2017 Year in Review: Top Trading Tech & Market Structure Themes

Global Fixed Income, Derivatives and ETF Markets Embrace Change on Eve of MiFID II

After a wild and volatile 2016, this year was all about the business of adjusting to the new normal. Market participants have been deeply focused on getting their houses in order, with new legislative and regulatory regimes in place and the impending MiFID II and MiFIR deadline next year. Compliance loomed large in that effort, as the industry began preparing for new pre- and post-trade transparency requirements that will come into force next month. FinTech also played a major role, and electronic trading continued to transform workflows with greater operational efficiency. From new and evolving market structure, to the adoption of more automated, intelligent execution, here’s a look back at the eight major milestones we saw this year.

The Industry Adapts for MiFID II

The biggest story of the year in global financial trading and technology has been the approaching MiFID II and MiFIR compliance deadlines. The sweeping regulations will introduce significant changes to reporting, transparency, clearing and trading across a broad range of asset classes in Europe. Policymakers have made it clear that all firms are expected to comply with the new rules beginning on January 3, 2018.

As market participants have begun to accelerate their implementation efforts in anticipation of the deadline, the adoption of electronic execution has simultaneously been picking up pace, helping to smooth the transition to this new regulatory environment. Accordingly, Tradeweb’s Multilateral Trading Facility (MTF) is already seeing an increase in the number of inquiries from institutional investors ahead of the derivatives trading obligation (DTO) for specified interest rate and credit default swap instruments.

Pre- and post-trade transparency requirements under MiFID II are also expected to encourage more activity on regulated trading platforms, which will assume all reporting responsibility for on-venue trades. Transactions executed off venue, or over-the-counter (OTC), will need to be reported by a counterparty to the trade using an approved publication arrangement (APA).

The Tradeweb APA leverages our network to allow a wider group of market participants to satisfy their post-trade reporting obligations without major changes to their existing trading workflows, and is already supported by sell-side firms representing approximately 70% of OTC non-equity trading volumes.

MiFID II also puts a spotlight on best execution by requiring investment firms to take all sufficient steps to obtain the best possible result for their clients, taking into account price, costs, speed, likelihood of execution and settlement size. Electronic trading venues like Tradeweb help participants satisfy their obligations for competitive pricing, while also providing access to transaction cost analysis, tools that support regulatory compliance, and workflows that refine their trading processes.

There is little doubt among anyone in the marketplace that MiFID II is about to significantly transform Europe’s market structure and trading operations, but technological innovation fostered by electronic execution will help manage new challenges while improving transparency, efficiency and connectivity.

Innovative Solutions in Electronic Credit Trading

With both U.S. and European corporate bond markets on pace for record issuance 1,2 in 2017, market participants have dramatically increased the reach of their networks through electronic trading venues. They have also begun to access liquidity from a wider range of counterparties, including regional dealers and buy-side participants with whom they did not previously interact.

Having connected with new buy-side price-makers in their search for liquidity through all-to-all trading (Blast A2A on Tradeweb), credit investors are now leveraging technology in new ways to enhance their trading with greater intelligence and efficiency. Electronic trading platforms have helped streamline the flow of information to market participants, offering new levels of intelligence and awareness in price discovery, counterparty selection and transaction cost analysis. To date, more than $22 billion in high-grade and high-yield corporate bonds has traded through Blast A2A, and RFQ volume has more than doubled on Tradeweb overall.

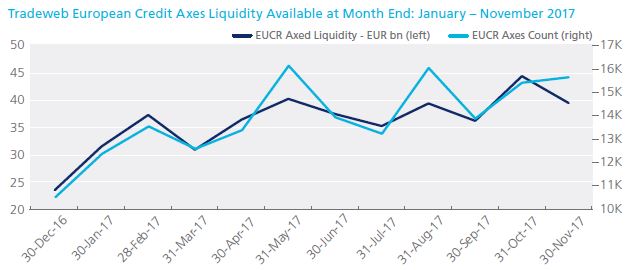

Institutional investors have also begun to use data more effectively in finding the other side of their trade, which is most evident in the growing popularity of axes, linking pre-trade information with trade execution. For example, Tradeweb has seen a 65+% increase in axed liquidity available on its European credit marketplace since the beginning of 2017.

In addition to the evolving pre-trade workflow for credit  traders, Tradeweb has also seen significant growth in U.S. high-grade (USHG) credit trading with the automation of spotting and netting of those spot trades.

traders, Tradeweb has also seen significant growth in U.S. high-grade (USHG) credit trading with the automation of spotting and netting of those spot trades.

By applying new technology to the processing of high-touch credit trades, U.S. high-grade traders can now initiate a seamless automated spot with dealers’ Treasury desks using the Tradeweb Treasury Composite benchmark. They can also net all of their Treasury risk at the same time using one spot price for all offsetting trades through multi-dealer netting.

Together, this unique approach to enhancing the entire lifecycle of credit trading – integrating market intelligence with flexible execution and efficient processing – is driving the rapid adoption of electronic credit trading on Tradeweb.

Electronic Bond Trading Ramps Up in China

The continued electronification of bond markets is not unique to the U.S. and Europe.

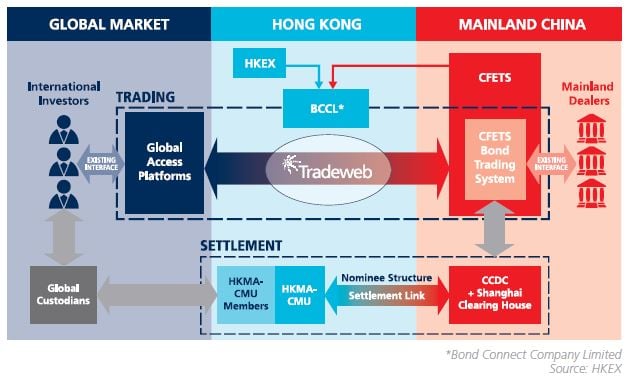

The launch of Bond Connect in July 2017 by the China Foreign Exchange Trade System & National Interbank Funding Centre (CFETS) and Hong Kong Exchanges and Clearing (HKEX) signalled the increasing importance of electronic trading in the growth and internationalization of the nation’s domestic bond market. Northbound trading - the scheme’s first phase - allows international investors to access the China Interbank Bond Market (CIBM) using Tradeweb as its first, and currently only trading link.

The response from the global investor community has been staggering. By the end of September, foreign holdings of Mainland domestic bonds had increased to CNY1,061.0 billion from CNY842.5 billion as of end of June, according to the China Central Depository & Clearing Co, Ltd and Shanghai Clearing House.

More than 200 funds have been approved to use Bond Connect, catching up fast with other longer-running access channels. Through November of this year, Tradeweb has on-boarded more than 146 institutions to its platform, of which at least 120 are actively trading. The average trading volume and the average duration have more than doubled, while the number of onshore market makers has increased to 24.

Via the connection established in Tradeweb’s fully disclosed RFQ system, investors can send requests to the market for all CIBM cash bonds, removing the need to execute though an agent bank. Settlement has been streamlined to follow international standards more closely, thanks to the nominee holding arrangement provided by the Hong Kong Monetary Authority’s Central Moneymarkets Unit, enabling the use of global custodians.

Gradually, the hurdles preventing the world’s third largest bond market from earning a more prominent spot in foreign portfolio holdings are being cleared. However, the real tipping point will occur when Chinese bonds are included in global bond indices, which will drive further offshore fund inflows into the country’s bond market.

Central Bank Bond Activity

As global quantitative easing continued at a strong pace, balance sheets of the big four central banks – The U.S. Federal Reserve (Fed), the European Central Bank (ECB), Bank of England (BOE), and the Bank of Japan (BOJ) – have swelled to over USD14 trillion. However, despite the continued growth in central banks’ balance sheets, quantitative easing and extraordinary measures seemed to have reached a turning point:

- The Fed allowed maturing assets to roll-off its balance sheet, resulting in the slow reduction in its mortgage-backed security (MBS) and Treasury asset portfolio

- The ECB began to taper its monthly bond purchases from EUR80 billion to EUR60 billion and pre-announced further reduction to EUR30 billion in 2018 as it rapidly approaches its self-imposed limits on government bond purchases

- The Bank of England increased its benchmark bank rate for the first time in a decade to 0.50% from 0.25% on the back of rising inflation related to Brexit.

- The BOJ has been the one outlier, continuing to maintain its negative short-term interest rate and hold its 10-year government bond yield at zero.

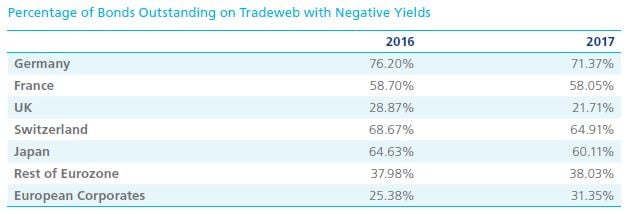

As economic conditions across the globe continue to improve,

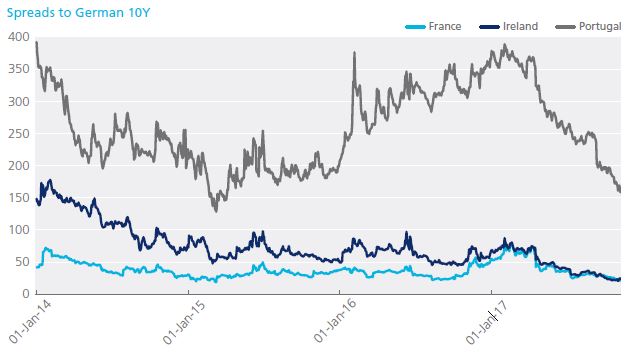

the record amount of negatively yielding high-quality bonds has abated from levels seen in late 2016 and early 2017. However, the demand for yield has become more evident with spreads narrowing between Germany and other European sovereigns, as well as corporates–driving more non-core bonds into negative territory.

More specifically, Germany and other European government debt, such as France, Portugal, Ireland, and Greece are back at post-European crisis lows. For example, the spread between German and Irish 10-year government bond yields narrowed to just 18 basis points in November of 2017, the tightest in a decade. Meanwhile, the spread between the German and Portuguese 10-year is back below 160bps after reaching as high as 389bps in February 2017, and the ECB’s corporate bond buying program has helped drive European high-yield rates to close to 2%, their lowest levels ever.

Transforming the ETF Trading Landscape

One thing that hasn’t changed in 2017 is the institutional market’s love affair with ETFs, with record inflows of over USD400 billion through November 2017.

As they ramp up their investment in the asset class, institutions are also changing their approach to ETF trading, increasing their use of over–the-counter platforms that support RFQ execution. Using RFQ, investors gain better pricing by putting liquidity providers in competition in real-time, while also improving workflow efficiency. This type of trading also provides investors with immediacy in execution, and the ability to buy or sell an ETF as soon as liquidity providers submit their pricing.

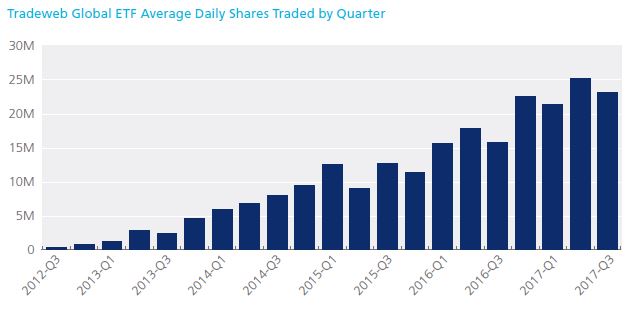

Tradeweb has been central to changing the way investors transact ETFs since launching its platform for RFQ ETF trading in Europe in October 2012 and in the U.S. in 2016. Clients on the platform have access to enhanced pre-trade transparency, efficient execution and electronic audit trails for compliance and best execution through an automated and compliant workflow. As of November 30, 2017, more than EUR484 billion in European-listed ETFs and over USD74 billion in U.S.-listed ETFs have traded on its platforms. Activity on the global Tradeweb institutional ETF platform topped 118% in compound annual growth, exceeding USD900 million in average daily trading volume each of the last four quarters.

A recent report from Greenwich Associates estimates that institutional flows will increase further into ETFs3. According to ETFGI, fixed income ETFs saw net inflows of approximately USD130 billion through the end of October 2017. This brings the total invested in fixed income ETF assets to USD800 billion globally. On Tradeweb, approximately 30%-40% of trading activity takes place in fixed income ETFs, while the overall market for the asset class falls between 15%-20%.

As investment in ETFs continues to grow and become more attractive to institutional investors, RFQ trading has helped support the adoption of these products with better access to liquidity, more competitive and transparent pricing, and an optimized workflow.

Electronic Derivatives Trading Volume Surges

Derivatives products tied to LIBOR and other inter-bank rates have yet to be noticeably impacted by upcoming changes to the de facto benchmarks for interest rates. In fact, Tradeweb continues to see record volumes in electronic trading of these products, with over USD10 trillion in rates instruments traded so far in 2017.

However, as officials look for a replacement for LIBOR (and other IBOR rates), overnight indexed swap (OIS) markets continue to grow. OIS transactions in USD, EUR and GBP grew a combined 18+% this year compared to a 4% decline of notional volumes in vanilla IBOR swaps, according to ISDA data. Tradeweb market share of electronic trading continue to increase, including 460% growth in OIS trading volumes in 2017 to over USD1.5 trillion.

Swap clearing continues to become more pervasive in rates markets. This has been driven by several factors, most notably the onerous margin fees mandated for uncleared trades under Dodd-Frank, which took effect in 2016. As a result, cleared transactions represented 80% of interest rate derivative trades and 87% of notional volumes in 2017, up from 75% and 83% respectively in 2016, according to ISDA data.

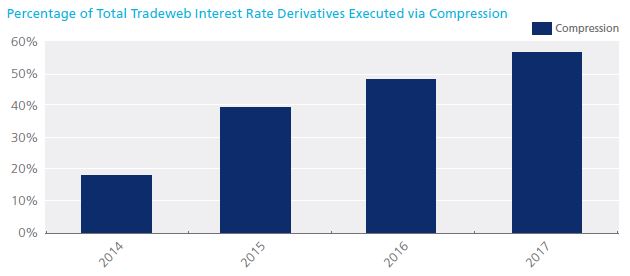

Reporting and margining requirements have made maintaining a big number of largely offsetting risk positions an expensive proposition. This has prompted a significant uptake in compression trading activity across markets. On Tradeweb, compression/list activity for 2017 comprised over 55% of total volumes in interest rate swap products, up from 49% in 2016 and 39% in 2015.

With vanilla derivative markets continuing to mature, Tradeweb has seen adoption of several new niche products, in particular inflation swap, swaptions and single name CDS trading.

The evolution of the derivatives landscape will continue as MiFID II comes to fruition in 2018. Market participants will likely adapt by expanding into even more products and shifting them onto electronic platforms.

Global Repo Trading Tilts Electronic

Repurchase agreements, or repo, have long played an important role in supporting capital markets liquidity, but the marketplace has remained relatively static technology-wise in contrast to other asset classes, such as fixed income and derivatives.

Repo traders may have already streamlined their manual trading experience, where electronic trading would have historically been perceived as having less of an impact on their workflow. That changed in both the institutional and wholesale repo markets in 2017, as innovation began to streamline execution, and demand for operational efficiency increased alongside regulatory reform.

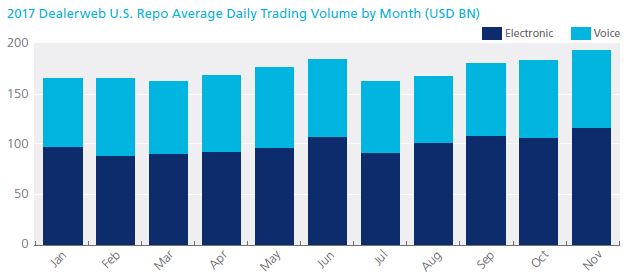

In the wholesale market, Dealerweb paired electronic execution with traditional voice brokerage this year to help reduce costs, while enabling traders to leverage relationships when necessary. Participants are clearly taking advantage of new electronic efficiencies, with repo activity on Dealerweb growing to more than USD190 billion in average daily trading volume - up 17% since January, and representing approximately 20% market share in the U.S.

Institutional dealer-to-client trading through electro nic markets is also on the rise, both in Europe and the U.S. Reduced balance sheets, new risk limits, and resource constraints are driving demand for greater operational efficiency and enabling a resurgence of bilateral repo trading.

nic markets is also on the rise, both in Europe and the U.S. Reduced balance sheets, new risk limits, and resource constraints are driving demand for greater operational efficiency and enabling a resurgence of bilateral repo trading.

Tradeweb integrated request-for-quote trading with straight-through-processing on its global repo platform, and market participants are beginning to optimize their workflows and better demonstrate best execution.

Traders can now access real-time pricing from multiple sources, quickly and easily execute bulk lists, and benefit from a fully-electronic post-trade workflow. And as clients realize the benefits of electronic repo in their overall trading performance, we expect to see continued growth on our institutional platform.

Automated Intelligent Execution Comes to Fixed Income

The arrival of the multi-dealer request-for-quote protocol nearly twenty years ago was an innovative step forward in electronifying relationship-based trading across the fixed income industry. Since then, marketplaces like Tradeweb have expanded their networks across market participants, delivering greater transparency, flexibility and efficiency into trader workflows.

However, the arc of electronic trading in fixed income and derivatives has grown in new ways over the last twelve months as investors were introduced to Automated Intelligent Execution – known as AiEX on Tradeweb. Now, clients can fully automate execution from their order management systems, leveraging market intelligence on Tradeweb to guide counterparty identification, price discovery and choice in execution protocols to access liquidity more efficiently.

Traders benefit from automating their lower-touch business, allowing them to focus on more complex or significant trades, while delivering reduced execution risk in the overall trade workflow through increased speed.

Tradeweb is now seeing significant adoption from market participants across several different asset classes. AiEX is now processing upwards of 1,500 transactions daily, accounting for 16% of tickets executed on Tradeweb in supported products – and over 30% of European Credit and European ETF trades.

This represents an exciting new frontier in electronic trading, and a realization of even greater operational efficiency benefits for end investors. As clients continue to leverage robust networks to find the other side of their trades, we are excited to see the opportunities that AiEX brings to a faster, more efficient marketplace.

1 https://www.ft.com/content/b433ae2a-c630-11e7-a1d2-6786f39ef675

2 https://seekingalpha.com/article/4114189-u-s-corporate-debt-issuance-pace-record-year

3 https://www.ishares.com/us/literature/whitepaper/2017-greenwich-global-research-report-web-en-us.pdf