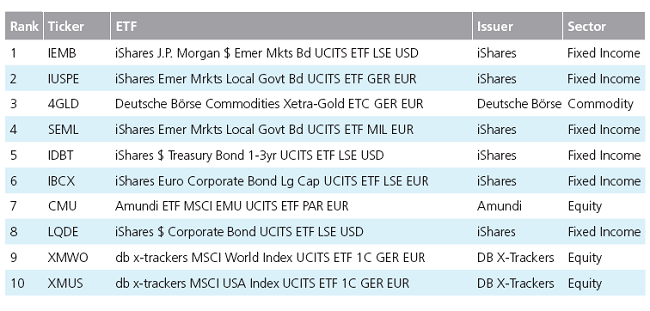

Top ten ETFs by trad ed volume

ed volume

September’s top ten ETF list by traded volume was dominated by fixed income products, with the highest-ranking ones offering exposure to global emerging markets debt. In fourth place, the iShares Emerging Markets Local Government Bond UCITS ETF was also the most heavily-traded fund in the third quarter.