European Credit Update - January 2015

Following the meeting of its Governing Council on January 22, the European Central Bank (ECB) confirmed the launch of an expanded stimulus program aimed at boosting the eurozone economy. From March onwards, the ECB will buy €60 billion of public and private sector securities per month until at least September 2016, after adding sovereign bonds to its existing purchase schemes for asset-backed securities and covered bonds.

Eurostat figures released on January 30 showed that eurozone consumer prices had dropped by 0.6% - their largest annual decline since July 2009. Similarly in the UK, the Office for National Statistics announced on January 13 that the country’s annual inflation rate had halved to 0.5% in December, its lowest level since May 2000.

Meanwhile, the Swiss National Bank (SNB) abandoned its currency’s cap of 1.2 against the euro on January 15, causing the Swiss franc to soar against the euro and the dollar. The SNB also pushed its key interest rate deeper into negative territory to -0.75%.

In Greece, anti-austerity parties Syriza and Anel joined forces to form a coalition government, following the former’s electoral victory on January 25. New prime minister Alexis Tsipras vowed to renegotiate the country’s debt and revive the economy.

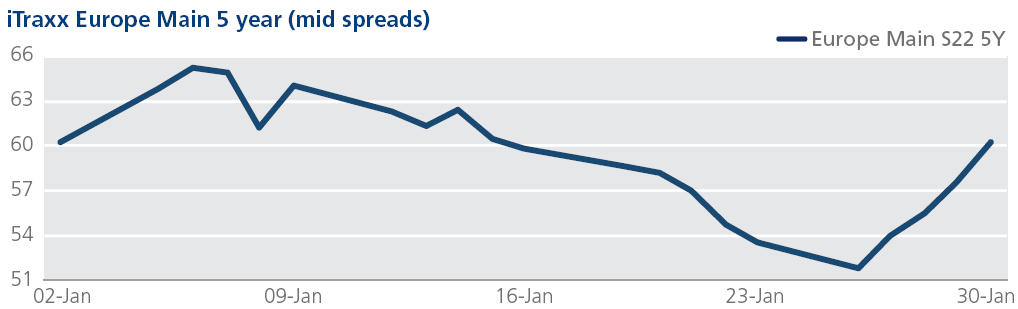

CDS on Tradeweb: European credit indices had a volatile start to the year, with Europe and Crossover spreads tightening from 65 bps and 360 bps on January 6 to just below 52 bps and 290 bps on January 26 respectively. Spreads for both indices moved wider as month end approached, closing at 60 bps (Europe) and 326 bps (Crossover) on January 30.

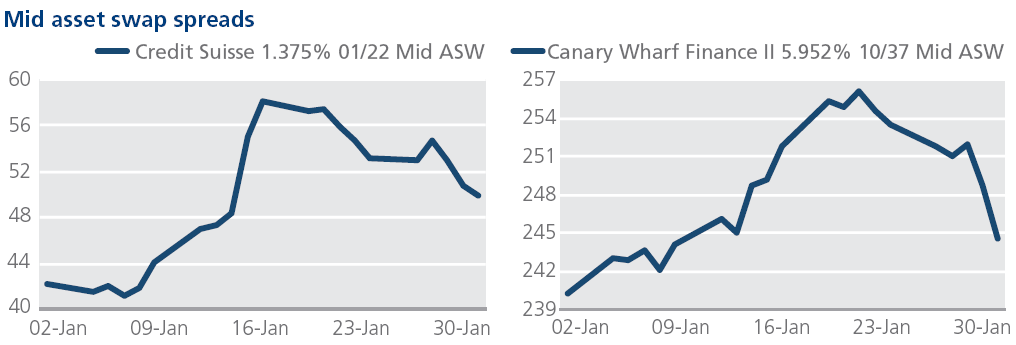

Cash on Tradeweb: Zurich-based Credit Suisse said on January 21 that it had not suffered any “material trading losses”, following the SNB’s decision to remove the Swiss franc’s cap against the euro. The bank re-iterated its October guidance that a 10% move in the euro to the franc could have reduced its profit for the first three quarters of 2014 by 180 million francs. Mid asset swap spreads for its 1.375% 1/22 bond widened by 8 bps to 50 bps over the month.

In London, Canary Wharf owner Songbird accepted a £2.6bn takeover bid from the Qatar Investment Authority and U.S. investor Brookfield Property on January 28. Songbird had rejected the same offer earlier in the month. In the secondary market, the company’s 5.952% 10/37 issue widened by 16 bps from January 2 to January 21, but ended the month in tighter territory at just below 245 bps.