Tradeweb Exchange-Traded Funds Update – January 2024

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Trading activity on the Tradeweb European ETF marketplace reached EUR 51.7 billion in January, while the proportion of transactions processed via Tradeweb’s Automated Intelligent Execution (AiEX) tool amounted to a record figure of 85.8%.

Adam Gould, head of equities at Tradeweb, said: “This year is off to a very strong start. We’ve had a record-breaking proportion of volume traded through AiEX at 23.1% of the overall platform flow, as well as a record proportion of transactions at 85.8%. Our clients are continuing to recognise the value in automating their trades and achieving higher quality execution at scale.”

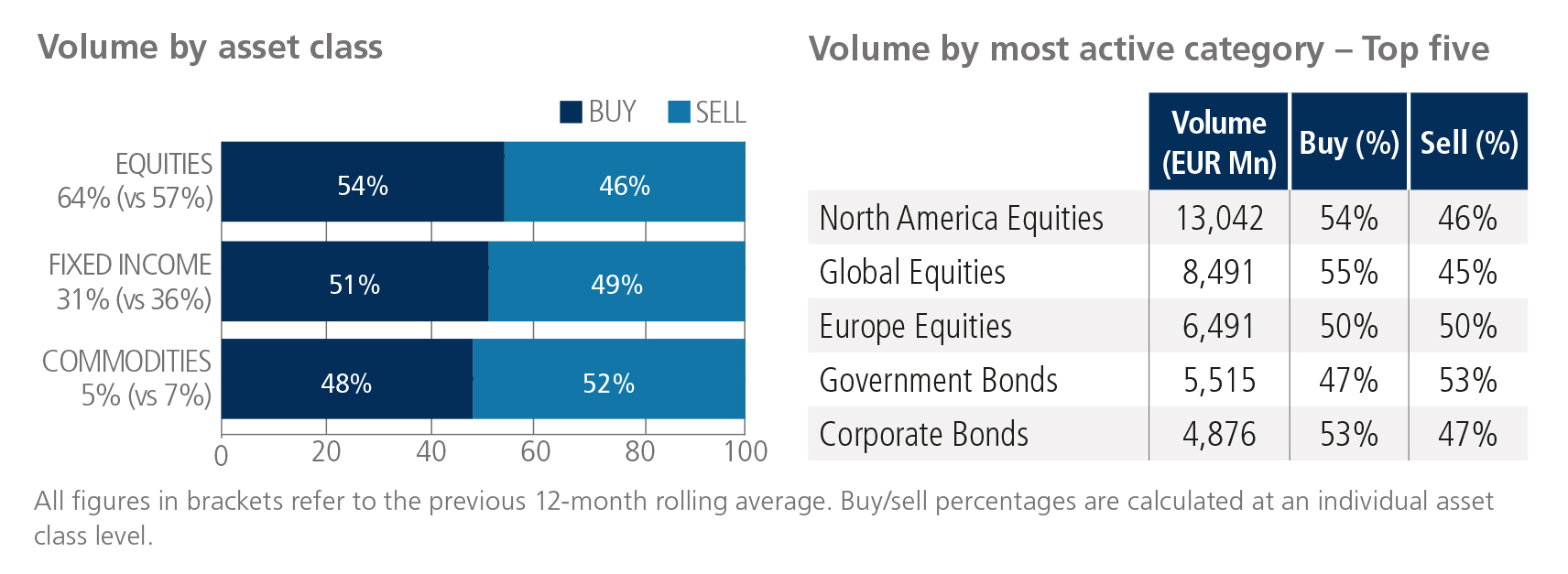

Volume breakdown

In January, trading activity in equity-based ETFs was almost two-thirds of the total traded volume at 64%, while fixed income and commodities were at 31% and 5%, respectively. Once again, commodities was the only ETF asset class where ‘sells’ exceeded ‘buys’ , this time by 4 percentage points. North American Equities was the most heavily-traded ETF category, with EUR 13 billion in total notional volume.

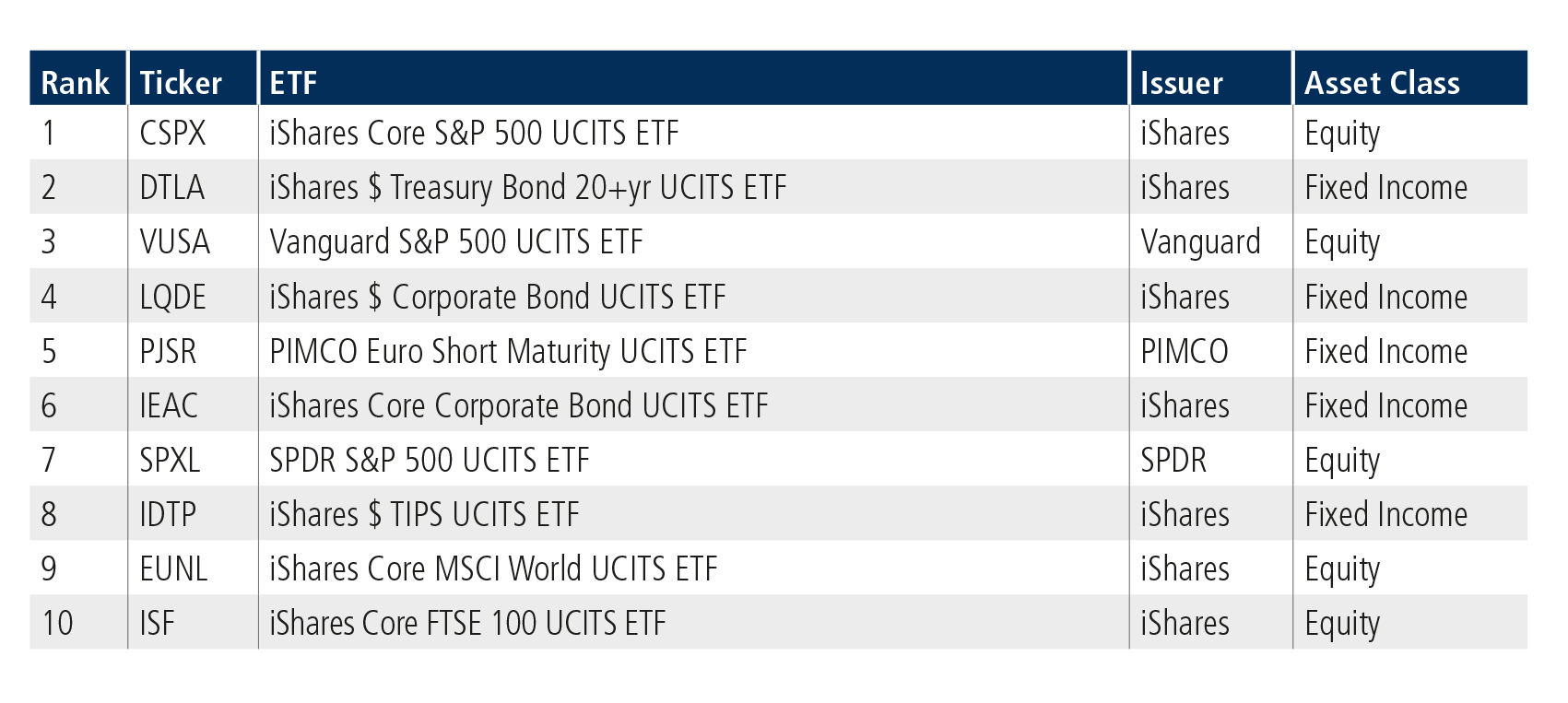

Top ten by traded notional volume

Half of the top ten spots were occupied by equity-based products, with the iShares Core S&P 500 UCITS ETF moving one place up from the month prior to be ranked first in January.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in January reached USD 69.6 billion, the third highest month on record.

Adam Gould, head of equities at Tradeweb, said: “It was great to see that Tradeweb institutional ETF volumes in the U.S. were the third highest on record, indicating that clients are increasingly seeing the benefit of putting multiple liquidity providers in competition on their orders.”

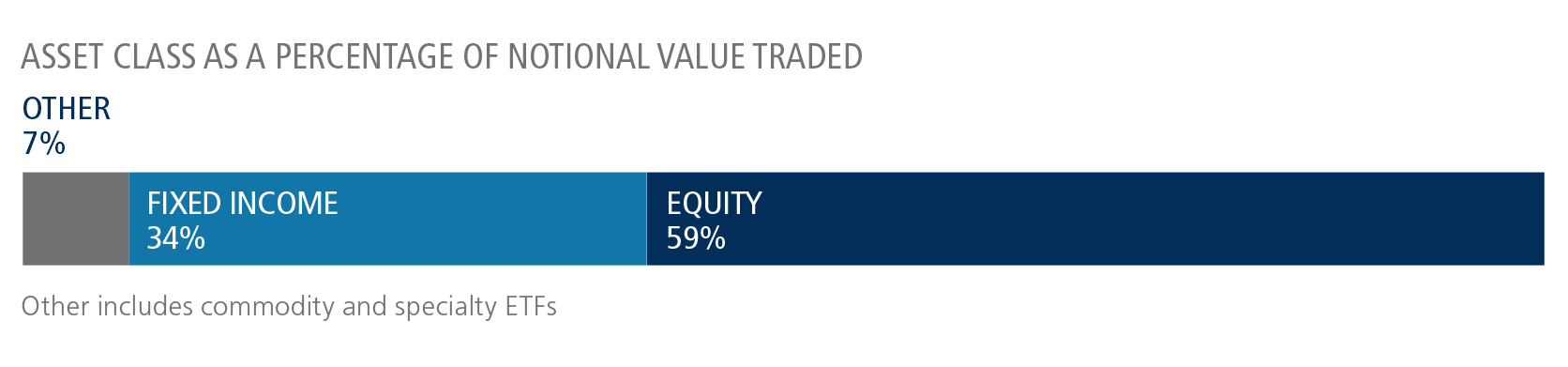

Volume breakdown

As a percentage of total notional value, equities accounted for 59% and fixed income for 34%, with the remainder comprising commodity and specialty ETFs.

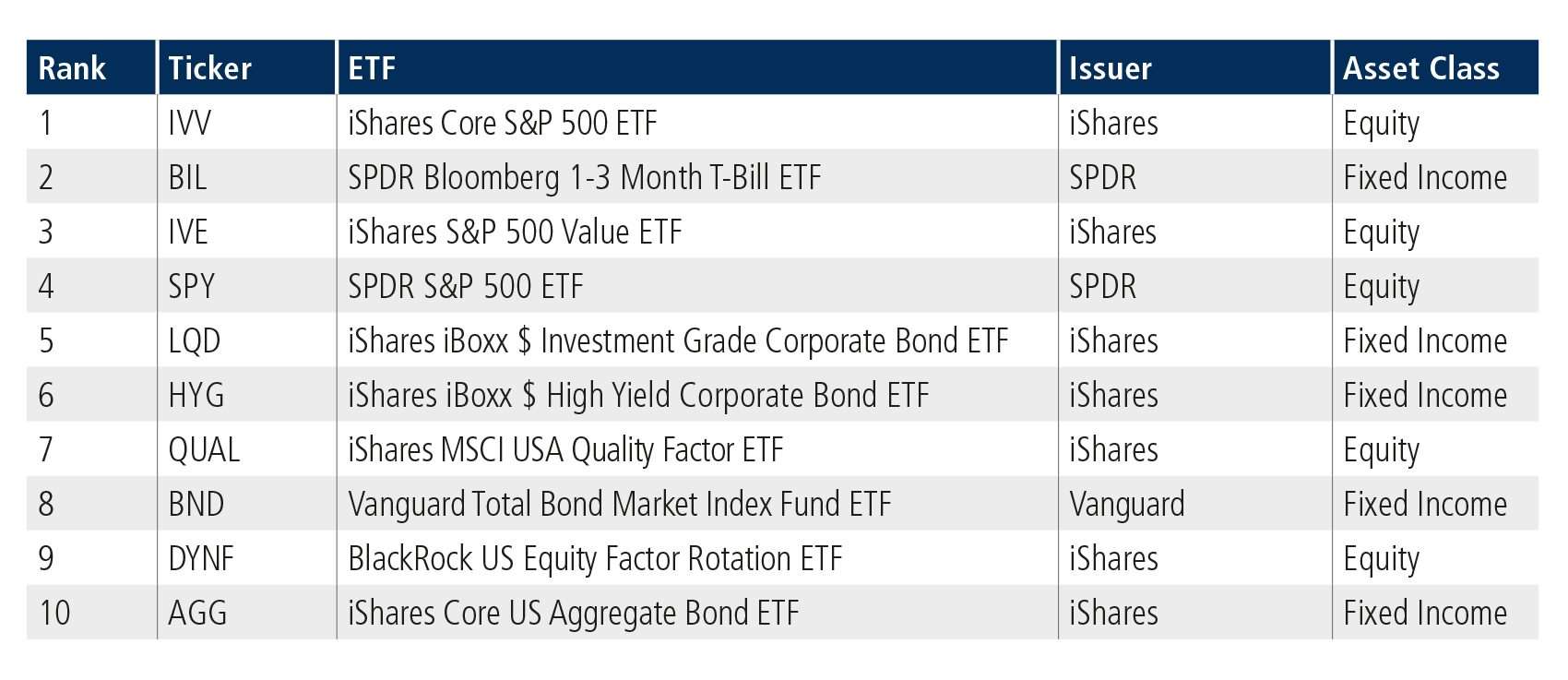

Top ten by traded notional volume

Similar to Europe, half of the top ten ETFs by traded notional volume were equity-based, with the iShares Core S&P 500 ETF taking first place in January. The number one spot in both Europe and the U.S. was occupied by a product offering investor exposure to U.S. stocks.

Related Content

Tradeweb Exchange-Traded Funds Update – December 2023