European Credit Update - November 2015

In her testimony before Congress on November 4, U.S. Federal Reserve chairwoman Janet Yellen said that a December interest rate rise was a “live possibility” depending on the state of the economy. Conversely, ECB president Mario Draghi stressed that the central bank was prepared to use all the instruments available within its mandate to raise inflation in the euro area “as quickly as possible”, while speaking at the Frankfurt European Banking Congress on November 20.

Earlier in the month, the ECB had unveiled its plans to harmonise banking rules across the eurozone to encourage cross-border lending in the region. Meanwhile, the Financial Stability Board issued the final Total Loss-Absorbing Capacity (TLAC) standard for global systemically important banks. The minimum TLAC requirement will be at least 16% of the resolution group’s risk-weighted assets as from 1 January 2019, and at least 18% as from 1 January 2022.

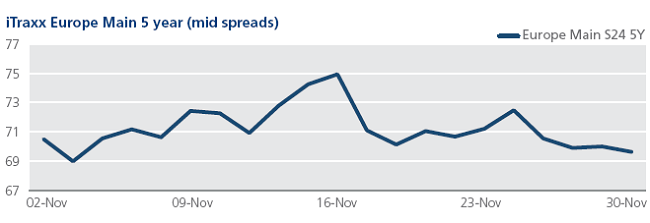

CDS on Tradeweb: European credit indices moved into wider territory in the first half of November, with the Europe (S24) and the Crossover (S24) closing at 75 bps and 316 bps respectively on November 16. Both indices, however, ended the month tighter by 5 bps and 27 bps respectively. Financial indices had a similar trajectory: spreads for the FinSen (S24) and the FinSub (S24) closed at 68 bps and 142 bps respectively on November 30, 8 bps and 16 bps tighter than their November 16 market close values.

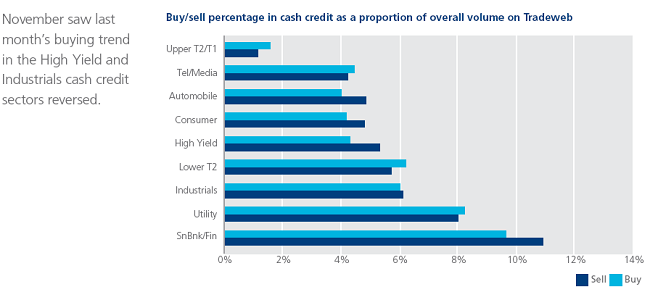

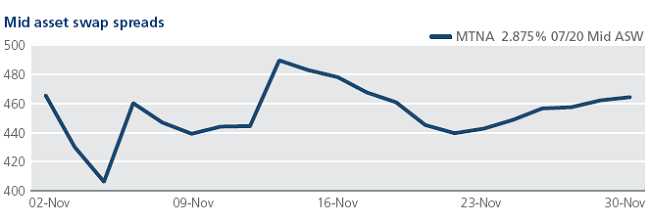

Cash on Tradeweb: Metal prices slid to multi-year lows in November. Steelmaker ArcelorMittal scrapped its annual dividend after losing $711 million in the third quarter of 2015, compared to a net income of $22 million in the same period last year. The global steel giant saw its rating downgraded to Ba2 from Ba1 by Moody’s as a result of its weaker operating performance since the beginning of 2015. Mid asset swap spreads for the firm’s 2.875% 07/20 bond tightened by almost 60 bps to 406 bps between November 2 and November 4, but closed the month at 464 bps.

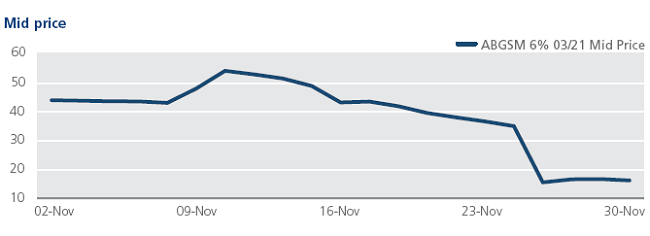

In the High Yield sector, Spain’s renewable energy group Abengoa said on November 25 that it was starting insolvency proceedings after a deal for a €350m capital injection was cancelled. The announcement raised concerns over the impact of Abengoa’s financial troubles on Spanish banks with exposure to the company. In the secondary market, Abengoa’s 6% 03/21 bond fell from 44.08 on November 1 to a cash price of 16.22 on November 30.