European Exchange-Traded Funds Update - December 2017

The following data is derived from trading activity on the Tradeweb European-listed ETF platform.

ETF total traded volume

December’s activity on the Tradeweb European ETF marketplace reached €10.9 billion despite lower than average market volatility and the holiday season effect. Adriano Pace, managing director for equity derivatives at Tradeweb, said: “December marked the end of another record-breaking year for our platform, with more than €165 billion executed in European-listed ETFs throughout 2017, an increase of 23% from 2016. The number of clients trading ETFs on the platform was also up by 13%, while the number of dealers providing ETF liquidity climbed to 29.”

December also saw the proportion of European ETF transactions processed using Tradeweb’s automated intelligent execution tool (AiEX) increase to 31.3%, surpassing November’s figure by two percentage points.

ETF volume breakdown

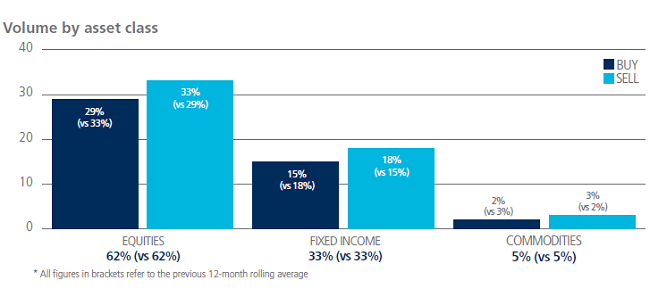

All ETF asset classes saw net selling in December, particularly equity and fixed income products, where ‘buys’ lagged ‘sells’ by four and three percentage points respectively. Meanwhile, individual asset class flow mirrored the previous 12-month rolling average albeit with reverse buy/sell ratios.

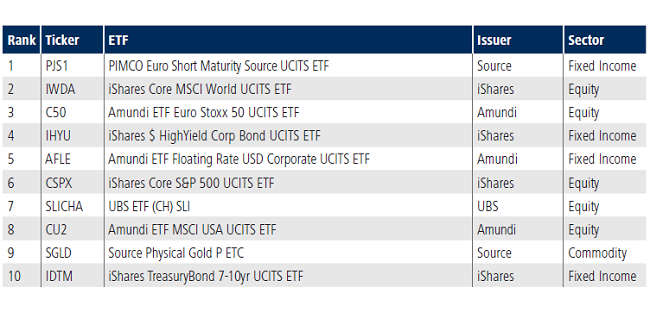

Top ten ETFs by traded volume

The PIMCO Euro Short Maturity Source UCITS ETF, which primarily invests in short-term investment grade debt, proved to be the most heavily-traded instrument on the Tradeweb European-listed ETF platform for the second consecutive month. The fund was also the top ETF by notional volume during the last quarter of 2017.