Data Points: Government Bond Update - March 2016

Key Points:

- U.S. Fed trims 2016 GDP growth outlook

- ECB announces new stimulus package

- Japan issues 10Y debt at a negative rate

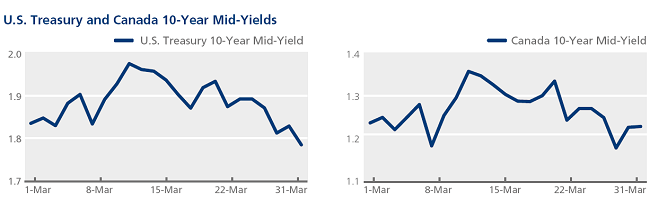

U.S. Federal Reserve Chair Janet Yellen said on March 29 that the central bank must “proceed cautiously” in lifting interest rates, almost two weeks after the central bank had trimmed its GDP growth forecast for 2016 to 2.2% from 2.4%. The Treasury 10-year mid-yield rose by more than four basis points during the month to close at 1.78%. In neighbouring Canada, finance minister Bill Morneau unveiled the government’s C$60 billion stimulus plan to boost economic growth on March 22. The mid-yield on the country’s 10-year benchmark bond climbed as high as 1.36% on March 13, before retreating to 1.23% at month end.

Following its monetary policy meeting on March 10, the European Central Bank announced a series of fiscal measures aimed at reviving the eurozone economy. The latest ECB policy package includes deeper interest rate cuts, a new series of four targeted longer-term refinancing operations with a four-year maturity, and expanded monthly asset purchases, which will now extend to non-bank corporate bonds. However, ECB president Mario Draghi stated that the ECB “does not anticipate more rate cuts” at this stage.

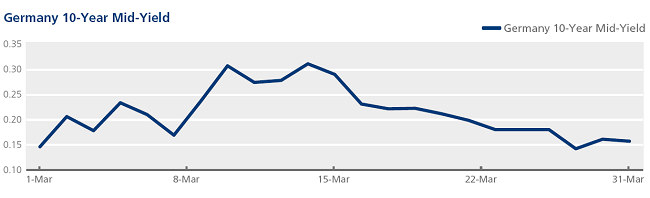

Meanwhile, the euro area remained in deflation in March, as consumer prices contracted 0.1% year on year. In contrast, consumer prices in Germany increased by 0.3%. The country’s GDP grew by an annualised 2.1% in the fourth quarter of 2015, beating the eurozone average by half a percentage point. The German 2-year and 5-year benchmark bond mid-yields finished March in negative territory at -0.49% and -0.33% respectively, both having risen by eight basis points over the course of the month. Their 10-year equivalent ended the month five basis points higher at 0.16%. According to Tradeweb data, approximately 45% of euro-denominated government bonds offered negative yields on March 31.

Japan became only the second country after Switzerland to issue 10-year benchmark bonds at a negative interest rate, with an auction for ¥2.2 trillion government paper at an average yield of -0.024% on March 1. Later in the month, Bank of Japan Governor Haruhiko Kuroda said in parliament that there was room to cut interest rates further to -0.5%. The 10-year JGB mid-yield closed at a record low of -0.10% on March 18, but finished the month five basis points higher at -0.05%.